A recent survey on e-commerce in India by Dyn found that over 52 percent of the respondents feel that online buying experience is better than in-store purchasing experience. E-commerce in India is a recent phenomenon, and it is growing really fast. It is expected that e-commerce in India will breach the $100 billion mark by FY 2020 (Source: Goldman Sachs). So, will physical stores eventually die?

What you read above is the India story. Contrastingly, “The 2015 TimeTrade State of Retail” study in the US finds that over 85 percent of consumers still prefer in-store shopping. Also, note that the same study by Dyn finds that a high 42 percent of Indian consumers still prefer in-store purchasing experience over online purchasing. About 48 percent of the respondents of a survey carried outby PwC said that they purchase a product online due to lower prices and better deals than in-store options.

A majority of Indian e-commerce players are startups. They are all mostly working towards rapidly increasing their market share. Almost all of them have been very aggressive in implementing discounting strategies to get customer attention. With strong backing from investors, Indian e-commerce players are simply doling out discounts and special offers to their customers without worrying about the deepening losses. Flipkart alone reportedly dished out INR 2,000 crore loss in FY 2015. But how long will this sustain? Investors and industry watchers are already raising questions about sustainability of a discount strategy.

Now let’s try to make sense of Indian consumer’s preference of online shopping as against in-store shopping. It is no secret that over 60 percent of Indian population is millennial (less than 35 years of age) with higher disposable income than ever before. The 2015 TimeTrade State of Retail study in the US finds that millennials are just as likely to shop in-store as previous generations. So, given that most of Indian population consists of millennials, the fact that the percentage of respondents who prefer shopping online versus offline are comparable (52 percent online versus 42 percent in-store) is no big surprise then.

There is definitely scope for physical stores to make a comeback, and in a much sophisticated way. Let’s see how.

Silo No More

Call it arrogance or ignorance, but Indian retailers are definitely not leveraging the power of digital, although most of them are just waking up to it. The real problem lies in the fact that retailers are too busy creating digital experiences in silos across consumer’s journey instead of connecting them. According to a Forrester study, organisational silos are today’s biggest digital experience barrier. In fact, according to this survey of 135 digital delivery decision-makers in 2015 the top three barriers to digital experience success are not even technology related. The following are rated as top three barriers:

- Lack of budget or right people (61 percent).

- Lack of agility and slower time to market (57 percent).

- Organisational challenges such as dividing roles and responsibilities and departmental processes set-up (57 percent).

Although digital experiences are a priority for every retailer, the organisational processes are still siloed leading to lack of agility and slower time to market with new initiatives. For example, separating e-commerce from brick-and-mortal operations. One would imagine that single customer view should be the top most priority in today’s digital world. The truth is that the customer data is fragmented between different phases in customer journey.

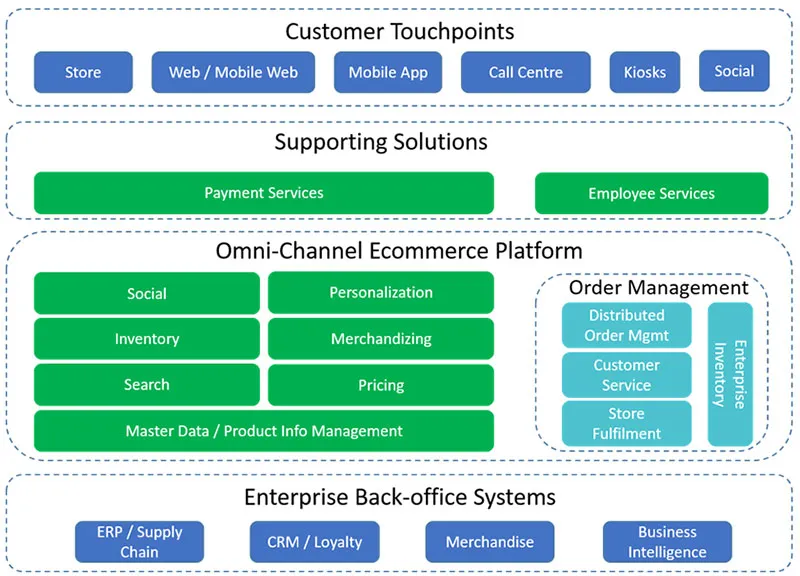

This lack of systematic integration is simply not acceptable in today’s world. A successful omni-channel implementation will consist of at least the following modules.

Don’t get too “physical”

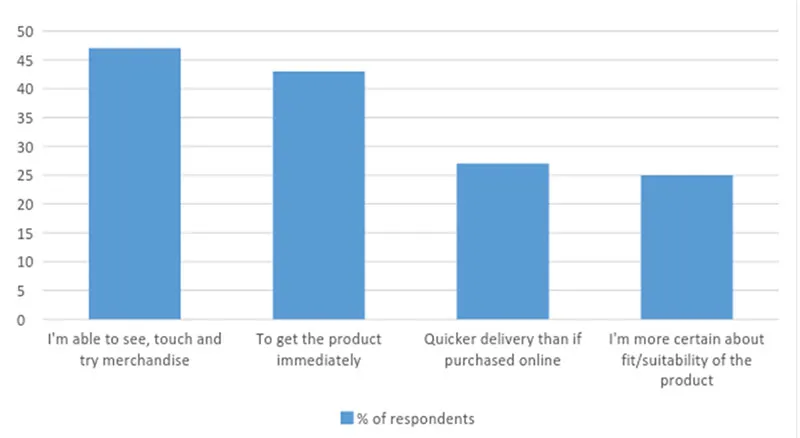

Mobile and social media are a huge part of consumer’s shopping experience today. Digital devices are changing the way consumers discover, assess, purchase, and get post-sales service. So, omni-channel retail strategy will play an important role in the days to come. Retailers must integrate the best of both digital and physical worlds in the consumer’s purchase journey. Following is a graph based on PwC study thatshows top four reasons why consumers purchase in-store instead of online.

Source: PwC Retailers and the age of disruption survey

In the same survey, about 27 percent of the respondents also responded that they shop online instead of in-store because of wider variety of products online than in-store. So, retailers can use digital channels to showcase their entire merchandise and variety of products. Also, if a product’s style or size is out of stock in a store, why not give an opportunity to the shopper to book it online and have it delivered home either from the warehouse or another store location?

Also, retailers must realise now that “showrooming” phenomenon is for real and most likely here to stay. In the PwC survey, when respondents were asked if they have ever intentionally browsed products at a store but decided to purchase online, about 77 percent of them responded in positive. A significant majority of those who answered yes also said that better prices online (86 percent) and desire to touch and feel the product before purchasing (72 percent) were top factors influencing their decision.

So, all this leads to only one thing. Retailers must reimagine their stores as digitally enabled showrooms, purchasing points, shipping centres or pick-up points, and help desks.

Make it fast and easy please

As per Dyn’s survey, when it comes to online purchasing, 65 per centof all surveyed consumers are not willing to wait for more than three seconds of load time on web or mobile. Also, apart from lower price and better deals, shoppers rated the following as other top factors to shop online instead of in-store:

- Ability to shop 24x7 (46 percent).

- No need to travel to a store (38 percent).

- Easy product comparison and research capabilities (36 percent).

All these indicate that convenience and ease of purchase are becoming important decision-making factors for retail consumers. Customers expect retailers to make their store visits worthwhile as well. Consumers expect retailers to make it easier for them to research about products and also provide delivery services or have pick-up stations at the store to make it faster, easier, and convenient for them.

Employee empowerment with digital

It is about time retailers empower their employees with digital tools as much as their customers. Their staff is already using mobile and social media on a day-to-day basis. So, why not empower the store employees with all the information such as product information, training, legal and regulatory updates, and consumer’s preferences and history which will help them be more engaging and productive when they are servicing the customer?

Not just sales, service experience too must be seamless

Today’s consumers expect retailers to solve their problems quickly and empower them with information to find solutions on their own anytime, anywhere, on any device, and on any channel. According to PwC’s study, over 16 percent of respondents said that service on social media channel attracted them to the brand’s social media page. With the world getting more connected and social, percentage of consumers with this expectation will surely increase.

Conclusion: It’s time to take bold initiatives

Retailers have as much access to technology as their e-tailing counterparts. In order to survive, retailers must reimagine their business in terms of providing digital experiences along the customer’s journey. It is about time they invest in technology infrastructure that allows them to experiment fast, learn quickly, and improvise even faster. It is time they took note of customer’s expectations of receiving consistent, contextual, relevant, and personal experiences throughout the purchase lifecycle.

In the context of this article, it is now time for that clichéd conclusion – “Innovate or Perish!

About the author

Manjunath Padigar is a startup enthusiast and new age marketer. He features in World Marketing Congress and CMO Council’s “100 Most Talented Marketers”. He consults on startup product strategy and development and enterprise mobility strategy.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory)