Key insights on education startups from EduStars 2013 report to be released soon: Part 1

With the EduStars 2013 finale just around the corner (on December 6, 2013), we studied education startups in India. Extensive data was collected from EduStars applicants over 2012 and 2013 in an attempt to understand the current startup ecosystem in this space. We covered companies from across sectors, including K12, Test Preparation, Skills Development and Corporate Learning, looking to identify areas of focus, revenue models, traction and key challenges faced.

We will be presenting the key insights on education startups through a series of posts over the next few days. These findings will then be consolidated in the EduStars 2013 report, which will be released soon. This post will focus on the education startup ecosystem as a whole, while subsequent posts will deep-dive into the sub-sectors. Here are the key insights:

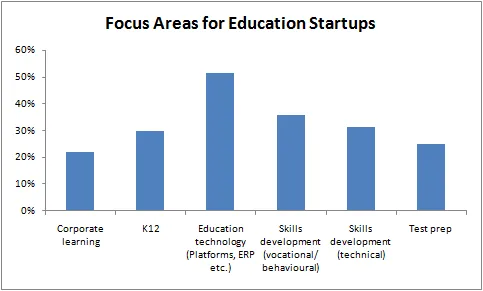

Skills Development is the primary area of focus for education startups

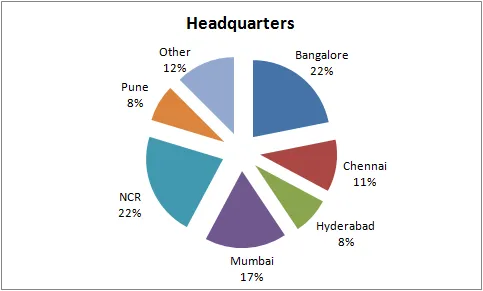

Bangalore and NCR are the largest hubs for education startups

Another interesting trend is the increasing number of startups from cities like Chandigarh, that are not traditionally known to have evolved startup ecosystems. Interestingly, December's EduStar of the Month was Focus Academy for Career Enhancement, which is based in Coimbatore.

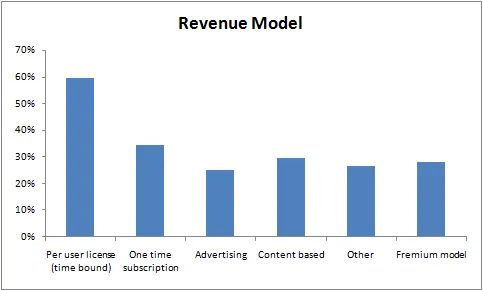

Per-user licensing is the most preferred revenue model.

Startups in K12 are seeing the maximum revenue

Contrary to expectations, it is not Corporate Learning and Skills Development that have startups reporting the highest revenue. A majority of companies that are expecting to cross INR 3 crore in revenue next year are serving the K12 segment. The dominant strategy for growing revenues is to acquire more users and try to convert them into paying subscribers.

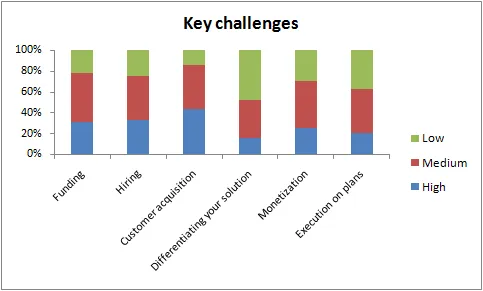

Customer acquisition is the biggest challenge faced by startups

Other findings

• There was no clear sectoral preference from investors and we have a healthy mix of companies that reported Angel or VC funding.

• Only about one fifth of startups did not have solutions that are mobile-enabled.

• 2011 and 2012 seem to be years of the education startup boom, seeing the largest number of new startups emerging.

Book your ticket for the EduStars finale now. Reach out to us on [email protected] or +91 9900844990 for a discount code