Indian brands check into luxury space to cash in on surging middle class, aspirational youth

Amidst global challenges, retail sales of luxury goods grew 3% in India last year, driven by the rise of affluent class and aspirational individuals who desire exclusive products and unique experiences. This has resulted in a spate of homegrown brands that are eager to cash in on the trend.

Late last year, Kolkata-based Vedant Fashions Limited, which owns ethnic wear brands Manyavar and Mohey, ventured into the premium men’s and women’s wear segment with the launch of Twamev.

Recently, introduced a range of high-end mattresses, specifically targeting high-networth individuals. A few years ago, Cholayil, the makers of the legacy brand Medimix, too ventured into the luxury Ayurvedic segment with the launch of Sadhev—a premium skin and hair care brand.

While international luxury brands have always existed in the country, why are many Indian brands embracing the premium space in a spate now?

Retail sales of luxury goods in India increased by 3% in current value terms to reach Rs 553.8 billion in 2023. This is despite the headwinds caused by the war in Ukraine, supply-chain issues, and inflation, according to Euromonitor International Report.

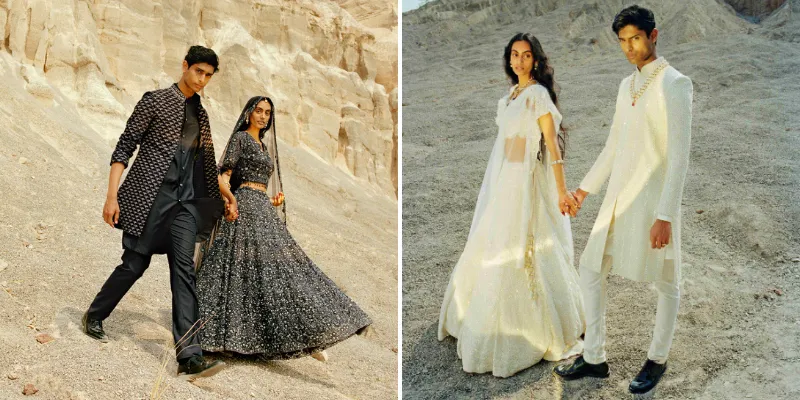

Twamev's range of ethnic wear

As India is expected to witness a substantial rise in the affluent class in the coming years, brands are keen to gain a large share of their wallet. The burgeoning middle class and the growing tribe of aspirational youth are also set to contribute to the consumption of luxury goods going forward.

According to a report by Credit Suisse and UBS, India will see a 69% growth in the number of millionaires between 2022 and 2027. A report by Goldman Sachs Group Inc., released last month, forecasts that India’s affluent class will reach 100 million in the next three years. All this points to the ample opportunities for businesses in the luxury segment.

20 years on, this Made in India luxury brand is fashioning a global empire for itself

Arvind Singhal, Chairman and Managing Director of , says while the market for luxury products has always existed in India, what’s new is that more categories are entering the space today.

“When it comes to tableware, we take pride in our legacy of exquisite silver utensils. The finesse of our handlooms has consistently embodied elegance, and, globally, Indian handwoven sarees are renowned for their captivating craftsmanship. Whether it’s attars or marbles, India has long been a hub for luxury markets. But yes, there’s more category creation happening,” he says.

The emerging categories in the luxury segment include exotic holidays, destination weddings, gourmet food and dining, travel accessories, personal care, home décor, and sleep essentials.

What’s driving the luxury market

It is not only the ultra-rich who are seeking luxury, but the middle class is also increasingly aspiring for premium products and services. The luxury segment, which was earlier dominated by people in their 40s and 50s, is also seeing more and more aspirational young, urban consumers willing to splurge on high-end items and experiences.

According to a study by People Research on India’s Consumer Economy, the middle class in India, with an annual household income between Rs 5 lakh and Rs 30 lakh, will be 715 million in 2030-31, up from 432 million in 2020-21.

The report mentions that with the upper-income classes rising faster than the lower classes and the ‘destitute’ classes shrinking, by the end of the decade, India’s income demographics will be unrecognisable.

Singhal notes that luxury products are gaining greater acceptance among individuals due to the increase in disposable income, prevalence of dual-income households, and individuals capitalising on their legacy wealth. These factors, coupled with strategic investments in the stock market, are propelling an elevated standard of living, he adds.

Rudra Chatterjee, Managing Director of Luxmi Tea Group, a century-old company that is known for fine teas, says that in recent decades, there has been a nuanced evolution in the relationship between Indian consumers and the luxury industry.

“This transformation is influenced by various factors, such as our diverse social landscape, changing cultural dynamics, increased spending power, and the impact of digitisation on our lifestyles,” he reasons.

“As the Indian economy continues to expand and the middle class burgeons, the luxury market is expected to evolve with an even greater emphasis on personalised experiences,” notes Lasakan Cholayil, Co-founder of Sadhev.

Luxury today is not restricted to a few categories and straddles a gamut of products and services.

Sunil Suresh, Founder of , a luxury sofa and home décor retailer based in Bengaluru, says for aspirational individuals, luxury starts from small things, like food and beverage, and goes on to personal items like handbags and suitcases, and then big buys like automobiles and homes.

Stanley's range of home solution

Suresh says the luxury market has just opened up in India in a big way, with Indian brands coming to the fore to cater to the needs of consumers who have hitherto had to rely on international brands for luxury products.

“When discussing luxury brands in India, one can easily enumerate only a handful at their fingertips; international brands are widely recognised. Consequently, affluent individuals in India, seeking premium or luxury items, often lean towards imported products due to their established legacy and brand recognition.

“This inclination warrants correction. Therefore, there is a pressing need to fortify the luxury market within India itself,” he elaborates.

Cholayil entering the luxury market was driven by the recognition of its resilience and growth potential, says the founder of Sadhev and points to the market’s rapid recovery after a dip during the Covid-19 pandemic.

The luxury goods market not only rebounded swiftly but is also expected to grow significantly in the coming years, he adds.

Apart from the ability to afford luxury, the desire for something novel and exclusive not possessed by others is another significant dynamic in the flourishing luxury market.

Angelique Dhama, CEO of Mirzapur-based , says the desire for status and a sophisticated lifestyle plays a big role in the shift towards premium products.

Today there is heightened awareness of craftsmanship among discerning consumers who seek products that offer superior quality, exclusivity, and a sense of prestige.

Cost is no longer a prohibitive factor when it comes to owning luxury products. For instance, has watches ranging from Rs 20,000 to Rs 55,000 in its Pret collection, while its bespoke collection encompassing made-to-order gold pieces is priced between Rs 150,000 and Rs 2,400,000.

Sakshi Malhotra, a resident of Bengaluru who is moving houses, is going all out to do up her new home. She emphasises that buying furniture for Rs 10 lakh is no longer a formidable task, thanks to convenient repayment alternatives.

Bespoke Veena Watch by Jaipur Watch Company

“For those with aspirations, the availability of straightforward monthly instalment plans proves to be a saving grace,” she says, adding that it is all about acquiring something distinctive and unique.

In the personal care space too, consumers are increasingly opting for premium products that are safe, rich in quality, and sustainable, and a hefty price tag doesn’t come in the way.

How homegrown luxury brands are growing

Luxury brands in the country are operating with a long-term perspective, gradually establishing a presence in the minds of customers and potential customers.

Sadhev, a D2C brand, largely follows a digital-first approach as it aims to become a globally renowned luxury Ayurvedic brand. It also has a store at a mall in Bengaluru.

On the other hand, luxury occasion wear brand Twamev has set up expansive offline stores in Bengaluru, Hyderabad, Pune and Delhi, apart from establishing an online presence.

Twamev seeks to redefine luxury and bridge the gap between mid-premium celebration wear and couture with handcrafted garments that marry Indian aesthetics with modern sensibilities.

Jaipur Watch Company is thriving on innovations and bespoke collections to build its brand. It was the first Indian brand to launch a 3D-printed watch and has turned Raja Ravi Varma’s works into wearable art.

A carpet from Obeetee's Proud to be Indian collection

The brand has a coveted clientele—its watches are donned by Prime Minister Narendra Modi, actors Amitabh Bachchan, Vidya Balan, and Rana Daggubati, and cricketers Rahul Dravid, Yuvraj Singh and KL Rahul.

As far as growth numbers are concerned, homegrown brands are steadily making a mark. In FY22, Ayurvedic beauty brand Forest Essentials’ revenue from sale of products rose 41.96% to Rs 298.05 crore, while net profit was Rs 62.35 crore, while Sadhev claims to be clocking an average revenue growth of 50% year on year. Cholayil envisions Sadhev to clock a turnover of Rs 100 crore in the next seven years.

Some of the homegrown luxury brands in India have also grown into global brands that serve a diverse clientele worldwide.

Prominent Indian brands Forest Essentials, Jaipur Watch Company, Sabyasachi Mukherjee – The Sari Savant, and Da Milano, have not only positioned themselves as frontrunners in the luxury sector in India but have also garnered international acclaim in countries such as the UAE, Europe, the United States and the United Kingdom.

As the Indian economy expands, backed by the government's thrust to achieve a $ 5 trillion economy by 2028, experts anticipate India to emerge as a prominent market for luxury brands, following in the footsteps of the United States and China. According to a report by Bain & Company, India’s luxury market could expand to 3.5 times its current size by 2030.

Edited by Swetha Kannan

![[Product Roadmap] How CASHe used proprietary tech and credit writing systems to disburse Rs 2,500 Cr in loans](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/ProductRoadmap-21-1625558161031.png)