Edging out: Indian manufacturing cashing in on China Plus One strategy but more can be done

While India’s electronics industry has benefitted from global supply chains routing away from China, other sectors need standardisation, PLI schemes, and expertise to grow, say industry stakeholders.

The Indian industry is gaining manufacturing momentum, benefitting from global companies rethinking their supply chains and diversifying production.

Recently, Taiwan-based Innolux revealed plans to mass produce LCDs in India within the next 18-24 months, with a substantial investment of $3-4 billion in collaboration with Mumbai-based Vedanta Group. US chip manufacturer Micron Technology has started constructing a $2.7 billion semiconductor chip assembly in Sanand, Gujarat, to be operational by next year. In 2023, Tata Group acquired Wistron India, a division of Taiwan-based Wistron Corporation, becoming the first Indian company to join the Apple supply chain as an iPhone assembler.

With low labour costs and business-friendly policies, India is positioning itself as a lucrative option for global companies looking to diversify operations by establishing an additional production base outside of China.

The China Plus One strategy, also Plus One or C+1, has become increasingly significant, particularly in light of shifting global dynamics and the uncertainties arising from over-reliance on Chinese manufacturing. While many companies had been mulling the approach since the mid-2010s, the US-China trade war and the industrial and supply chain disruption caused by the COVID-19 pandemic forced them to act.

Countries such as Vietnam, Taiwan, Bangladesh, Malaysia, and Saudi Arabia, alongside India, have reaped the rewards of this strategy. Where India stands out, according to experts, is through the Foreign Direct Investment (FDI) regulations that encourage partnerships and joint ventures with local businesses.

Talking to SMBStory, Sanjeev Sehgal, Founding Chairman of the Security Promotion Group of India and Convener of Video Surveillance Standards in the Bureau of Indian Standards, says collaboration with local businesses helps in ecosystem creation.

Sehgal, who is also the Founder of Sparsh CCTV, has observed a substantial reduction in imports for manufacturing CCTVs over the last decade. While the company would earlier source 40% of materials indigenously, the share now stands at 80%. “Thanks to government initiatives like the Telecom PLI (Production Linked Incentive) scheme that has enabled Sparsh scale and also added an in-house process and increased more SKUs (stock-keeping units).”

The Telecom PLI scheme was launched in 2021 to help reduce India’s dependence on other countries for the import of telecom and networking products.

Electronics: The hottest sector?

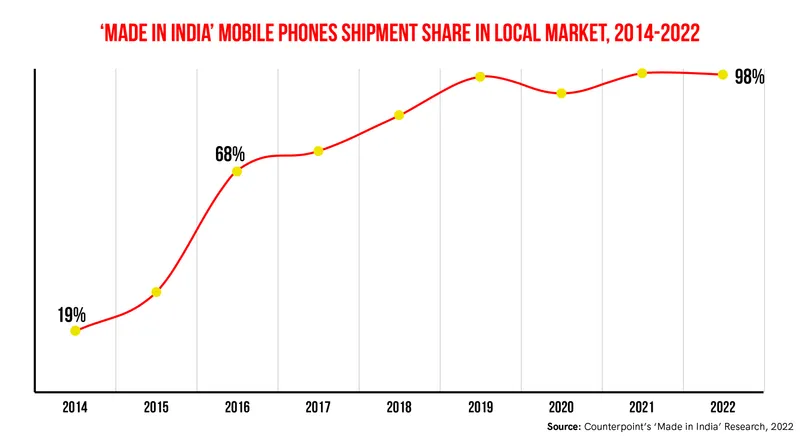

In 2023, India became the second-largest smartphone-producing country. Counterpoint research noted that ‘Made in India’ mobile phone shipments crossed the 2-billion cumulative units mark during 2014-2022, registering a 23% compound annual growth rate. This was enabled by an increase in import taxes for fully assembled phones.

“India has come a long way in mobile phone manufacturing,” Counterpoint Research Director Tarun Pathak noted in the report, highlighting that in 2022, over 98% of shipments in the Indian market were Made in India—a significant improvement from 19% in 2014. The government also recently slashed the import duty on smartphone parts from 15% to 10%.

With the increase in mobile phone shipments, industry stakeholders anticipate that associated products like cables, chargers, earphones, batteries, semiconductors, etc will become more localised.

Smartwatches is another booming sector which saw a growth of 21% YoY in July-September 2023, as per Counterpoint Research.

Noise, one of India’s leading consumer electronics brands, has also localised the production of smart wearables while generating over 5,000 employment opportunities. Its Co-founder Amit Khatri says that the company made over 10 million products in 2023, of which nearly 95% were manufactured locally. While it had earlier tied up with Chinese manufacturers to make the smartphone covers, it has taken the initial steps to localise components procurement.

Ashok Rajpal, Managing Director of Delhi-based Ambrane India—a leader in computer peripherals, mobile accessories, wearables and power banks, says that the manufacturing space has witnessed a lot of indigenisation over the last few years.

“Earlier, every part or component for electronics was imported—from cables, wires, plastic coverings, to even batteries. Now, the imports have vastly reduced and these are made locally. Even brands now, rather than importing, source these from India,” he adds.

According to the Ministry of Electronics and Information Technology, with the National Policy on Electronics 2019, the government attaches high priority to electronics hardware manufacturing. Besides the economic imperative, it also places importance on electronics hardware manufacturing up to the integrated circuit or chip level due to growing security concerns. Its objective is to establish India as a global hub for electronics system design and manufacturing.

The government's initiatives, including the Phased Manufacturing Programme, elevated import duties on assembled products, and PLI schemes, have significantly bolstered the electronics sector but Rajpal says that further reform is expected in the next 3-5 years.

Potential for disruption

Other than the electronics industry, other industries with the potential to benefit from China Plus One strategy include drones, toys, and textile and apparel.

Rahul Mehta, Chief Mentor at Clothing Manufacturers Association of India, told SMBStory that China continues to be the leader in apparel and textile manufacturing.

“The buyers need large and bulk purchases, for example, two lakh pieces per style. They look for a large production facility so that they don’t have to go to multiple factories. India has a comparatively smaller ecosystem hence, competing with other countries like China, Vietnam or Bangladesh is challenging,” he explains.

Though there are PLI schemes and MITRA Parks (Pradhan Mantri Mega Integrated Textile Region and Apparel) set up in different states, there is a need for India to specialise in textile manufacturing and performance fabrics.

Indian brands check into luxury space to cash in on surging middle class, aspirational youth

The drone industry too requires investment for R&D.

Vipul Joshi, CFO of drone manufacturer ideaForge, expressed hope that the rise in allocation for the PLI scheme in the Interim Budget 2024-25 will boost the defence and drone technology sectors. However, more incentives are needed to support the industry's growth.

“Concrete drone ecosystem support, including testing facilities and import exemptions for critical components, is crucial for boosting local value addition,” Joshi added.

The toy industry also offers a big opportunity, however, there is a large dependence on imports. The industry is also awaiting a PLI scheme.

Arjun Bajaj, Director of Videotex, one of the largest manufacturers of webOS TVs (LG’s smart TV operating system) and also the original design manufacturer for various brands, says that despite the government’s focus on electronics, TV is by and large neglected.

“India is an important market for the world, even for sectors like TV. While many raw materials used are localised now like metal press, cabinet body, etc, there is a need to enhance the quality,” he adds.

He also stressed the need to tap into the components supply chain for which expertise needs to be honed.

The country also needs to standardise manufacturing processes, especially in smaller industries, due to which many of India’s 63.3 crore micro, small, and medium enterprises (MSMEs) get left out on producing for corporates, says Shaurin Patel, Managing Director at Vexma Technologies.

The next decade of growth

The major factor that attracts investments in India is the labour cost, which is anywhere between 3-7X cheaper than China. However, cheap labour alone can’t be an impetus for investment inflow.

India is one of the world's fastest-growing major economies with a large and increasingly affluent population. In terms of purchasing power parity, the country is ranked third in the world, as per the IMF.

By establishing a presence in India, companies not only gain access to a significant domestic market but also position themselves strategically for regional and global trade. India's geographical location makes it a strategic hub for companies looking to serve markets in South Asia, Southeast Asia, the Middle East, and Africa.

China, too, doesn’t want to miss out on tapping into the now world’s most populous country. While the government earlier halted planned projects from BYD and Great Wall Motor, Chinese firms are ready to court India.

“Earlier, China was only supplying products and raw materials to India and other countries, but with the China Plus One strategy in place and to remain competitive, the country is now not resistant in sharing the tech and machinery, and that too at discounted prices,” adds Patel.

Global investors are now betting on India’s growth story, with Wall Street giants including Goldman Sachs Group and Morgan Stanley, as well as hedge funds like Marshall Wace and Vontobel Holdings AG endorsing India as a prime investment destination.

While many countries, especially in Southeast Asia, may have benefitted from the China Plus One approach, no country matches India’s scale, and companies and investors know that.

(Feature image and infographics by Nihar Apte.)

Edited by Kanishk Singh