What goes into an M&A deal: a comprehensive timeline of events

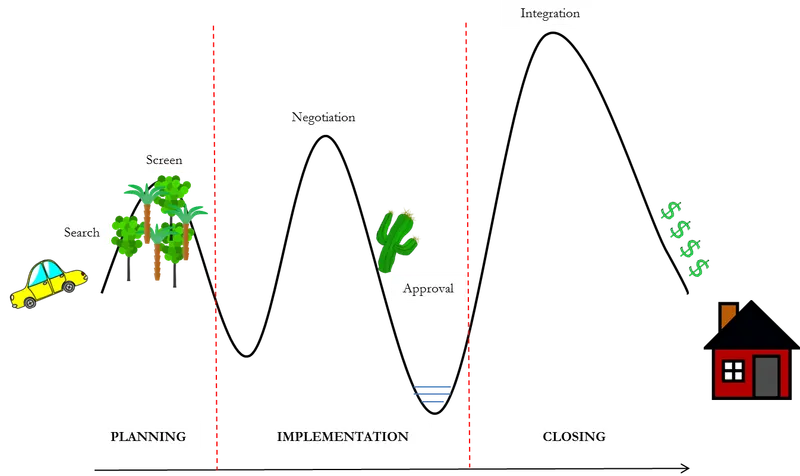

Merger and acquisition (M&A) deals get announced almost every other day, but have you ever wondered how long it takes for a transaction to formalise? Well, it does not happen overnight. Months and months of work, perhaps years sometimes, go into a deal. From searching for a suitable target or buyer to the final shareholder/government approval and integration – this is a complex process. For simplicity the deal timeline can be divided up into three major phases: Planning, Implementation, and Closing. The picture underneath is a simple representation of the tumultuous journey taken up by companies in the M&A deal process. The car is the buyer or the seller. Either of them could start the search process. The thought of acquiring a company is cool, but as the company progresses in the process it goes through ups and downs, highs and lows. Approval can be the scariest point in the deal because the company doesn’t have any control over it; shareholders and governments do. Integration or closing is the highest point in the deal as now no outside factor can affect it.

- Planning

This is the very first stage of the M&A process. Senior management and teams map out current and future directions of the business. Depending on the company and industry needs, a firm might have to add assets, reduce assets, or buy up an entire company. Industry–related factors like competition, barriers, customers, and suppliers play an important role when a company evaluates its needs. The company also conducts a SWOT (Strength–Weakness–Opportunities–Threats) analysis on its infrastructure. After the identification of gaps and needs the company develops a plan to fill up the gaps. At this stage emerges the acquisition idea and the company develops the acquisition plan. The plan is a detailed outline of what the company really needs, suitable targets, contingencies, and backups. Financial returns, technological factors, costs, and other objectives are added to this plan. One important aspect to keep in mind is that the acquisition plan works in conjunction with the company’s mission statement. The acquisition aims to make the company more competitive in the industry and furthers the company’s mission. With all this research and planning, teams go out on a mission to find a suitable target.

This is the point where investment bankers come into the process. Before beginning the search, the deal value – maximum price a company is willing to pay – is decided. Next up are geographic preferences, market share, product lines, and cultural fit. Some companies might abandon the idea of acquisition at this stage itself. When a target company satisfies all the criteria, it is approached with the acquisition proposal.

Yahoo was seeking buyers in as early as 2011. Some of the companies that expressed interest were Microsoft and Alibaba. In 2016 the list of bidders was even more attractive as it included AT&T, Disney, Google, Softbank, and a few PE firms. In Yahoo’s case it took almost five years to find the perfect match – Verizon. When goals of both the buyer and the seller align, they proceed with next steps. Here we see lawyers entering the field as they prepare a non–disclosure agreement and the letter of intent. At this point the planning stage ends. Now begins the real action.

2. Implementation

All the work done so far helps in taking the deal forward. Negotiation and due diligence are the main tasks of this phase. A lot of deals can fall through at this stage if the buyer and seller cannot agree to a purchase price. Investment bankers begin their grind with valuation by requesting historical financial statements.

Deal structure is important as it involves components like risk management, form of payment, accounting issues, and tax considerations. In June 2016, Elon Musk's Tesla Motors offered to buy SolarCity Corp. in an all–stock deal for $2.8 billion. Lazard, the investment bank that advised SolarCity, made an error in its discounted cash flow model by double counting indebtedness and therefore reduced company value by $400 million. Even though the purchase price was well within the range after accounting for the error, this instance shows that even leading banks are capable of making mistakes that cost millions of dollars.

Due diligence comes next. This process is late in the deal but is the most important aspect of the entire M&A process. This is like a final OK check and signals the buyer/seller to proceed with deal closing. The due diligence process is mainly a review: operational, financial, and technological. Teams identify any problems with the buyer, seller, and the deal itself. This is an opportunity for the buyer primarily and also for the seller to walk out of the deal if they find misrepresentations or problems. A thorough diligence and board approval lead to an integration plan and closing.

3. Closing

After all parties are satisfied with their respective reviews, companies move towards attaining necessary approvals. If it is a stock–for–stock deal, a shareholder approval is required for the deal to complete. The $115-per-share offer of Mondelez International – the Oreo cookie and Cadbury maker – was rejected by Hershey Co. The trust that controls Hershey holds 81 percent of the voting stock. Following a row with the Attorney’s General Office, the trust is unable to consider an offer until it is reconstituted. This deal would have created the world’s largest confectioner.

Government approval is key to a successful deal. The government evaluates market concentration and market share of existing firms to make a decision. If the merging entities get a relatively high market share, they could have a high pricing power to the detriment of consumers – a case in which the merger would not be approved. AbInBev, the world’s largest brewer, struck a $101-billion deal with SABMiller to gain access to emerging markets in Latin America and Africa. Before the deal was approved, stakeholders were worried about antitrust issues as AbInBev would attain a 28.4-percent market share of the global beer industry. The combined entity will divest its stake in MillerCoors and refrain from practices that restrict distribution of smaller rival brews. This settlement would prevent increase in concentration in the US beer industry. Once the government approves the deal, companies move to integration – a process where employees are reinstated into the new organisation, requirements are set up, and cultural issues dealt with. After the successful completion of the deal, companies could start realising returns and synergies in as early as a few years.

Sometimes, the simplest of deals turn out to be challenging and sometimes the toughest of deals sail smoothly. Investopedia referred to the process as trying to put together a 1,000–piece puzzle, except that your right and left hands have never worked together before, and I cannot agree more. With so many moving parts in the deal, one wrong step could mean the deal going kaput. A beautiful puzzle picture emerges once the deal is successfully completed.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)