How Reliance Jio is going to affect the Indian online video ecosystem in the near future

People waiting for hours in queues to get a Reliance Jio sim. You must have read about this everywhere ever since Reliance re-entered the telecom space with the launch of its much anticipated 4G network recently. With dirt cheap data plans and free voice calls till the end of the year, the outrageous offering of Jio has captured the imagination of the whole country. The craze is not just because of the low pricing, but also because of the incredible data speeds promised. It says that users can experience peak download speeds of up to an incredible 70 MBPS! Who wouldn’t want that right?!

‘How is it going to change the online video landscape?’ was a question that most people had on their minds right after news broke out. Through this article, I’d like to share what I believe is going to happen in the online video space in the country over the next few months.

The controversy and the debate

The response from rivals after the launch, as expected, was immediate. Bigger competitors like Airtel have been forced to reduce their 3G and 4G plans by almost 80 percent, while smaller counterparts like Aircel, Telenor and Tata Teleservices have their backs to the wall already. This has prompted an outright war in the $50 billion telecom industry, with accusations flying all around.

Helmed by India’s richest man Mukesh Ambani, Jio has even been sardonically called a $20 billion startup by its competitors. The accusations aren’t just coming from one side of the street though. Reliance, which is at the receiving end of most of this flak, claims that ever since its launch, more than 5 crore calls by Jio customers to other networks have failed!

Back in the mid 1990s, an outgoing call used to cost around Rs 35 per minute, and now Jio is offering free voice calls till the end of this year! Despite an exponential growth in mobile internet penetration in the last two years, the Indian telecom space is still voice-heavy. That’s exactly why this move could be a death knell for the telecom industry as we know it in the country. Almost all telecom operators in the country depend mostly on the revenue that they generate through voice calls. This price war effectively means that the revenue growth of the bigger rivals like Vodafone and Airtel will come down from 10 percent in 2015-16 to 5 percent in 2018-19.

Now let’s talk about the positive effects of the launch. Here’s what I think is going to happen in the near future:

More video platforms will come to India

Lack of original local programming, high price points and low consumer interest were some of the major deterrents to the entry of global streaming giants like Netflix and Amazon Prime in India. Besides these, there was another major reason for their apprehension – slower and low quality internet speeds.

Now, with millions of people projected to use Jio’s super-fast 4G connections in the next few months, some of the other major streaming platforms will also shift their focus to India to tap into one of the biggest customer baskets in the world. When more people have access to high quality internet, video platforms that are yet to arrive in the country will be more willing to throw their hats in the ring.

Increase in VOD platform and OTT subscriptions

When Netflix was launched in India in the beginning of 2016, I remember reading tons of articles on why it wouldn’t work in India. Most of these articles cited reasons like –

- The Indian online consumer mindset (When one can download a movie/show through torrents, why would he/she opt for a paid subscription?)

- Lack of local programmes in the content library.

- Low broadband penetration and lack of quality internet speeds.

Tackling the first two problems was never going to be a big deal. The spending capacity of the millennial generation in India is increasing all the time, and more and more people are willing to spend for stuff that they really want. And it is only a matter of time before Netflix buys the rights to local content and improves its local programming strategy.

But the third issue was always going to be a big question mark for all the stakeholders in the industry. Jio’s launch is set to change that by providing not only cheap but quality 4G data connections to the general population. And because the connections are cheap, users will be more willing to spend some extra money on quality content that they can get through OTT subscriptions.

Increase in advertising spend on OTTs

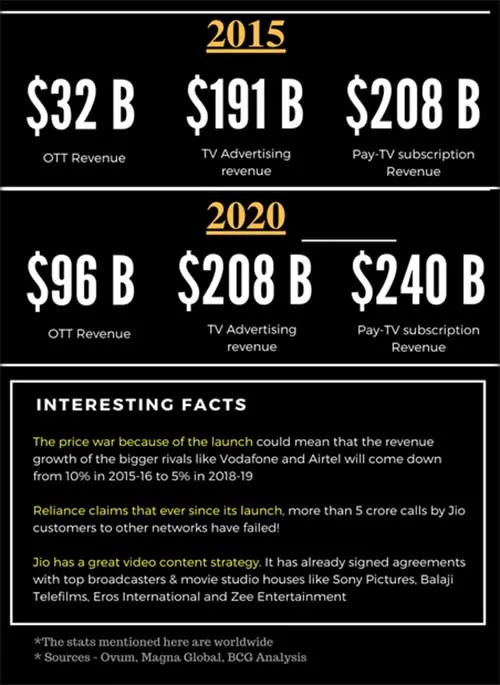

In 2015, the revenue from OTT platforms globally was around $32.57 billion. Estimates suggest that this is set to almost triple to $96 billion by 2020! During the same time, revenue from TV advertising and subscriptions is projected to increase by just a fraction from $192 billion to $208 billion. India is definitely going to be an integral part of this whole scheme of things since it will have millions of people moving from slower internet connectivity to broadband and 4G.

Lower internet speeds till now meant that people weren’t really interested in opting for an OTT subscription. And a low user base meant that brands weren’t really interested in advertising on these platforms; which in turn meant less revenue prospects for these OTTs. But now, with more people accessing high quality internet, the OTT user base is definitely set to increase, giving brands a reason to advertise to catch eyeballs. This would lend a little breathing space to these platforms, allowing them to spend some money on original programming.

Another interesting prediction that I have is with regards to the consumption of video ads in the country. A major deterrent to online video advertising in India was their viewablity. Since video ads also consume high bandwidth, poor internet speeds here meant that people just hated watching them, especially on their mobile devices. The influx of fast 4G connections is probably going to help the situation a little.

More digital first original programming content will be produced

Even though online video penetration in India has increased in the last couple of years, if you analyse some of the biggest players in the market, you will come to realise that most of them are traditional video entities that are trying to tap into the growing digital user base. For instance – the biggest YouTube channel in India is T-Series, which mostly uploads video content that it already has for traditional mediums like TV.

The number of web shows that are produced here is also really low when compared to the West. Even some of the biggest OTT platforms in the country like Hotstar and Voot depend mostly on video content from television. But now, with better internet infrastructure and more money seeping in, media and production houses will be more willing to produce digital first original programmes.

Investors will start pouring more money into the video domain

Better internet infrastructure is going to give investors more confidence to put money not only in established OTT platforms, but also in promising upcoming players. The platforms will then have more financial freedom to reinforce their current strategies, bulk up their content libraries and commission new original programmes. This would benefit the whole video ecosystem in the country.

Looking at how things played out in developed economies during the initial OTT boom, it is safe to assume that there will be a lot of aggressive acquisitions in the coming days as well. Just look at these examples:

- In 2014, AT&T had acquired Fullscreen, one of the biggest Multi Channel Networks on YouTube.

- Earlier this year, Verizon bought a 24.5 percent stake in Awesomeness TV, a digital video-focused company.

- SingTel, an Asian telecom giant, started an OTT HOOQ, which was a joint venture with Sony Pictures and Warner Bros in 2015.

It’ll be interesting to see if Jio acquires any of the existing OTT platforms in the country.

Jio will strengthen its content game

Other than the aggressive pricing plans, Jio has also been strategically making moves in the content space. It has already inked agreements with top broadcasters and movie studio houses like Sony Pictures, Balaji Telefilms, Eros International and Zee Entertainment for video content on its platform. Providing cheap high speed internet along with a good video content library is a really smart move by Jio.

Final words

I wrote this whole article from the perspective of the online video ecosystem and its stakeholders in the country. How about from the consumer’s perspective? Personally, I should admit that I’m absolutely thrilled! We can now watch videos on mobile devices not just when we have good quality wifi, but also when we just have a data connection. We will be more willing to spend our money on other internet products rather than just on data.

This is a shot in the arm that the industry in the country desperately needed. It’ll be really interesting to see how things fare after the initial hubbub. What is your take on it? Drop a line in the comments section here or tweet to me @subratkar. Until next time!

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)

![[Funding alert] Artha Venture Fund leads investment of Rs 3.5 Cr in foodtech startup Daalchini](https://images.yourstory.com/cs/2/79900dd0-d913-11e8-a160-45a90309d734/AtGaanaOffice1562235899831.jpeg?mode=crop&crop=faces&ar=1%3A1&format=auto&w=1920&q=75)