Tech, trust, and the new path to wealth creation

India’s next phase of wealth creation will hinge on technology—through smarter regulation, digital platforms, and AI-led financial education—to make investing simpler, faster, and more inclusive for all, fintech leaders said at GFF.

At a time when India’s capital markets are expanding faster than ever, industry leaders and regulators agree on one thing: technology—not just policy—will determine how inclusive this growth becomes.

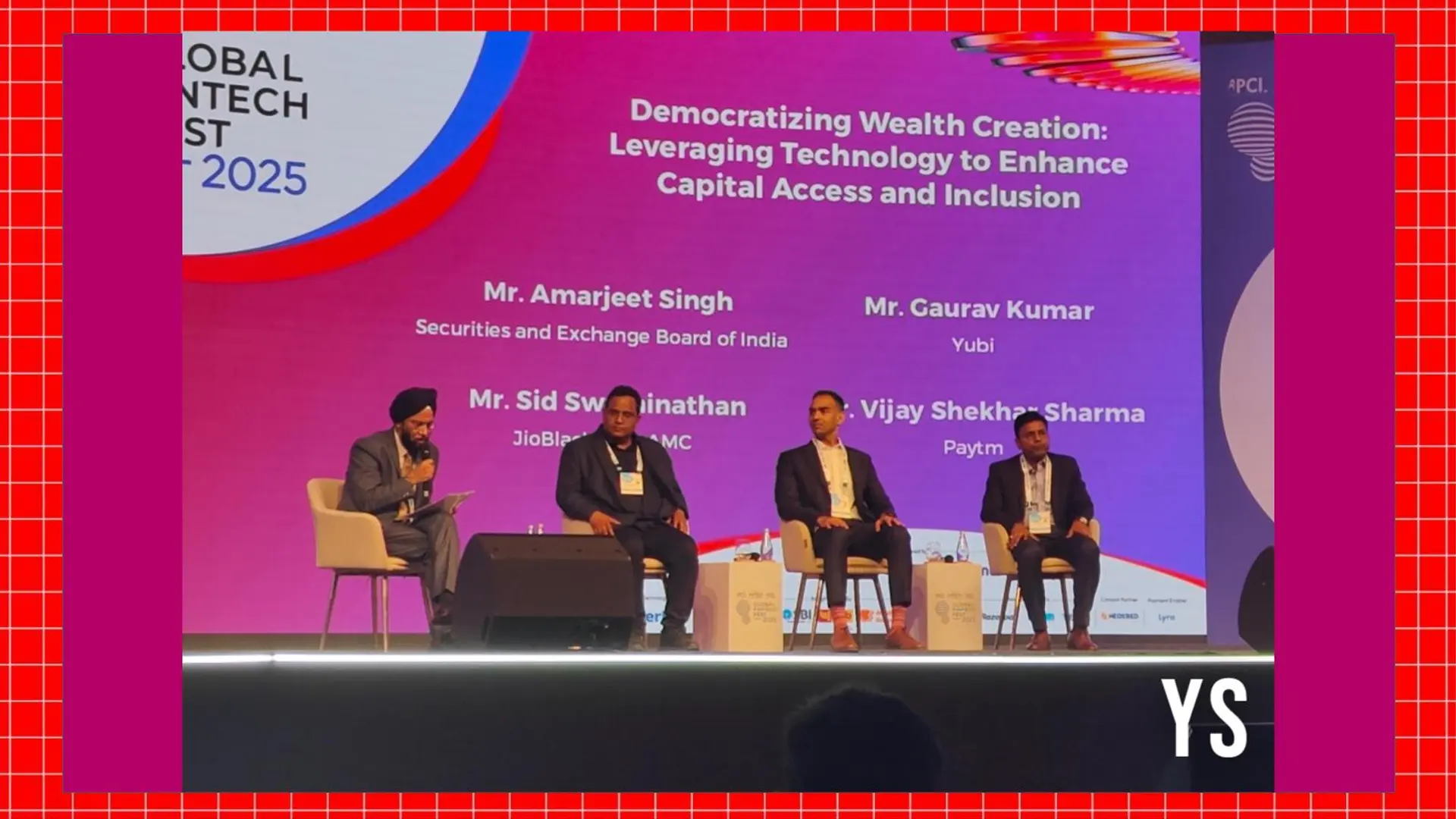

At the Global Fintech Festival in Mumbai, a panel titled “Democratizing Wealth Creation: Leveraging Technology to Enhance Capital Access and Inclusion” brought together some of the country’s most influential voices from finance and technology. Their message was clear: India’s markets are maturing, but widening participation will depend on building trust, improving transparency, and using technology to lower long-standing entry barriers.

Paytm founder and CEO Vijay Shekhar Sharma said the foundation of an inclusive market lies in a regulator that encourages innovation while safeguarding investors. “The first and foremost rule of thumb for a private-market company to go public is that the regulator must be welcoming and inviting,” he said, recalling how SEBI’s decision to allow loss-making firms to list in 2021 made India “the most vibrant market to raise capital.”

But he argued that access should not stop at regulation. Investor communication, he said, needs to evolve with the times. “IPO ads should come with a QR code or video where the promoter explains why to invest,” he suggested, noting that complex disclosures often fail to reach first-time investors. Sharma also called for using central bank digital currency (CBDC) to make IPO settlements nearly instantaneous — a move he said would make India’s capital-raising process more efficient and transparent.

Gaurav Kumar, founder and CEO of Yubi, said the time had come to view India’s private and public markets as part of a single ecosystem rather than two separate worlds. “Globally, the question is no longer why go public but why not stay private,” he said. Regulated technology platforms, he added, could allow retail investors to safely participate in unlisted securities while ensuring better oversight and price discovery. Kumar also spoke of creating “digital twins” — real-time data profiles of companies — to track governance and financial health, reducing the risk of fraud and information gaps.

For Sid Swaminathan, of JioBlackRock AMC, the next frontier of democratisation lies with ordinary investors. He said financial inclusion would deepen only when information becomes easier to understand and act upon. “Imagine learning about a stock through a cricket analogy in your own language — that’s the power of technology,” he said, referring to how AI could deliver personalised, regionalised investor education. Mehta added that simplifying KYC and account-opening processes, along with combining digital tools and human support, could bring millions of first-time investors into formal markets.

While each speaker approached the question from a different angle — regulation, market structure, and retail participation — the discussion underscored a shared conviction: technology will be central to building trust and inclusivity in India’s financial system. From blockchain-based settlements to AI-driven financial literacy, they said, the tools already exist; what remains is the will to deploy them effectively.

India’s next wave of wealth creation, the panel concluded, will come not only from new companies going public but from ensuring that every citizen, investor, and entrepreneur can take part in the process — with technology as the common enabler.