HarperCollins

View Brand PublisherHow the pandemic changed personal finance and how you can save, invest and spend better

How should one grow their hard-earned money?

This question has been written, spoken, and debated at length and in depth. And, continues to.

Yet, most people still find it difficult to manage, save and invest their earnings. If anything, the pandemic has once again put the spotlight on why one must plan their financial future early on. And, the experience was no different for Monika Halan, best-selling author and consulting editor and part of the leadership team at Indian daily Mint. She says, like many, the pandemic compelled her to relook at her portfolio allocation. This is in spite of the fact that they are in their 50s and confident of earning even post retirement. She reveals that it is not the market crack of 30 percent that triggered the rethink but the fact that there are less years ahead than a younger person - both in terms of health and income.

Money management: Lessons from the pandemic

Monika could up her saving target sharply the day she decides to go on a lockdown mode pandemic. While she previously considered herself a frugal spender, the lockdown had prevented her from spending anything beyond the basics. Other than EMIs, rent, helper salaries and basics, the expenses had crashed. This experience of living on so little was a powerful experience, she shares.

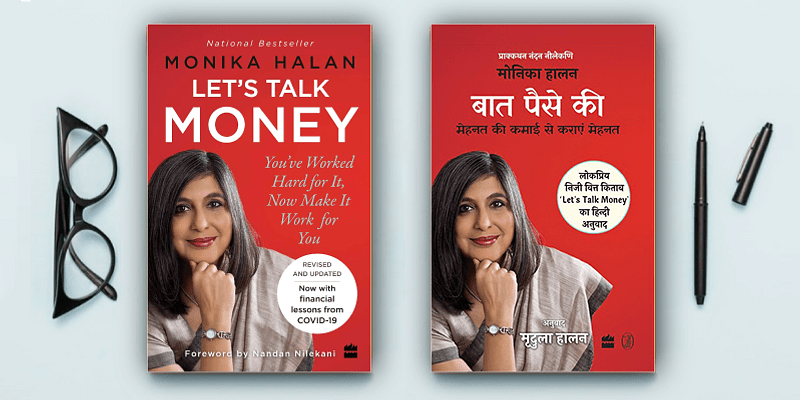

In the updated version of her best-selling book Let's Talk Money - first published in 2018 by HarperCollins - Monika shares interesting insights on what the pandemic taught all of us about our money. Pointing to another financial lesson was the need to have an emergency fund. Holding a high-risk private sector contract job, she had maintained a six-month emergency fund despite knowing that their jobs are fairly secure. But, she decided to ramp up the fund to two years’ expenses in a fixed deposit (FD). In the book she says, “The need for zero-risk money needed for survival in a safe bank (PSU or one of the largest private sector banks) suddenly becomes manifest. My recommendation of emergency funds has now changed. For those forty years and below in a secure job, you are fine with six months of living expenses in an FD. But as age increases, as the riskiness of the job goes up, ramp up the fund to reach two years for older cohorts in jobs that are not that secure.”

The third lesson was that of rethinking risk. From freezing of deposits by a private bank to fund houses shutting down to market crashing, nothing felt safe, which highlighted that no financial product was without risk, just different kinds of risks. She writes, “The fact is that there is no safe haven for your money. Each investment comes with some risks and you have to decide which one you are able to take.” And, here she makes an interesting observation. She points out that risk capacity and risk appetite are completely two different things. While risk appetite refers to one’s willingness to take risks, risk capacity is dependent on factors such as age, number of dependents and stage of dependents, confidence in generating income for a long time. That’s why risk appetite and risk capacity need to be aligned while planning the finances and allocating assets. In the book she also explains why one fixed obligation-to-income ratio should be 30 percent or less. In other words, all EMIs put together must not be more than 30 percent or less.

She writes, “Uncertainty got a new name with COVID-19 for our health, life, income, and wealth. While the basic principles remain the same, there are some lessons learnt from this crisis for our health and wealth.”

Finance is for everyone

Apart from how the pandemic brought in a shift in perspective on certain aspects of money management and investments - which Monika explains in detail and quotes her own investments as examples - the book holds increased relevance for people who are looking for practical tips and easy-to-understand explanations on how to manage their money. And, here, Monika’s past experience as a certified financial planner and a leader who worked in India’s top media organizations writing and running successful columns and TV shows around personal finance advice, comes to the fore. For her, tips are not only insightful and comprehensive but also practical. The many real-life anecdotes play an equal role in making it easy to understand. The book cuts through the cutters because the explanations address every question you had in mind and clearly outlines the steps you could take to manage your finances better amidst the Indian realities.

For instance, the book reiterated the need to observe your spending patterns and how you can analyze the pattern to save money that you can later invest. She explains how once you question your spending, you will realize how much money you actually need for managing regular expenses. and by parking money for investing you will be able to gauge your savings capacity. She advises that one must be able to move at least 10 percent of your in-hand salary for investments, irrespective of what your financial commitments are - be it EMIs, rent, etc. She writes, “Eating out, going to the movies, travelling and buying gadgets are the big budget breakers. Go for a balanced rather than a hard-spending diet. Hard diets fail.”

The book also demystifies many aspects about money management and investments. For instance, it not only explains what a medical insurance cover is, but also if one must invest

in medical cover even if they are covered by their employers and how much cover one would. It explains the different policies that are available in the market, the prices, the benefits and the questions one must ask before making a decision. Another financial product that the book explains beautifully is life insurance and her take on it. She writes, “We buy life insurance for all the wrong reasons - fear, greed, pity, frustration, taxes. The real reason for a life cover, to protect your family if you die, is never explained.” She adds, “The day you realize that it is in your best interest to separate investments and insurance products, is the day you move solidly towards building your financial security. Else you are building wealth for seller and the insurance companies.”

Don’t miss the chapters on ‘Let’s de-jargon investing’ - nature of different kinds of investments and the purpose they serve. and what kills a money box that talks about the one single factor that is responsible for the investment decisions.

TITLE: Let’s Talk Money

AUTHOR: Monika Halan

PUBLISHER: HarperCollins India

BUY NOW (English): https://harpercollins.co.in/product/lets-talk-money/

BUY NOW (Hindi): https://harpercollins.co.in/product/baat-paise-ki/