How this serial entrepreneur is helping Indians make happy decisions with their finances

Happyness Factory is a robo-advisory technology platform which helps individuals with their finance and investment goals.

The story goes back to 2004 when Amar Pandit, an electronics engineer, was working in the US with banking and financial software company Infrasoft Technologies.

It’s there that Amar realised his true calling for finance.

It didn’t take him long to realise that his strength lay in planning others’ finances. He initially thought of starting up in New York, but was keen to come back to India following some well-meaning advice from professionals.

“I looked at the advice I was getting from banks here and saw a huge opportunity. When I decided to come back to India and start this off, a lot of people tried to convince me that my business idea wouldn’t work in India and I was better off in the US,” says Amar.

But all wasn’t hunky dory.

In early 2005, he started My Financial Advisor (MFA) in Mumbai with a vision to give returns by allocating assets and reducing risks. At a time when it was believed that one didn't need a financial advisor due to a bullish and positive market, Amar kept striving.

Defining his passion, Amar says,

“The eureka moment was when I decided to change my base of operation from the US to India and do something purposeful and happy in my life. After a lot of introspection I figured that the process of financial planning gave me happiness, since I was already helping a few family members and friends.”

After 12 years, Amar claims that MFA has made a happy difference in the lives of more than 500 affluent families.

And adopting this knowledge, Amar has launched his latest venture - Happyness Factory - a robo-advisory technology platform which helps individuals with their finance and investment goals.

Although work on Happyness Factory started in 2015, the platform was only launched in March this year.

The Happyness way

According to the founder, Happyness Factory is built on a Plan-Process-Product Model, where an individual defines his goal that he wants to invest towards, and then decide how much he wants to invest towards each goal.

Based on goals and risk profiles, the platform then suggests mutual fund schemes and invests online.

The working

Amar explains the different features of the platform:

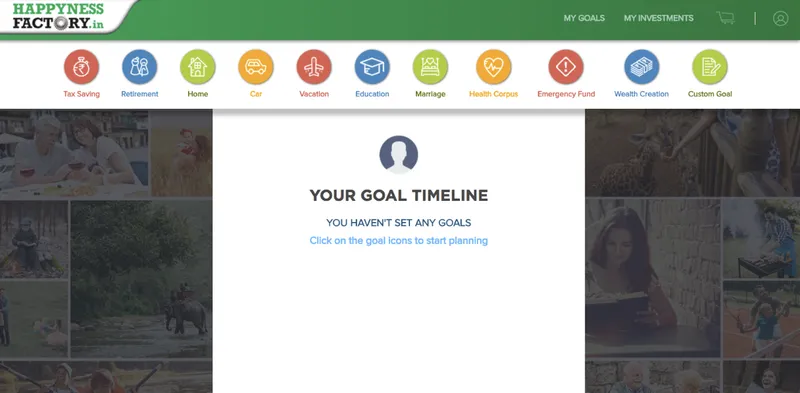

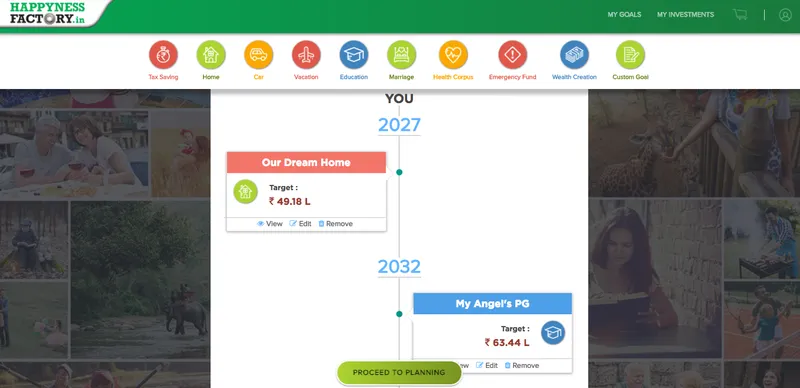

Goal Dashboard: Once investors register on the platform, it prompts them to define their financial goals including retirement, tax saving, wealth creation, emergency, as well as buying a house, etc.

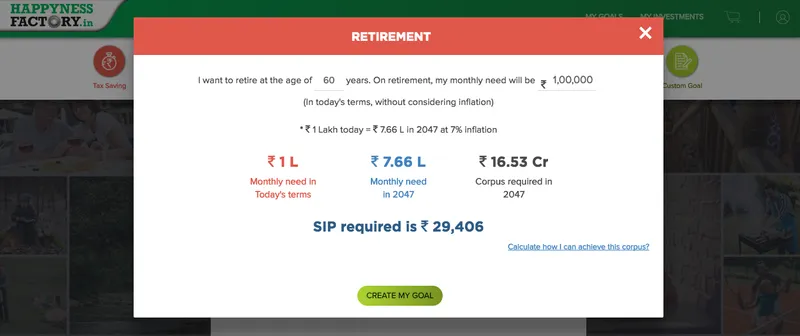

Based on the goal, age and monthly amount required, the platform shows the future value of the monthly requirement, corpus as well as the SIP required.

In case of home planning, investors are prompted about their savings in the long run, further citing the loan they would have to take.

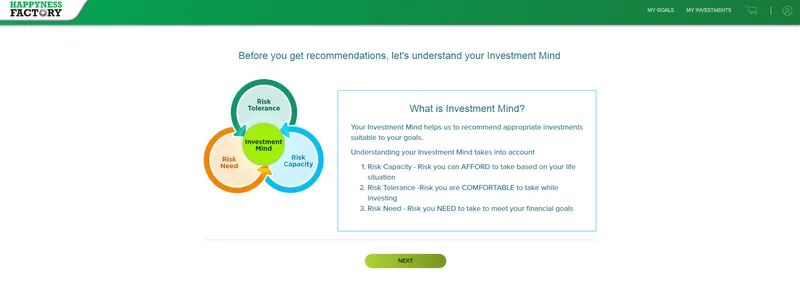

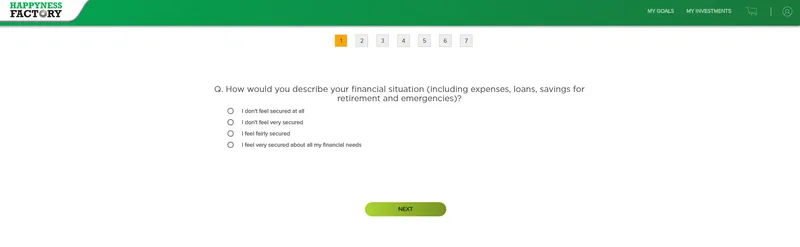

Risk Profile: While enrolling on the platform, investors are asked seven questions to understand their risk profiles (INVESTMENT MIND). Based on the answers, the Happyness Factory platform evaluates an Investor’s Risk Appetite on a scale of three: Conservative, Moderate or Aggressive.

The Goal Timeline: Once the users start, their timeline automatically gets populated with the investments planned, along with the year of accomplishment.

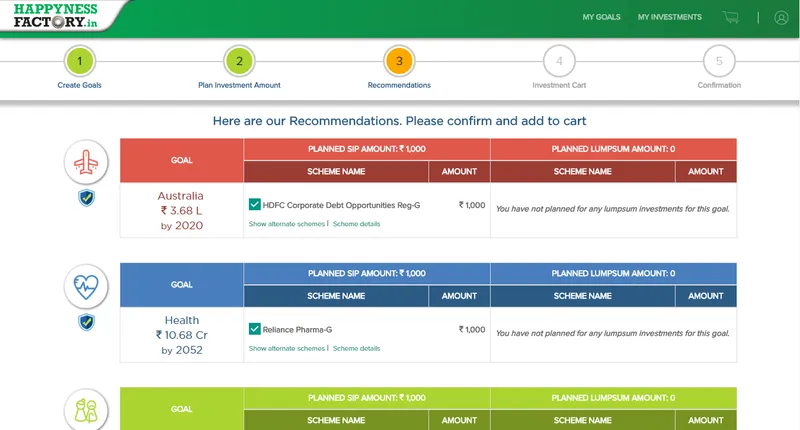

Investment Recommendation: Based on the Goal Timeline and Risk Profile, the platform curates and recommends appropriate Mutual Fund Schemes to help investors meet their financial goals.

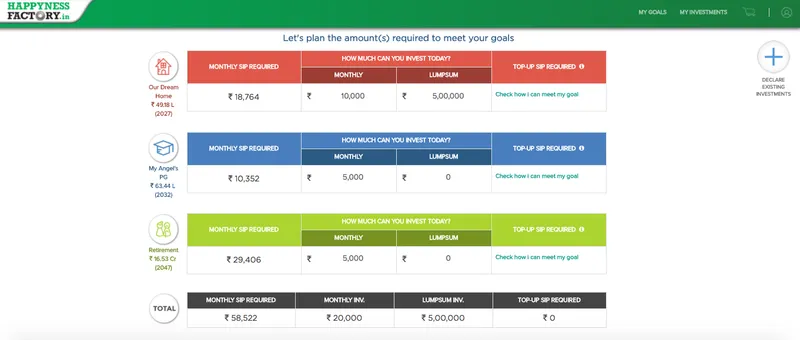

Planning for the Goals: Investors can decide how much SIP or lump sum investments of mutual funds they want to plan for each goal based on their Cash Flows.

However, the platform also expects investors to declare their previous investments made outside the platform, suggesting how much they need to increase their SIP investment amount annually to meet their goals.

Stacking up

Since the launch in March this year, Happyness Factory has more than 500 active clients, garnering a little more than Rs 80 crore in assets under management for the platform.

Amar says the number of registered users is double of that of active clients.

At present, the platform sees an average monthly SIP investment of Rs 30,000 and one-time lump sum investments can go up to Rs 10 lakh.

Looking at future projections, the founder and team remain positive that by the end of this fiscal, they will reach Rs 200 crores in assets under management. This number is expected to double in the next fiscal.

On an inventory perspective, Amar says that the financial products on the platform are highly curated, only from the top 15 to 20 fund houses in the country.

The company earns revenues from commission on investments made on the platform, which vary depending on different asset classes.

For example, the commission on equity investments can be as high as 1.3 percent, while debt stands on an average at 1 percent.

Amar claims that the hybrid net yield rate stands at 0.7 percent.

What’s so different?

The past year has seen a plethora of robo-advisory platforms which have hit the market, like Kuvera, ProsperX, ET Money and savings engine Zerodha partnered Balance.

There are the other existing platforms like FundsIndia, Scripbox and Zerodha that are commonly criticised by the new age platforms for their lack of personalisation.

So, how is Happyness Factory different from the new players?

Apart from the experience running wealth management platforms, Amar believes that the differentiation lies in their UI.

He adds,

“For us ‘Personal Finance’, is more about being personal. Our UI tries to make the experience emotional. This is done by giving our customer’s clarity on what they are really looking for and what their goals really are. Through our goal based questions, we make the customer think deeply, which translates into an emotional and trusting relationship.”

From a YourStory perspective, what seems to give Happyness Factory an edge over its competitors is its offline advantage.

The company is tying up with individual wealth advisors offline to expand its distribution network, lending trust to the platform.

This face-to-face interaction eliminates the jitters customers have around investing online, with most preferring individual wealth advisors.

But metrics seem to be in the favour of the robo-advisory industry with the country’s mutual fund assets reportedly clocking the highest growth in seven years, reaching a total corpus of about 17 trillion.

Media reports said in 2016, asset management companies' assets under management grew by 30 percent.

In such scenarios, multiple robo-advisory platforms crowding the space makes sense make perfect financial sense.

Website: happynessfactory.in