[Decoding Angel Investing] Start small, start sure: the who and why

In this series ‘Decoding Angel Investing’, Shanti Mohan, Co-founder and CEO of LetsVenture, breaks down the fundamentals of angel investing and answers why it is a good idea to start now.

, , , , , and . These companies have shifted the paradigm of the business world by tackling consumer pain points with unique business models, marketing strategies, and product solutions.

But here comes the big question. Do you want to be a shareholder in these companies when they list and go IPO? Or be a part of the journey in discovering the idea, creating the solution, and being a real catalyst for change in the ecosystem? That’s where angel investing comes in.

Angel investing allows you to invest in companies that you love and believe in from day one, and watch the growth (or downfall) of the company at close quarters.

Let's look at . In 2010, the startup raised its angel round with multiple investors, including Sanjeev Bikhchandani. By 2021, when Zomato went for an IPO, Sanjeev Bikhchandani’s initial investment in the company had grown and skyrocketed by 1000X!

Globally, private markets have seen outsized returns as compared to public markets. My belief is that when you do financial planning, you should keep aside a small allocation towards private markets and make this part of your financial asset allocation. Start small, start sure.

Let’s start by answering some basic questions.

Who is an angel investor?

Any investor or group of investors who write the first cheque in a startup is termed an ‘angel investor’. The definition is broad and people tend to use this terminology for anyone who invests in startups.

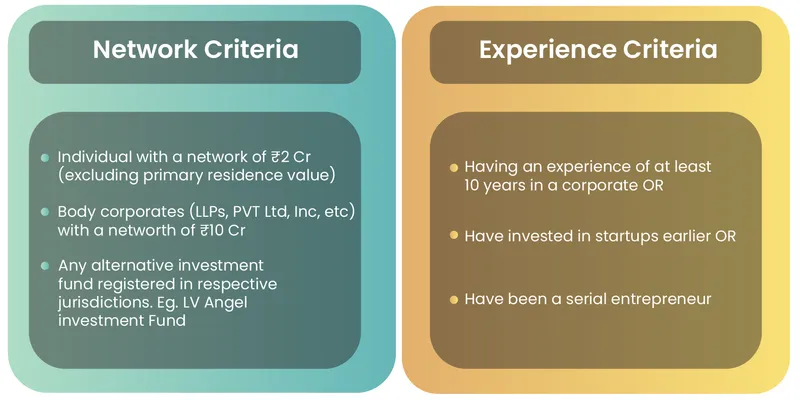

For you, who is looking at investing in Indian startups, SEBI has defined criteria for you to qualify as an accredited investor:

As an angel investor, you would invest at a very early stage -- pre-revenue or even at an idea stage -- in exchange for equity in the business. This is undeniably a risky decision.

SEBI’s definition is intended to warn you of the risk of investing in private markets, and also protect you from misinformation about companies that are being funded.

At LetsVenture, we see four different profiles of investors:

- CXOs in large corporates

- Other startup founders and entrepreneurs

- Second-generation family business owners

- Global Indian looking to invest in Indian startups

Why do startups need angel investors?

Every year, more than 90 percent of startups fail. They are risky assets, to begin with, and have high mortality rates. However, the few that succeed can help you generate exponential non-linear returns as an investor.

You as an angel investor play a very crucial role in nurturing startups that are very early in their journey. Usually, these startups have yet to create a product or a proof of concept or even generate any revenues.

Given the risk associated with an unproven idea or product, most institutional investors or large investors would wait before deciding to invest, or just avoid it completely. Therefore, you become pivotal in helping founders develop their ideas and getting their businesses off the ground, not just with capital, but also with mentorship and support.

One of the most important upsides of being an angel investor other than life-changing capital returns or IRR (Internal Rate of Return), is the opportunity to be part of the startup journey, and watch closely as the business is being built.

Key traits of becoming an angel investor

I’m sure that by now you know that angel investing is a high-risk investment and asset class. The awe-inspiring and gigantic returns one would expect from their investments may never actually see the light of the day, or may only fructify over a long period of time.

To be an angel investor, here are some key traits you must possess:

- Composure - being okay with making the wrong decision

- Friendliness - being a people person or being able to hold a conversation about a topic

- Availability - making time to help your founders

- Philanthropic - looking to “pay-it-forward” for wealth creation and value creation

- Patient - being able to play the long game and wait for returns

Say you check the boxes with these criteria, how do you now begin making angel investments?

At LetsVenture, after having interacted with thousands of startups and investors, we have outlined some of the best practices that you can adopt while starting your journey.

Start with play money:

Be okay to lose money. You need to set aside some money that you are comfortable losing. This should ideally be the sum of money you have leftover after you have met your savings and expenses goal in a defined time frame.

Not a momentum play:

Unlike investing in public markets, angel investing is not a momentum play where you blindly back popular companies or sectors. If a sector or company is already popular, chances are you may have missed the boat already.

Game of building winners, not picking them:

Startups take a long time to mature (sometimes even up to five years). Treat your capital as “patient capital”. As an investor, you will have to toil just as hard as a founder to make your capital grow. You have to build winners, you can't pick them right away.

Plan your portfolio and build your investment strategy:

In the startup ecosystem, a ‘spray and pray’ investment strategy is bound to fail especially when you have limited resources to dedicate to founders. Point to note, plan your investments akin to how you would approach investing in public markets:

- Study the sectors you are interested in (healthtech, D2C, consumer internet, agritech, food tech etc).

- Leverage your experience in the domain to understand the value you want to add to the startups.

- Most importantly, diversify. Don't put all your eggs in one basket. Invest in startups and sectors across the board after you’ve built your investment thesis.

Start small, start sure:

Before you kickstart your journey as an angel investor, define your purpose. Evaluate if you are:

- Passionate about startups and technology.

- Passionate about building companies and ideas from scratch.

- Equipped with resources (capital, time, and more) to invest in startups.

- Rational with your return expectations.

If your answer is yes, you don't need a ton of capital to kickstart. You can start with as little as Rs 50,000. As you gain more experience you can scale your investment and ensure that you maximise your returns.

Edited by Dipti D

![[Decoding Angel Investing] Start small, start sure: the who and why](https://images.yourstory.com/cs/2/a182c7e0140711e987e2f7248b252f46/AngelInvestment-02-1631881240020.png?mode=crop&crop=faces&ar=2:1?width=3840&q=75)