The present structure of Indirect Taxes is very complex in India. There are so many types of taxes that are levied by the Union and State governments on goods and services.

How nice will it be if there is only one unified tax rate instead of all these taxes? Yes, that's what the Government of India has proposed through GST.

The current tax regime is unfairly skewed against most producers. Let's outline and simplify the current system of taxes and GST to see how it operates:

Image credit "ShutterStock"

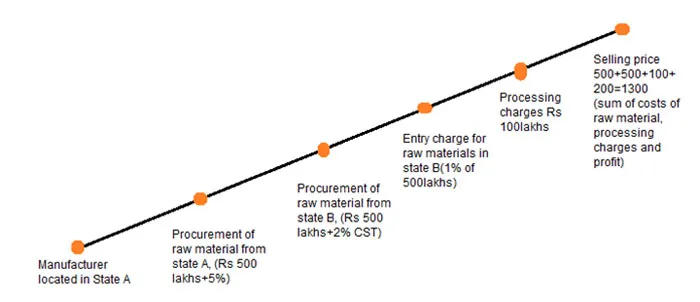

Let's take an example of a toothpaste manufacturer. Assume the manufacturer procures raw materials at Rs 1000 lakhs per batch – Rs 500 lakhs of raw material from the same state and Rs 500 lakhs of raw material from another state.

The manufacturer keeps his operating profits at Rs 200 lakhs and encumbers a processing cost of Rs 100 lakhs. The flow would look something like this:

Taxes to be paid

The producer in the present regime only has an input tax credit of Rs 25 lakhs. In the GST regime, the producer will get the credit of VAT, CST as well as Entry Tax. The GST hence, reduces the tax burden on producers.

The GST also subsumes within it the taxes like Excise Duty, Additional Custom Duty, and Luxury Taxes etc. This means that in GST regime, the producers will be relieved of filling multiple returns.

For service providers like web development companies, which are unable to take the credit of VAT paid on infrastructure cost, will now be able to take credit of VAT in this new regime. The GST hence, reduces the tax burden to some extent on service providers too.

GST is clearly a long-term strategy and would lead to ease of doing business, a higher output and more employment opportunities. Initially, however, it is likely to cause high inflation rates, administrative costs, and face stiff oppositions from states due to loss of autonomy.

About the author:

Rohit Lohade is the Co-founder at www.businesssetup.in)