Budget 2021: Hospitality industry lays out expectations after a year of constant low

Input tax credits, streamlining of regulations, and simplified procedures are some of the expectations by the hospitality industry from Union Budget 2021.

In 2020, the hospitality industry underwent its most challenging crisis as one of the worst-hit sectors due to the COVID-19 outbreak. According to IBEF, the tourism and hospitality industry created 39 million jobs in FY20 — eight percent of the total employment in the country.

However, with travel restrictions imposed by the various governments across the globe, the hospitality industry came to a standstill, facing major salary cuts and job layoffs.

Image source: Shutterstock

Tanai Shirali, Senior Director - Operations of Mumbai’s rooftop lounge ASILO, says, “COVID-19 has shaken our already eroded foundation. While our income has been severely stunted due to the ongoing crisis, our expenses have not.”

While ASILO witnessed encouraging numbers in sales volumes during the first 10 days of December — usually its best performing month, there was a sharp dip in sales towards the end of 2020 as states enforced New Year’s restrictions and lockdowns.

The Confederation of Indian Industry (CII), in its report on the impact of COVID-19 on the hospitality sector, estimates that the entire value chain linked to the industry is likely to lose around $65.57 billion, with the organised sector alone likely to lose $25 billion.

Tushar Mehta, Chief Strategy Officer, The Chocolate Spoon Company, says, “Hospitality has been one of the worst impacted sectors and will likely be among the last sectors to recover fully. So far, we have seen very little support from the Centre and are hopeful that the Budget will give us the tools we need to tide over this crisis.” Despite month-on-month improvements, the company is only able to do 60 percent of its pre-COVID numbers.

In October 2020, the Ministry of Tourism announced SAATHI (System for Assessment, Awareness and Training for Hospitality Industry). The initiative, in partnership with the Quality Council of India (QCI), will implement guidelines/SOPs issued with reference to COVID-19 for the safe operations of hotels, restaurants, and B&Bs.

However, the hospitality sector has more in its Budget 2021 bucket list, and is awaiting key announcements and policy measures from the government on February 1.

Expectations of players in the hospitality sector

Rohit Kapoor, CEO, - India and South Asia:

“With turbulent economic recovery trends, we expect further streamlining of regulations in the travel, tourism, and hospitality industries to spur greater demand amongst domestic and international travellers for accommodations. We are hopeful for some financial support, uniform taxation, an extension of the moratorium period so that our small hotel partners can benefit from the required working capital to sustain these challenging times and thereby, meet their operational costs, retain jobs, and boost domestic tourism, an integral contributor towards India’s robust revival story."

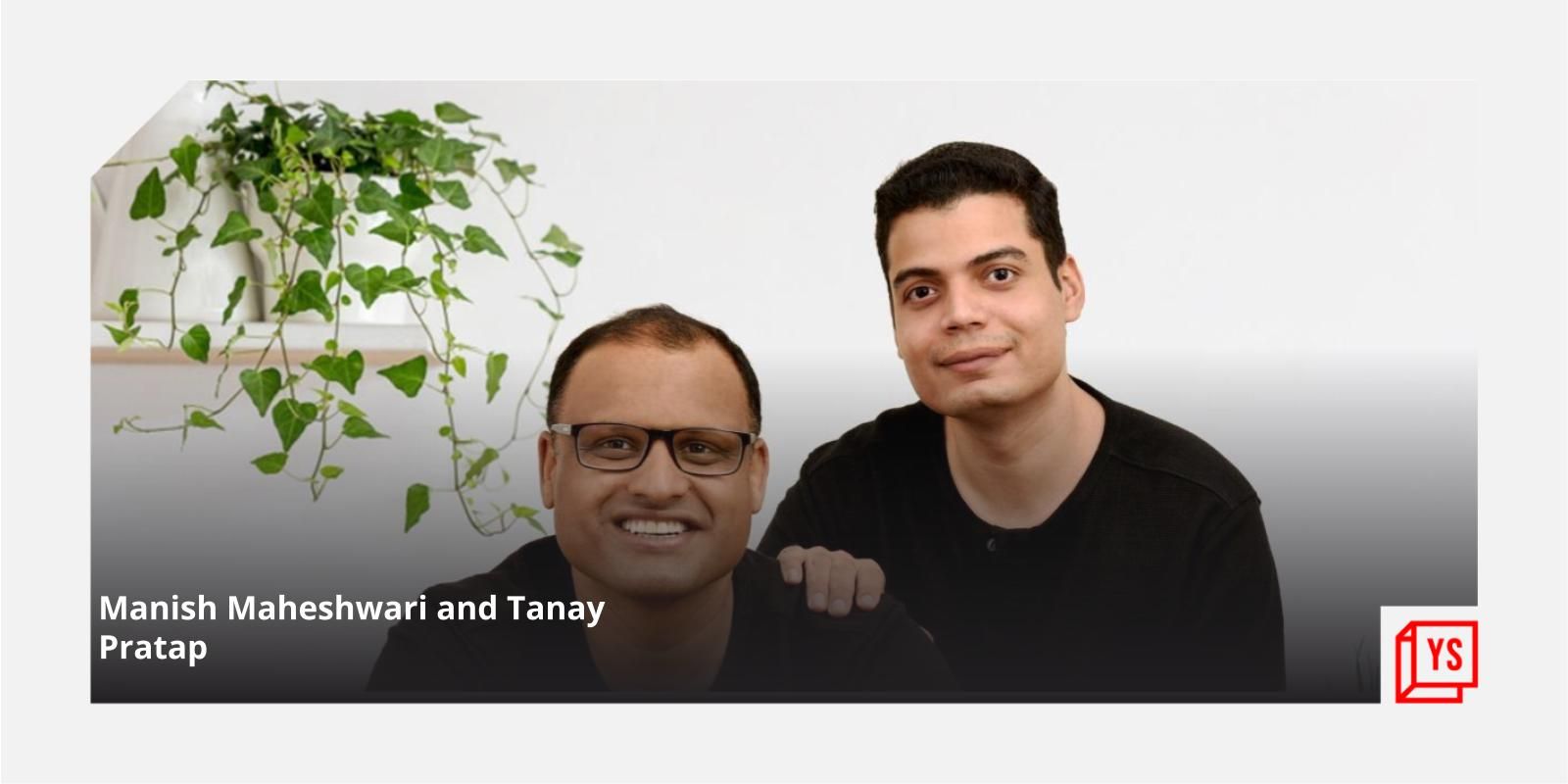

Rajnish Kumar, Co-founder and CTO, ixigo:

"The industry saw a 90 percent dip after the lockdown was announced last year. While the vaccine rollout has strengthened traveller confidence and demand and search queries for travel are slowly climbing, certain provisions by the government can help bolster the industry back to pre-COVID-19 levels sooner. IT deductions on travel will help incentivise tourism and encourage domestic travel. Lowering taxes on ATF(which currently comprises 30-40 percent of the total cost of an airline) and ensuring uniform pricing across all states will also bring much-needed relief to the aviation sector."

Yash Bhanage, Partner at Hunger Inc (The Bombay Canteen):

“Benefits for employees who lost livelihood in the last couple of months, input tax credit, and reforms to enable the hospitality industry to hire back employees who had to be laid off during the pandemic are some of the things we look forward to from the Union Budget.”

Farman Beig, Founder and CEO of Wat-a-Burger:

“Understanding the fact that this particular sector employs a huge number of semi-skilled and under-skilled manpower, it becomes imperative to enable a fast recovery system. For a food service provider, it takes multiple licenses to be able to establish a business. And it has been this way for over years. This procedure needs to be simplified to make it more productive for an F&B business. Secondly, the sector requires reintroduction of the input tax credit.”

Tushar Mehta, Chief Strategy Officer, The Chocolate Spoon Company:

“There has been some support from the Maharashtra government by way of excise fee discounts and the awarding of industry status to the hospitality sector. This needs to be replicated at a national level. However, these are just temporary bandaids when what we really need is systemic support. For instance, we have been lobbying for the hospitality industry to be allowed input tax credit, which is permitted for all other industries. It has become critical for our survival. Additionally, we would benefit from the waiver of late fees for GST and VAT payments.”

Dipinder Benjamin, CEO, Morpho Hotels:

“Our expectations are that hotels would definitely close on a plus 60 percent year-on-year occupancy levels, ADR (Average Daily Rate) would be lower to the 2019 figures, food and beverage business may not be as healthy as 2019 with high MICE (meetings, incentives, conferences and exhibitions) business missing throughout the year. Weddings would be the contributor for social business as they continue to drive revenues despite the limitation to the attendees.”

Bala Sarda, Founder of :

“Reducing long-term Capital Gains Tax on Private Equity and making it at par with the public market. People pay 10 percent tax on investments in stock markets but an entrepreneur pays about 27 to 28 percent tax on a business he has built from scratch. And stronger subsidies on import of Capital Goods used for core manufacturing and value addition for exports.”

Chef Aditi Handa, Co-founder and Head Baker, The Baker's Dozen:

“It is very necessary to provide the F&B sector with a dedicated stimulus package in the budget that can ease their pandemic journey. Also, as the lockdown has observed a growth in the home growth brands who wish to do something big in the upcoming future, it would be great if the government can provide them with access to easy credits to start their businesses on a larger scale.”

Kausshal Dugarr, Founder and CEO, :

“With the entire tea industry looking to pivot online in a post-pandemic world, the government should focus on increasing the pace of digitisation in semi-urban, non-urban or Tier II and III cities across the country by a faster roll-out of 5G services this year. This shall enable direct-to-consumer companies like us gain faster access to these untapped markets, expand the distribution channels and build on our customer base."

"The taxation structure needs a relook wherein the government must ensure the start-ups in the sector can be provided bigger tax breaks so that they can invest in creating a vibrant online ecosystem; whereby more value and efficiency is created. More clarity on ecommerce policies and a budget that addresses regularisation of the digital economy and an adequate information communication technology (ICT) infrastructure to support the robust growth of startup economy will set the pace for the year ahead,” Kausshal added.

Tanai Shirali, Senior Director - Operations of ASILO:

“One of our major pleas for this year's budget is the roll-back of input credit on GST. We also would urge for more liquidity and policy support as the real crunch time is what we are going to face in the next 12-18 months.”

Hopeful about the future

According to RateGain Technologies, a SaaS startup in the travel and hospitality industry, India has started travelling and filing flights to almost 100 percent capacity.

Its hospitality and travel trend report PULSE suggests that Goa was the most booked destination in December 2020, followed by Shimla and Jammu. Hotels in Mumbai drove the maximum social media engagement, and Bengaluru witnessed the least engagement from travellers on Instagram and Facebook.

Kamesh Shukla, EVP and Head APMEA, RateGain said in a statement: “In the new normal, the Indian millennial traveller would play a critical role in the recovery of the region and therefore this recovery is not encouraging for the domestic hotel industry but also for neighbouring Asian markets that rely on China and India to drive their tourism markets.”

Vaibhav Patil, Director of Finance at hospitality software and services startup eZee Technosys says, “We expect the Budget 2021 to allot incentives for domestic tourism and promote it within the country. A reduction in GST will also favour tourism currently. The government should also consider providing tax exemptions for new developments and a longer tax holiday for new hotels and resorts that will help in attracting investments into the industry."

For YourStory's multimedia coverage of Budget 2021, visit YourStory's Budget 2021 page or budget.yourstory.com

Edited by Saheli Sen Gupta

![[Weekly funding roundup] Venture capital inflow into Indian startups maintains high momentum](https://images.yourstory.com/cs/2/f08163002d6c11e9aa979329348d4c3e/Weeklyimage-1577460362436.png)