ESOPs: a good tool for startups, but a bet for employees

Indian startups such as Flipkart, Snapdeal and Housing.com are increasingly offering ESOPs as part of their packages to attract talent. How beneficial is it for startups? What should employees take care of? Lets analyze.

Image Credit "ShutterStock"

So what are ESOPs?

Employee Stock Option Plans are the plans in which employees get the right to purchase a number of shares (decided by the employer) in lieu of salary in the company at a discounted price (less than the market price). Like for example, Google recently employed an Indian with a Package of Rs 1.2 crore per annum, with a catch that half of it was in form of ESOP.

In this case, employees have to wait for a certain time period – known as vesting period – before they can exercise the right to purchase those specified number of shares.

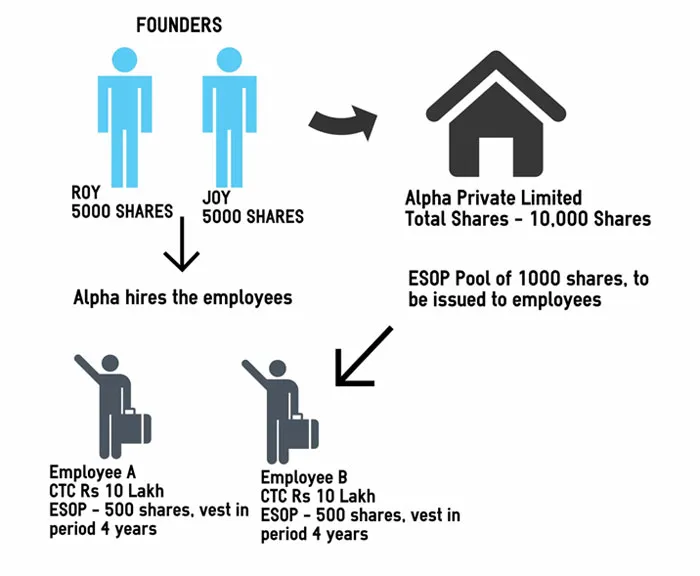

Let’s take an example of Alpha Private Limited.

In this case the founder Roy and Joy incorporate a company with Rs 1 lakh share capital i.e. 10,000 shares with 50% holding each.

To scale up they need talented employees who’s current CTC is around Rs 15 lakhs. As a startup, Alpha cannot afford these high salaries so it proposes Rs 10 lakh per annum plus 500 shares each with vest in period of four years.

Benefits to employer

- Hire good talent

Startup companies use ESOPs to hire good talent, as they cannot afford to pay very high salaries.

- Ownership feeling

The employees have the feeling that they are partner in the company and are motivated to work harder as companies growth is linked to their growth.

Disadvantages to employer

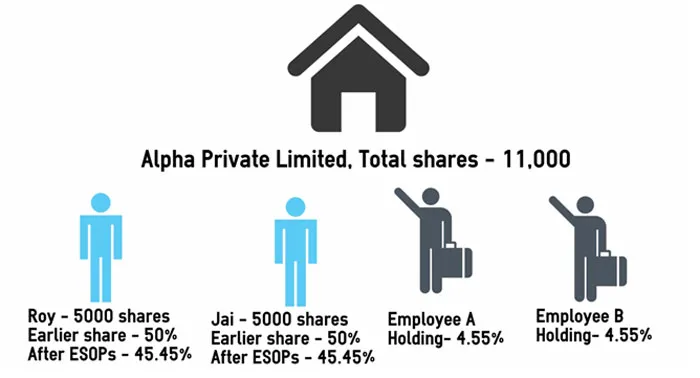

- Dilution

When the ESOPs are exercised, the founder’s share holding gets diluted.

In the above example, the shareholding will look like this

Benefits to employees

- Chances of becoming a millionaire

Stories of how Infosys, one of the earliest companies to offer ESOPs, created millionaires of employees such as drivers are wellknown. Thus ESOPs are beneficial only for high growth companies.

Disadvantages

- ESOPs are a bet

Only one among 10 startups are really successful. Stories of drivers becoming millionaires might happen only in some cases. In fact, in the case of startups, it is safer for candidates to consider only the salary component and look at ESOPs as an added bonus.

Things to take care by employees when having ESOPs in lieu of salary

- Proper Documentation

Employees should ensure that all the documentation is in place. They should also consider the present value and future value of shares.

- Proper Exit Mechanism

Ensure there is a proper exit mechanism, like promoter buyback, in case listing of the startup is delayed.

- Taxation

When the shares get allotted, they are taxed as salary or perquisite. Suppose in the above case when shares are allotted to employee A, he will have to pay flat 30% on difference between the fair value and exercise price.

Summary

Thus ESOPs are a really good tool for startups to attract and retain talent, but at the same time it’s a bet for the employees. Employees should be convinced about the growth of the company and should see if proper documentation is in place.

About the Author:

Rohit Lohade is the Co-founder at www.businesssetup.in.