[YS Trend] Hot off the oven: New-age platforms entice retail investors with solar biscuits

Platforms are throwing open solar projects to retail investors as an alternative investment choice, with an entry ticket as low as Rs 500, promising an average annual return of 9-15%. But how hot are these investment options and do they really rake in money?

A group of investors pooling in money to buy a high-value real-estate property, an aircraft, a luxury boat, or a huge warehouse and sharing passive ownership is not a new concept. Many investors adopt this approach—popularly known as ‘fractional ownership’—to reduce the financial burden on a single investor and earn returns proportional to their investment.

What’s new is that investors are now pooling in money to invest in an emerging asset class–renewable energy, particularly that of solar energy.

Rooftop solar projects—which are typically capital intensive and hence restricted to large investors hitherto—are now being thrown open to retail investors with a low investment threshold and pitched as a viable alternative investment option like mutual funds and fixed deposits.

While this asset class has been around for some time, only now it has started to gather steam, particularly among retail investors looking for fractional ownership of assets to earn monthly payouts.

The overall idea of fractional solar energy investment has had a strong start, though there is a long way to go before it becomes a mainstream asset class.

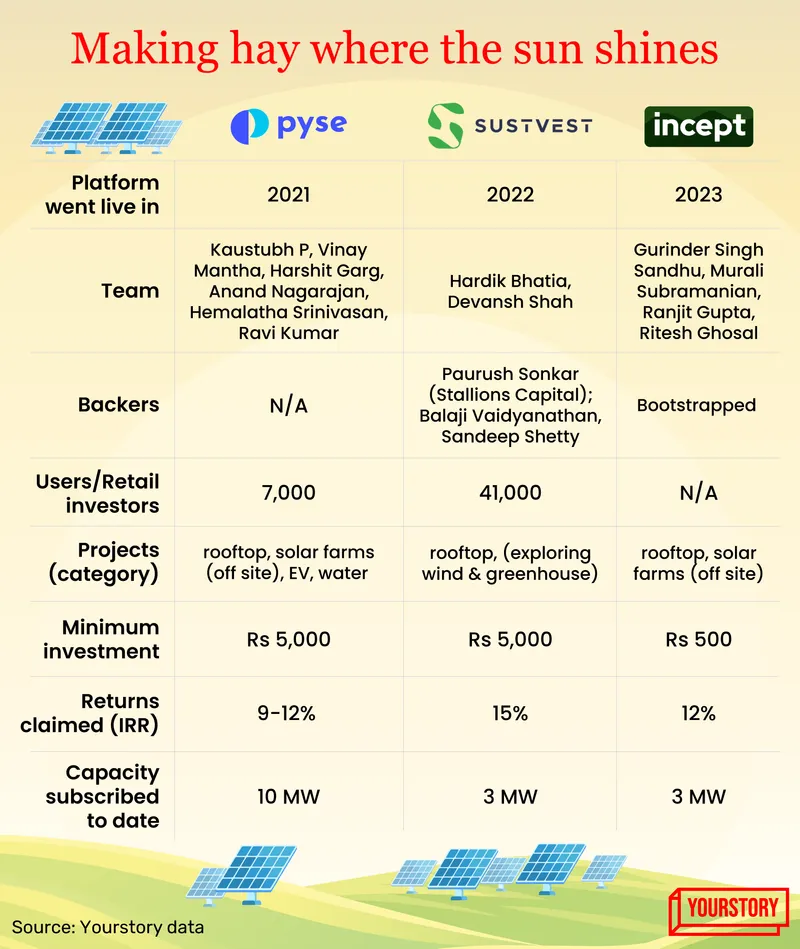

Facilitating this investment process are new-age tech startups such as , , and , which operate as intermediaries, aiming to democratise the asset class and make them accessible to investors at large.

Are digital solar assets or solar biscuits, as they are also known, really as bright and shiny as touted to be? Are the low-entry tickets—as low as Rs 500—and the promise of annual returns of 9-15% enough to draw retail investors? What are the red flags to watch out for? YourStory attempts to understand all this and more.

Warming up the field

Typically, there are two types of solar projects—rooftop projects (onsite) and ground-mounted solar plants (offsite), also known as solar farms. Electricity generated from these projects can be sold to a single buyer (such as a corporate entity for its buildings or a housing society) or multiple buyers via open access market (like large manufacturing units).

A solar biscuit is a unit or a portion of a solar plant project hosted online that can be purchased by investors.

Platform aggregators not only act as intermediaries between developers/sellers of electricity and buyers and retail investors, but they also make sure the projects are chosen carefully with necessary due diligence before putting them out on their platform for funding. Besides this, they also facilitate transactions, payouts, project maintenance, and more.

There are three ways in which a platform can enter and operate the project.

1. Acquire an already developed project (with an established power purchase agreement with a buyer) and list it out for subscription to investors;

2. Tie up with a developer and raise funds via the platform for a yet-to-be-developed project using estimated numbers;

3. Install their own solar farm to directly sell and raise funds in tranches via the platform. In this case, the platform operators themselves are the developers, who find buyers, sign power purchase agreements (PPAs), and finance the project.

Platforms have adopted one or more of these models depending on their requirements, goals and strategies.

For instance, Pyse operates in all three models, while Incept Green has taken the former ‘acquire-first’ approach.

An ‘acquire-first’ model comes with the advantage of low risk, as the project is already up and running, explains Ritesh Ghosal, Co-founder, of Mumbai-based Incept Green, the latest entrant in the space. Therefore, the project has an established track record in terms of electricity generation.

Gurugram-based SustVest, on the other hand, is operating on the second model.

Hardik Bhatia, Co-founder and CEO of SustVest, explains that the company takes the ‘develop later’ approach as it eliminates the need for a large upfront capital for acquiring projects and it is able to ensure the quality of the solar panels.

Note that a rooftop project on a commercial building can reach a maximum of 1 megawatt (MW), costing around Rs 4.5 crore, while a solar farm project has much larger capacities and costs.

Every solar project comes with a PPA that has to be signed by both the buyer of the electricity (off-taker) and the seller (project developer).

These agreements set the tariff at which electricity will be sold, which ultimately determines the returns. The higher the rates and generation, the better the returns.

A PPA can be both short and long-term, depending on the buyer. While short-term PPAs are typically for two to three years, long-term ones range from 15 to 25 years, depending on the project life.

The third model of developing ‘open access’ projects may be appealing to certain platforms as the policies of selling in the open market evolve.

Last year, Bengaluru-based Pyse installed a Rs 26-crore open-access solar project in Karnataka, with an average investor ticket size of Rs 25,000.

The platform divided the project into four tranches, which were oversubscribed 2.5x times, and the money was raised on an average of three days by over 600 investors.

“The advantage is that you are not fixed to a client. There is always a probability of default by a buyer. In such a case, we can easily move to another one. There is also the advantage of negotiating the rates while revising the short-term PPAs,” says Kaustubh Padakannaya, Co-founder, Pyse.

Playing where the sun shines

Platforms have been seeing steady demand from both individual investors and groups of investors interested in fractional ownership.

An investment of as low as Rs 500 in one of Incept Green’s listed projects could get investors 14 watts of capacity, which translates to a reduction of 270 kg of CO2 and an earning of Rs 64 per year on average.

Mumbai-based Incept Green, which has recently gotten off the ground after its testing phase till now, managed to sell 24 kilowatts (kW) of digital solar assets of one of its two projects through a 10-day social media campaign.

It has acquired two projects so far—that of TVS Motors and Dr Reddy Labs—at a total capacity of 2MW—from the original developers Sure Energy. A third project is in the pipeline.

“The traffic was so much that we had a crash on our website the first day. We managed to get almost 2 million visitors showing interest,” says Incept Green’s co-founder Ghosal, speaking on retail investors’ interest and growing awareness in the segment.

The majority of the demand came from people below 35 years of age, he adds.

Owing to an increase in demand, Sustvest is increasing its minimum investment size from Rs 5,000 to Rs 25,000. The maximum limit is Rs 5 lakh. Interestingly, one of its projects that got listed last month was 100% subscribed within 100 seconds.

The company claims to have sold 3 MW of assets worth Rs 20 crore on its platform since its official launch last year, among 41,000 investors. It says its investor base is growing 30% month-on-month.

Pyse, which has sold 10 MW to date, has seen its average investors increase their investment on the platform by 25-30% within six months.

“There is a lot of liquidity that people are willing to put into alternative assets, which has majorly picked up in the last two years. In 2020, people started their portfolio with 10% towards this asset class, which has jumped to 25-30%,” says Pyse’s co-founder Padakannaya.

Checks and balances

With interest picking up in solar biscuits, the onus is on aggregators to pick the right projects for investors. The parameters to look for include sustainability of the project, technology involved, panel quality, strategic location, and PPA clauses.

The magnitude of returns depends on the power rates negotiated in the PPA. In a majority of the cases, the PPA and the tariff may not be in the platform’s control as it acts as a mere facilitator of the investment.

In such cases, it is critical for the platform to choose the right project after thorough evaluation, as this determines the consistency in electricity generation and supply.

The platform must ensure the PPAs are concrete, the buyers are credible and the solar panels of good quality. The project must also be developed using the latest technology, so that maintenance does not prove to be challenging later on.

It’s important to note that maintenance is undertaken by a third party appointed by the platforms.

Platforms must also assess the creditworthiness of the buyer and their standing in the market to ensure regular payments.

“We look at a profitable balance sheet and rating of the buyer. The company’s net worth should be at least 7x the size of the asset,” says Bhatia of SustVest.

Risks and returns

The market for solar rooftop is large, owing to increased awareness and government subsidies for residential projects besides the global push towards net-zero emission targets.

The Indian government has set an ambitious target of achieving 500 GW of installed renewable energy capacity by 2030, which includes the installation of 280 GW of solar power.

While everything about investing in digital solar assets sounds ‘green’, experts lay down certain variables at play that amp up the risks involved.

Most of the platforms promise an average annual return of 9-15% (internal rate of return). However, experts caution that it is not easy for investors to accrue these returns.

The major challenge involves buyers changing project locations and surrendering contracts, despite termination clauses, if they find cheaper power elsewhere.

"Getting consistent returns across multiple contracts is a problem,” says Gokul Prakash, CEO at Lamberton Power, a Mumbai-based investment advisory firm focussed on solar financing.

A developer of large-scale solar projects advises investors to check the PPAs thoroughly, along with the buyer’s credentials in the market.

“Make sure the termination clauses are stringent and the assets have insurance,” he says.

Given the low barrier to entry into these small-scale projects, the quality is allegedly compromised by some developers. He advises checking the pedigree of the team as “having skin in the game” is important to run new-age investment platforms.

“Renewable energy sector requires a lot of expertise, especially in the backdrop of complicated contracts, financing structures, and evolving government policies,” he said.

Currently, the regulations for fractional ownership in green assets are yet to be framed, leaving the investors out of the lawmaker’s safety net.

As regulations evolve, the asset class could gain mainstream traction from retail investors at scale.

The internal rate of return (IRR) is affected by the depreciation of assets (solar panels) and seasonal variation, for there may not sunshine all throughout the year. All these factors impact the generation of solar power and ultimately the IRR. Therefore, maintenance of assets is crucial.

A solar panel usually depreciates by 0.05% every year and has a life of 25-30 years, provided it is maintained well.

“As years go by, the returns don’t decrease because that’s a part of the financial model. The asset (panels) generates different returns throughout the year, but y-o-y returns are steady at 12% IRR. As time goes by, debt reduces and return on equity increases,” says Ranjit Gupta, Co-founder, Incept Green.

Bhatia of SustVest adds that the asset class gives higher returns than debt and has a lower risk profile compared to equity.

Amidst challenges, the platforms are geared up with plans to expand and expedite operations.

SustVest is exploring wind and greenhouse as the next asset class besides open-access farms.

Incept Green is closing its third solar project since its launch in August and is looking for external investors, while Pyse will soon be closing a large fundraise.

“The idea is not just to pitch this as an alternative investment but also have environment-conscious people participate in mitigating pollution by investing in solar,” says Gupta.

(The infographic was updated in the copy.)

Edited by Swetha Kannan

![[YS Trend] Hot off the oven: New-age platforms entice retail investors with solar biscuits](https://images.yourstory.com/cs/2/628912e0d7f211eb8e8307e5b6451cf7/SolarInvestmentCover-1695052373255.png?mode=crop&crop=faces&ar=2:1?width=3840&q=75)

![[Funding alert] Swiggy raises $800M at $5B valuation](https://images.yourstory.com/cs/2/e641e900925711e9926177f451727da9/shutterstock1730607304-1594028762169.png)