Mumbai Angels basks in sunshine as funding winter grips the startup ecosystem

Venture investment platform Mumbai Angels continues to get strong interest from investors and entrepreneurs alike and sees no impact from the ongoing funding slowdown.

Funding winter has become the dominant theme for startups across the world but not for investing platform Mumbai Angels, which has conducted more deals this year compared to 2021.

It saw around Rs 100 crore of investments through its platform in FY22 versus Rs 35 crore in FY21. By 2025, the platform targets to deploy Rs 500 crore a year into startups.

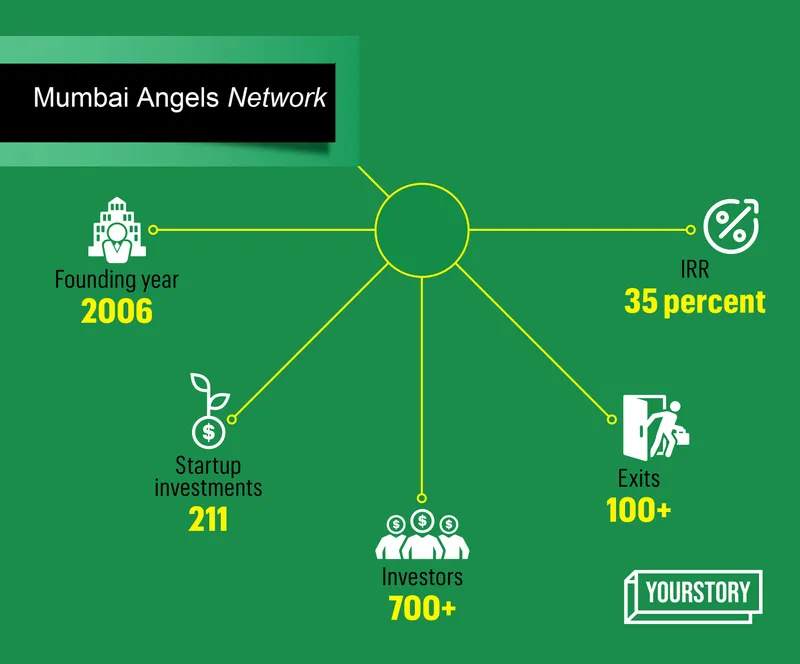

Established in 2006 to create a network of investors to back startups, has come a long way to become a venture investing platform.

Investors in Mumbai Angels include HNIs, UHNIs and structured family offices. According to Nandini Mansinghka, Co-founder and CEO of Mumbai Angels, the present economic downturn has not had any negative effect on these investors.

“The interesting piece of this asset class at the early or angel stage is actually downturn agnostic. It is completely insulated and we never see a slowdown,” Nandini tells YourStory.

Mumbai Angels typically backs startups early in their journeys—usually in the seed stage and going up to pre-Series. Investments range anywhere between Rs 50 lakhs and Rs 10 crore but the sweet spot is around Rs 2-3 crore.

“Our overall portfolio internal rate of returns sits anywhere around 35-36%,” says Nandini.

The platform has so far invested in 211 startups, and about 100 of them have either seen an exit or received the next round of funding. Nandini says it has also been onboarding more investors this year.

Mumbai Angels has backed the likes of mobile advertising technology company InMobi, ride-sharing startup Blu Smart, human resource management platform ZingHR, robotic kits maker Avishkaar, aerospace company Dhruva Space, among others.

Its most notable exits include startups such as beauty ecommerce platform Purplle, cloud telephony company Exotel, crowdfunding platform Ketto and SaaS firm Toch.

A bright future

While companies looking to raise large amount of capital are unable to do so due to current depressed macro-economic conditions, startups in the market for smaller cheques haven’t been impacted.

“If one compares the six months of this year to last year we have done more deals in 2022,” says Nandini.

The Mumbai Angels CEO believes there is much more sanity now that there is no “foolish money” chasing startups. Conversations are also happening around real business models and not vanity metrics.

According to Nandini, individuals or family offices are taking part in startups’ investments rounds and these entities are not governed by any set framework of a typical venture capital firm.

Nandini says that the funnel for startup proposals is also wider now. During FY 2021-22, the platform backed 56 startups which were screened from a pool of 7,000 proposals. Of these, only 700 were showcased to the investors.

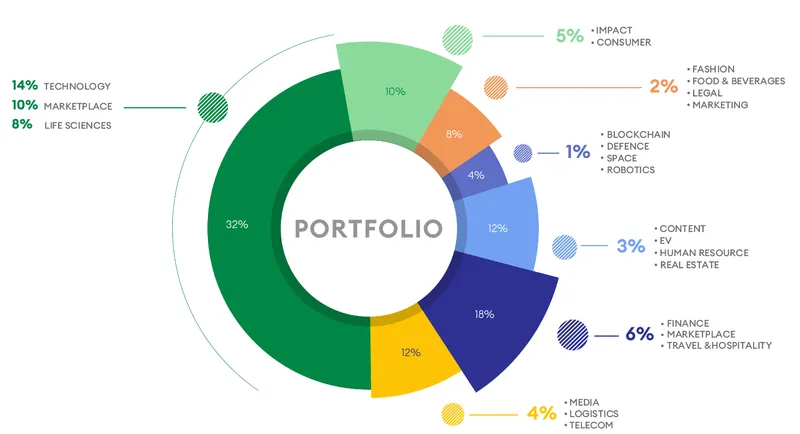

Given that Mumbai Angels is sector agnostic—it has backed startups across 26 segments—Nandini says the platform’s goal is to help investors access a diverse set of startups.

“For our investors, it is not just the quantum of deal flow but also the quality of our due diligence process,” she says.

For startups, the platform provides services such as finance, marketing, branding, and legal, among others, free of charge.

“We are looking at ourselves as a venture investing platform rather than a network,” says Nandini.

Wooing investors

Mumbai Angels is now holding active conversations with the investors, asking them to allocate a certain percentage of their corpus towards investing into startups. Today, it has around 700 investors on its platform from 70 cities spread across 10 countries.

The platform is asking its investor base to adopt a portfolio approach towards investing as this platform is sector agnostic in terms of investment. “Any investor on our platform knows that they are not left on their own,” remarks Nandini.

Segment wise investment portfolio of Mumbai Angels

Getting angel investment? Here are 5 tips to structure your term sheet the right way

She says Mumbai Angels is also an “expensive platform” where there is an onboarding fee for any prospective investor unlike many others who provide such entry for free.

“We have become a deep ecosystem by ourselves and will start investing into later stages of funding also,” says Nandini.

The Mumbai Angels CEO does not see any kind of funding winter affecting its target investment stages, and strongly believes that India’s entrepreneurial ecosystem is alive and kicking.

“Our job is to bring in more people into this asset class and to do that we will have to cater to a wide range of investing interests,” says Nandini.

Edited by Affirunisa Kankudti

![[Product Roadmap] How Gramophone used tech to increase crop yields by over 30 pc for 8 lakh+ farmers](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/PRM-1620125439692.png)