Startup news and updates: Daily Roundup (September 28, 2023)

YourStory presents the daily news roundup from the Indian startup ecosystem and beyond. Here's the roundup for Thursday, September 28, 2023.

Funding News

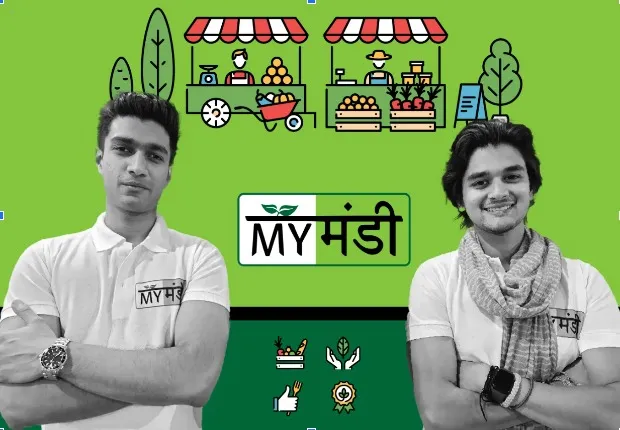

Real Time Angel Fund (RTAF) Leads MyMandi's INR 10 Crore CCD Funding Round

MyMandi, a B2B marketplace based in Gwalior that caters to cart-pushers (thela-walas), has recently announced the completion of its CCD round, raising Rs. 10 crores. This round of funding was led by Real Time Angel Fund (RTAF), a SEBI-registered angel fund based in India.

The investment will be instrumental in propelling MyMandi's growth trajectory and furthering its mission to empower farmers across India. MyMandi plans to utilise the funds to expand its offerings, enhance its technological infrastructure, and increase its market reach. The enterprise currently has over 3,000 cart-pullers/small retailers associated with it. It aims to bring aboard 5,000 of them by the end of this financial year .

"We are honoured to have Real Time Angel Fund as the lead investor in our current funding round. Their extensive experience in the agriculture technology sector will be invaluable to our team as we continue to push boundaries and make a meaningful impact on the Indian supply chain and distribution network in tier 2-4 cities," said Mahanaaryaman Scindia, Co-Founder of MyMandi.

Deeptech startup oorja raises $1.5 million in pre-Series A funding

Oorja, a Bengaluru-based deep tech startup that uses a combination of Physics and ML to perform predictive modelling, has announced that it has raised $1.5 million in seed funding. The funding round was led by Micelio Fund, a venture capital fund in India dedicated to enabling radical and sustainable innovation in the clean mobility ecosystem and co-led by Capital-A. Java Capital, Anicut Capital and Lead Angels also participated in the funding round.

Oorja will utilise the funds to build their product and make inroads into Europe and North American markets. On its cloud-based platform that uses a hybrid (Physics and ML) approach, oorja enables designers and engineers to create accurate solutions with predictable performance under real-life conditions.

“Our motivation behind oorja has been to solve complex engineering problems at the design stage with a cutting-edge world-class product made in India. Our Hybrid approach uses a combination of physics + ML to improve accuracy and speed up time to market,” said Vineet Dravid, Founder, oorja energy. “We are grateful to our investors for reposing their faith in our capabilities and empowering us in our journey.”

Decor Twist secures $250,000 in seed funding led by angel investor Adhvith Dhuddu

Delhi-NCR-based home decor brand Decor Twist has announced raising its first seed round fundraising, securing a total of $250,000 in investment. The round was led by serial angel investor Adhvith Dhuddu.

Decor Twist is a bootstrapped venture co-founded by Anupam Rajey and Nidhi Bajpai in March 2022.

“At Decor Twist, we’ve believed that home décor is about more than just products – it's about creating an environment that reflects your unique personality and style. The funds raised through this round will be strategically utilised in product line expansion, marketing outreach and to facilitate growth in the B2B segment,” said Anupam and Nidhi.

Adhvith Dhuddu's portfolio includes investments across sectors in F&B, adtech, logistics, like California Burrito, Wrap2Earn, CarterX and others.

General news

HMD Global appoints Tanuj Patro as Chief Financial Officer for India and Asia Pacific markets

Tanuj Patro, CFO, India and Asia Pacific, HMD Global

HMD Global, the home of Nokia phones, has announced the appointment of Tanuj Patro as its Chief Financial Officer (CFO) of the company.

With a career spanning over two decades in the finance domain, Patro has worked with industry giants such as Microsoft, Nokia, LG, and E&Y, as well as emerging market pioneers like Paytm.

"His deep financial expertise and strategic mindset align seamlessly with our vision for growth. As we continue to innovate and expand our presence in the global market, Tanuj's insights will be instrumental in shaping our financial strategies and ensuring sustained success. HMD Global recent move into launching its own line of mobile devices will greatly benefit from Tanuj’s financial acumen," said Ravi Kunwar, Vice President- India & APAC, HMD Global.

Locus onboards Nagaraju KB as Advisor

Locus, a dispatch management SaaS company, has announced the onboarding of Nagaraju KB (KBN), Ex-BigBasket’s Chief Customer Experience Officer, as a Strategic Advisor. KBN brings a wealth of expertise in supply chain operations, logistics management, and customer engagement.

In his role as an Advisor, Nagaraju will synergise with Locus’ product and strategy teams, infusing industry insights into the company’s offerings, thereby catalyzing its growth.

Before joining Locus, KBN was part of the senior management team at Bigbasket for nearly a decade where he oversaw crucial customer-facing functions, including delivery operations and customer support. Earlier, he helmed TVS Logistics Services Ltd. as its Chief Operating Officer.

“We are pleased to have KBN onboard. His steadfast support and guidance since our foundational partnership with BigBasket have been invaluable. As we strategise to amplify our industry footprint further globally, we foresee Nagaraju's deep knowledge in logistics operations, and customer experience contributing significantly to our growth plans,” said Nishith Rastogi, Founder & CEO, Locus.

Green Cell Mobility becomes first E-Mobility player to secure Green Loan Project Finance Facility

GreenCell Mobility has announced its green financing deal with the leading global bank, Standard Chartered Bank to revolutionise sustainable urban transportation in India. The company has secured a Green Project Finance loan to finance their Surat E-Mobility project, making it a notable financing partnership in India's electric mobility sector. Standard Chartered Bank served as the sole mandated arranger, lender, and green loan coordinator for the Rs. 1.25 billion Project Finance Facility.

The Surat E-Mobility project, which consists of 150 electric buses in Gujarat, represents the first-ever project finance transaction in India's E-Mobility sector by a global bank.

"The green loan is a significant move to step up our efforts towards transforming India's electric transportation landscape. The green financing secured for our project, will not only boost our operations, but also reaffirm our leadership in the e-mobility sector in India,” said Devndra Chawla, CEO & MD of GreenCell Mobility.

Aye Finance strengthens its board, adds three independent directors

, a credit provider to the underserved segment of the micro-enterprises sector, announced the appointment of Govinda Rajulu Chintala, Sanjaya Gupta, and Kanika Bhal as independent directors to its Board of Directors.

Rajulu is a financial services veteran with over 35 years of experience and his past appointments include Chairman of the National Bank for Agriculture and Rural Development (NABARD), Managing Director of NABFINS (NABARD Financial Services) and Chairman of NABARD Consultancy Services Ltd., NABVENTURE and NABFOUNDATION.

Gupta is a banking professional with over 35 years of extensive experience. He has served as the MD and CEO of PNB Housing Finance Limited, co-founder and non-executive chairman of India Shelters, and MD designate of a four-way joint venture between AIG Inc. National Housing Bank (regulator), International Finance Corporation (IFC), and Asian Development Bank (ADB)

Bhal is the Modi Chair Professor at the Department of Management Studies at IIT Delhi. An expert in behavioural sciences in general and leadership in particular, she is a visiting fellow at the Sloan School of Management, MIT. She has been a consultant to various government organisations and is often invited as an expert to serve on government committees.

(The copy will be updated with the latest news throughout the day)

![[Startup Bharat] MyBranch is helping companies like Flipkart set up sales offices in Tier II and III cities](https://images.yourstory.com/cs/2/3fb20ae02dc911e9af58c17e6cc3d915/Startup-11-1598527523085.png)