Long-term loan are not conducive to MSMEs looking to address immediate needs: CredAble

Cash flow-backed financing acts as a financial catalyst for MSMEs by significantly improving cash flow dynamics by solving the credit gap.

Working capital is one of the biggest challenges that the micro, small, and medium enterprises (MSMEs) of India face. While various lending options are available to MSMEs, traditional banks don’t usually deal with these enterprises, given the trust issue.

This was highlighted by , an MSME-focused fintech company, in its report titled Building Sustenance for SMEs: Navigating Working Capital.

“While fundamentally, MSMEs have strong business, bankers don’t want to take a risk lending to them, and that’s where cash-flow based lending comes into the picture,” Nirav Choksi, CEO and Co-founder of CredAble told SMBStory exclusively.

Besides banks demonstrating hesitancy in lending due to the perceived risks, Choksi contended that banks primarily provide long-term loans. However, for MSMEs facing short-term challenges and requiring funds to address immediate needs, long-term loans are not conducive. Choksi emphasised the importance of cash-flow-based lending as a more suitable solution in such cases.

According to the report by CredAble, cash-flow lending has replaced lending based on physical assets as collateral with transaction-based credit services. India has developed infrastructure to accelerate GST-based lending in the form of Open Network Digital Commerce (ONDC), Open Credit Enablement Network (OCEN), and Trade Receivables Discounting System (TReDS).

Cash flow-backed financing acts as a financial catalyst for MSMEs by significantly improving cash flow dynamics by solving the credit gap.

“The concept involves leveraging the financial robustness of the supply chain to direct financing towards the stakeholders in the supply chain who need it the most. Supply chain financing aims to redirect attention from ratios to cash flows. This entails making credit decisions for MSME businesses through a thorough underwriting process and developing customised structures that distribute risk among different parties,” explained Choksi.

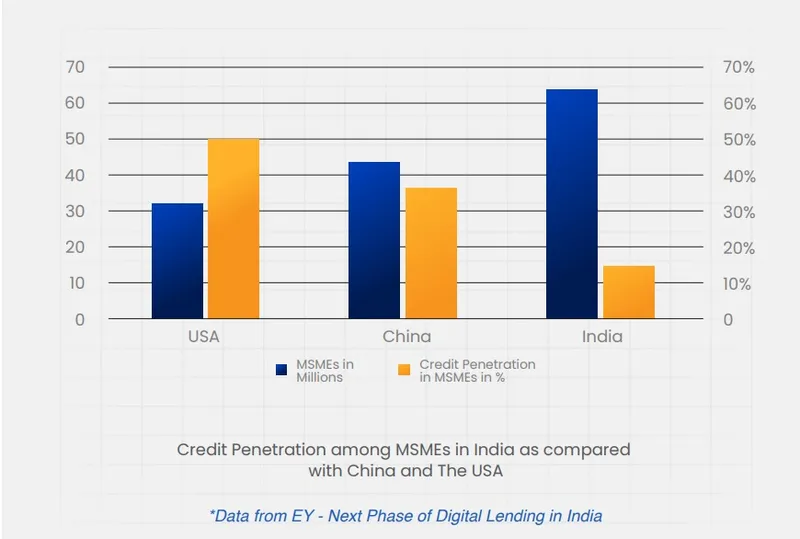

Source: CredAble report

Small and medium enterprises (SMEs) face a unique set of challenges in balancing their working capital positions. Cash flow is a constant concern for SMEs, and credit is scanty given the lack of collateral, insufficient credit histories, and traditional credit models adopted by lenders while evaluating SMEs.

India has about 64 million MSMEs—much higher than its comparable economic counterparts—the United States and China. That said, the penetration of modern credit facilities to these MSMEs is lagging. Only about 8 million MSMEs in India have access to modern banking facilities compared to 16 million in the United States and China.

Talking about the 45-day payment rule for MSMEs, Choksi said the move is great. While it will cause some challenges to MSMEs, cash-flow-based lending can help mitigate the issue.

As per the 45-day payment rule, MSEs (micro and small enterprises) are supposed to receive payments within 45 days if there is an agreement and/or within 15 days if there is no agreement.

The report added that traditional financing channels inadequately meet the unique needs of MSMEs. The remedy lies in a strategic amalgamation of government infrastructure, capital infusion from prominent financial institutions, creative financial frameworks, and cutting-edge financial technology that can effectively fill this gap.

Edited by Suman Singh