Revised Fund of Funds guidelines will double startup funding: DIPP

According to the Startup India Action Plan status report, Rs 500 crore out of Rs 10,000 corpus has been released to SIDBI (the fund manager of ‘Fund of Funds for Startups’) in FY 2015-16 and an additional Rs 100 crore will be released in FY 2016-17.

Since the government announced the approval of the Rs 10,000-crore ‘Fund of Funds for Startups’ in June 2016, the Small Industries Development Bank of India (SIDBI) has sanctioned Rs 129 crore for venture funds. Of the sanctioned amount, Rs 114 crore has been released to five venture funds, said the status report of the Startup India Action Plan.

At the time of its announcement (i.e. last year), the fund was expected to generate employment for 18 lakh persons and catalyse Rs 60,000 crore of equity investment. The Cabinet had approved the establishment of the 'Fund of Funds for Startups' (FFS) at SIDBI for the purpose of contribution to various alternative investment funds (AIF) registered with SEBI which will be further channelised to startups.

The total corpus of Rs 10,000 crore will be released by 2025, that is, by the end of the 15th Finance Commission cycle. SIDBI has been appointed as the fund manager. FFS will invest in SEBI-registered AIFs, which, in turn, will invest in startups. Thus, FFS does not fund startups directly, but through selected AIFs. According to the Startup India Action Plan status report, Rs 500 crore has been released to SIDBI in FY 2015-16. Additionally, Rs 100 crore will be released in FY 2016-17.

Restrictive clauses of Fund of Funds

According to present guidelines, FFS will fund the AIFs which, in turn, will raise counterpart funds from other sources. The corpus so pooled in will entirely be invested in startups. Further, AIFs funded by SIDBI shall not fund entities when they cease to be startups.

“Key revisions in the guidelines proposed under FFS to enable quick and easy access includes AIFs supported by SIDBI to invest twice the amount of contribution received from FFS in startups. Also, allow AIFs funded by SIDBI to fund an entity even after it ceases to be a startup (as defined by DIPP),” says Rajeev Kandpal, Director, DIPP.

713 startups make way towards Startup India programme

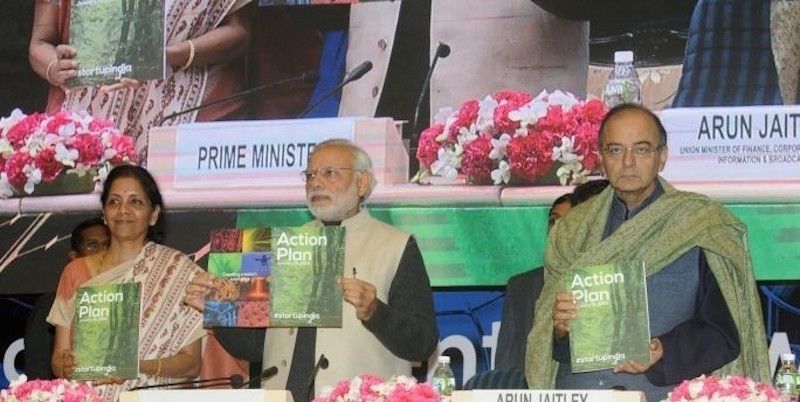

India in the last decade has witnessed a dynamic shift when it comes to technology interventions in almost every sector, thanks to the innovations by the startup fraternity eventually catching the government’s attention and resulting in a supportive system. Recognising the potential of startups to create a new India, Prime Minister Narendra Modi launched the Startup India Action Plan on January 16, 2016 in New Delhi to build a strong ecosystem and business-friendly environment for startups to grow multifold.

Until now, the Startup India programme has received 1,835 applications, of which 713 meet DIPP’s eligibility criteria. The Startup India status report states that the rest of the applicants will be provided with guidance and support by the Startup India Hub to submit the relevant documents. Of the total applicants, 146 could be considered for tax benefits as they have been incorporated after April 1, 2016.

The Startup India Hub, which was set up on April 1, 2016 to address queries and handhold startups, has so far answered 37,195 queries.

Considering the importance of intellectual property rights (IPRs) as a strategic business tool, the government has launched a scheme for facilitating startups’ intellectual property protection. The scheme has, till date, filed 108 patent applications by startups and what is even more encouraging is that 104 applications are provided the benefit of up to 80 percent rebate in patent fees and free legal assistance.

“The immediate plan is to work towards faster execution of the Startup India Action Plan, easier access to funds for startups, easier compliance norms for startups, and simpler regulations to help startups register and stay in India. To further help startups, a Startup India online hub is being developed which will serve as an online platform where all the stakeholders of the startup ecosystem (startups, incubators, accelerators, mentors, VC firms, etc.) can collaborate and synergise their efforts,” said Rajeev.

He added that the government will create an extensive database of all the stakeholders and facilitate location-wise as well as sectoral mapping, as required. Apart from this, the government envisions greater partnerships and collaboration among its departments and ministries and states and industry players to fruitfully channelise the momentum gathered so far.