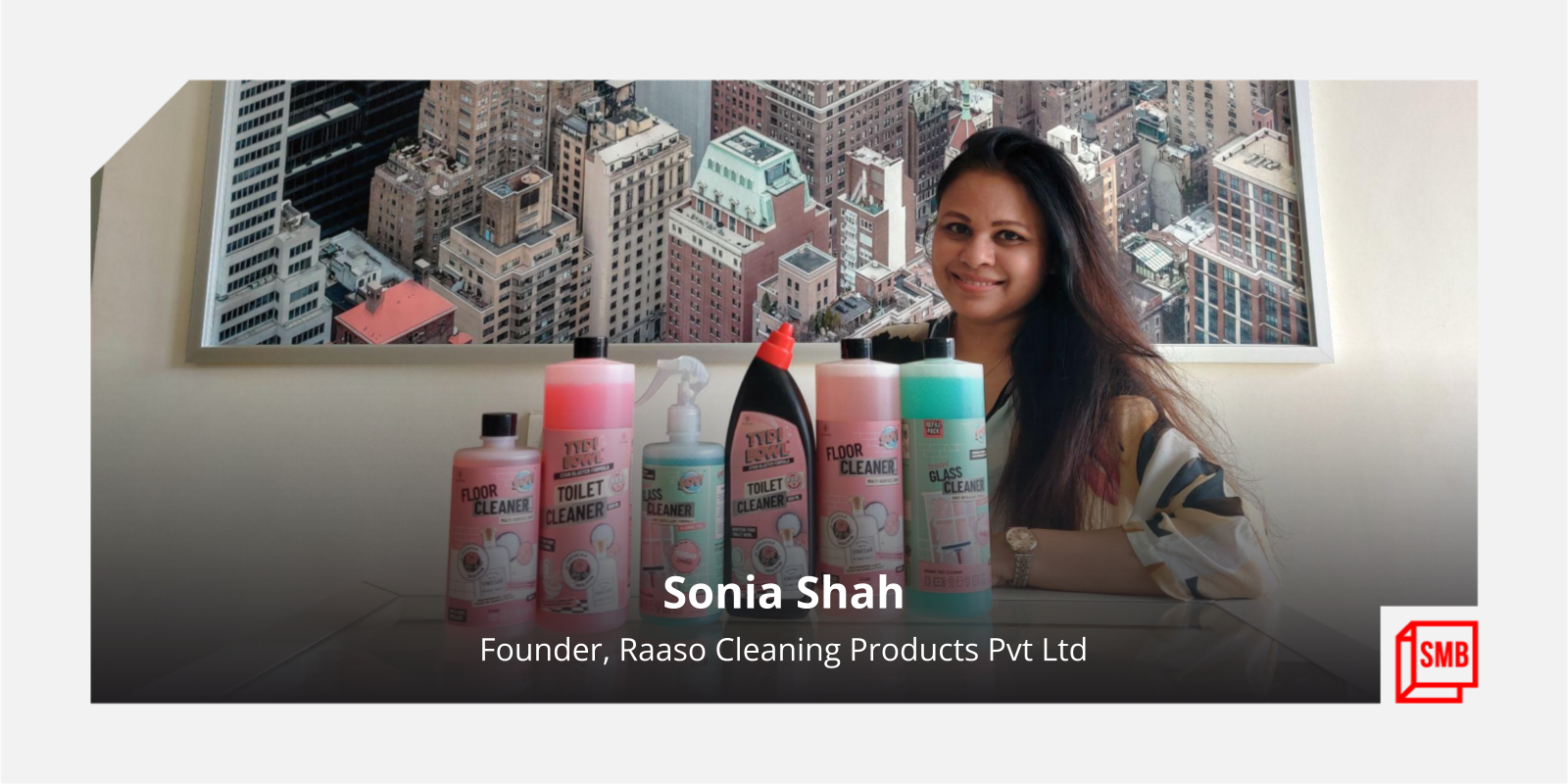

How this investment banker-entrepreneur started a home and kitchen cleaning brand

Sonia Shah, an investment banker turned entrepreneur, started Raaso Cleaning Pvt Ltd in Mumbai in 2019. Available on Bigbasket, Blinkit, and offline retail stores, the home and kitchen cleaning brand has sold 35,000 bottles.

Sonia Shah was working as an investment banker when she decided to pursue entrepreneurship. The double MBA graduate has worked for New York-based Citigroup Capital Markets and Anand Rathi Investment Banking.

She realised her entrepreneurial spirit after she dedicated some time to help her family’s tea business in Siliguri, West Bengal.

In 2015, she moved back to Mumbai and started importing home decor products and sold them to Indian wholesalers.

However, about four years into the business, a short call with her sister changed her path for good. “I am a workaholic, and I do not miss any idea that crosses my mind,” she says.

While they were discussing the lack of effective cleaning solutions in the market, her sister shared a home cleaning solution of a mixture of vinegar and baking soda.

“I tried that out, and it did wonders. I searched more about it on YouTube and found innumerable videos. But I could not find any products in the same composition in the market,” Sonia tells SMBStory.

After spending close to a year on R&D, in 2019, Sonia started Raaso Cleaning Products Pvt Ltd to formulate vinegar and baking soda powered cleaning products. Raaso has two brands — SOVI (floor cleaner) and TYDI Bowl (toilet cleaner).

Making the best of a pandemic

“The dirt came out like butter,” Sonia says about the first time she tried her sister’s home cleaning solution. She adds, “The idea was at an embryonic stage and needed strong R&D to make a successful product.”

She met ex-BASF scientist Dr Ramachandran who helped her with the R&D for over a year. By April 2020, she had the stock ready for 3,000 bottles of India’s first vinegar and baking soda powered cleaning products.

However, as the COVID-19 pandemic hit, it became challenging for Raaso to market and sell its product.

“Before April, we had a pilot launch, and our friends and relatives liked the product. Meanwhile, I was in touch with Bigbasket, but when all the listing formalities were completed, the country went into lockdown,” Sonia tells SMBStory.

While initially, Bigbasket had denied listing Raaso’s inventory, fearing market uncertainty and unnecessarily blocking the inventory of a new business. However, once the market got stable, it listed SOVI under the ‘essential’ category, which did wonders for the brand.

“Those 3,000 bottles were stocked out soon, which gave us a strong motivation. After the successful launch of floor cleaners, we launched dishwashing liquid, glass cleaners, and toilet cleaners — all highly ranked on Bigbasket,” Sonia asserts.

Raaso’s products — priced between Rs 219 and 299 per litre a bottle — are available online on , , and . It is also available in a few general stores in Mumbai and Siliguri.

By October 2021, Sonia claims both the brands sold 25,000 units, and by March 2022, Raaso had sold 35,000 bottles. The company had clocked a total gross merchandise value (GMV) of over Rs 4.5 million for FY21-22. It wants to achieve a revenue run rate of Rs 20 lakh per month by March 2023.

Raaso's product range

The home cleaning solutions market

Although Raaso is on the growth trajectory, Sonia says she didn’t have the R&D capabilities like Reckitt Benckiser and HUL, who have Domex and Harpic home cleaning brands, respectively.

India has the third-largest market for household cleaning and personal care products, with demand reaching $28.5 billion in 2020, and brands, including Lizol, Dettol, Colin, Harpic, Vim, Cif, Domex, etc., dominate it.

Sonia had bootstrapped the company with Rs 12 lakh, where she used 50 percent of the investment for R&D, formulation development, and quality testing.

She used a third of the capital for branding and packaging purposes, and the remaining funds to create a solid supply chain for raw materials, packaging materials, and logistics support.

Raaso manufactures all its products in its Mumbai unit, where it maintains strong quality checks and safeguards the proprietary formulations.

Sonia says home cleaning is a ‘low development and high demand’ category.

She says, “Home cleaning products are not paid much heed. People buy anything they find over TV ads or other commercials or if recommended by their house helps. They don’t make informed decisions, and that’s the challenge.”

“We are targeting a mass segment where our price point is not higher, but 10 to 15 percent costlier than the established mass brands. And I guess, it justifies the formulation we are offering. Till now, we have grown through word of mouth. I have received feedback where the house help has recommended our product to the owner, and that keeps us going,” Sonia adds.

Future prospects

Soon, Raaso is planning to come out with a new laundry liquid detergent. For Sonia and Raaso, 2022 has a rigorous expansion in cards. The brand is in talks with Foodhall and Haiko to strengthen its physical retail presence. Sonia is also looking forward to strategic investment partnerships.

“The pandemic prompted Indians to shop for home cleaning products online, but around 80 percent of the market for home cleaning products is through general trade, and we want to be present everywhere,” Sonia says.

Sonia is also working towards entering the business-to-business (B2B) space, but the fierce price competition from the unorganised players is a hindrance.

Edited by Suman Singh

![[Funding Alert] MakeMyTrip gets Rs 73.5 cr from its Mauritius entity amid coronavirus crisis](https://images.yourstory.com/cs/wordpress/2016/12/Deep-Kalra-founder-and-CEO-MakeMyTrip.jpg)