How broken customer communication pushed this founder to rebuild the messaging stack from scratch

Bengaluru-based Enterprise Communications startup Fyno is building a central communication layer to solve fragmentation in BFSI messaging.

Banks, insurers and NBFCs struggle to streamline customer communication, which spans SMS, emails and WhatsApp. All of these run on different systems, templates need constant approvals, and new regulations break flows overnight.

Amid numerous vendors and integrations, companies struggle to control costs and deliver messages reliably; customers, meanwhile, keep receiving confusing, repetitive notifications.

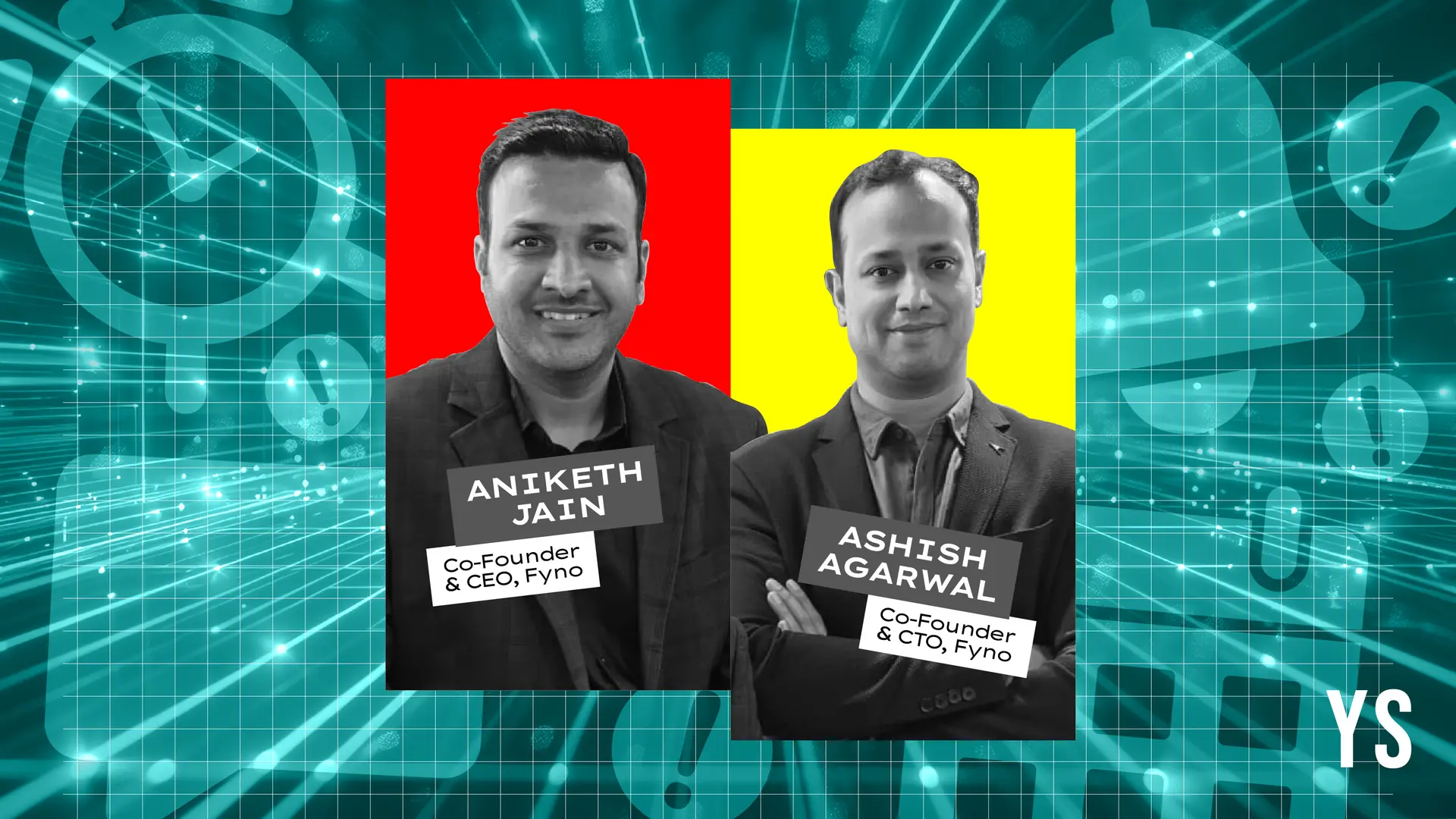

In 2022, this broken reality pushed Aniketh Jain to take on what most companies avoided: rebuilding the enterprise communication stack as a unified layer. Before taking up the mantle of Fyno’s CEO and Co-founder, Jain had built Kaleyra, a communications platform that served over 3,000 customers and handled billions of messages each month. In 2022, the startup was acquired by an Italian firm and eventually by Tata Communications.

Jain’s earlier startup experience helped him clearly see the gaps in the industry and showed him how fragmented BFSI communication had become. No orchestration, no central logs, complex compliance, and too many vendors. After leaving Kaleyra in 2022, he teamed up with CTO Ashish Agarwal to build a unified layer that connects enterprise systems to all messaging providers.

Bangalore-based Fyno today positions itself as a next-generation communications platform for enterprises, designed especially for banks, NBFCs, and insurers.

Based in HSR Layout, Bengaluru, with a branch office in Mumbai and a small presence in the US, the company follows a pure-play SaaS model and offers both cloud and on-premise deployments. “Currently, we’re 25 people, but expect to add about 30 more by 2026,” Jain says.

How it works

Fyno gives enterprises full control over their customer communication stack. The platform unifies all channels, SMS, WhatsApp, email, voice, RCS, and push notifications, and connects them to any internal system, whether it is core banking, mobile banking, CRM, or loan management software.

“We’ve built native integrations with more than 100 providers, so teams don’t have to rewrite multiple APIs every time they change or add a vendor,” Jain says.

One of its most used features is the compliance and template management engine. In sectors like BFSI, every SMS or WhatsApp message must be pre-approved by regulators or platform providers. These workflows are usually fragmented and difficult to track.

“Fyno puts everything in one place,” he says, by allowing enterprises to create templates, manage versions, seek approvals, and stay compliant without altering their internal systems.

Another key feature Fyno provides is orchestration. Since banks and fintechs use multiple providers for the same channel, “We let them set rules like round-robin routing, price-based selection, or switching based on performance so messages always take the best route,” Jain says.

It also gives enterprises a full audit trail, showing every message sent across channels and its delivery status, crucial for sectors where regulators like RBI or SEBI may ask for detailed logs during customer complaints.

Fyno’s first client was a small NBFC. It started with one simple use case and ran a small pilot. After Fyno showed faster delivery and easier management, the NBFC adopted the full platform and became its first customer.

Despite strong traction, the early days were challenging for Fyno. BFSI sales cycles are long, and building trust as a young company in a risk-averse sector required persistence. “Finding the right decision-makers and securing the first POC took almost a year,” Jain says.

Once the initial deployments succeeded, more customers followed. The company now serves around 60 customers, with strong traction in BFSI.

Its clients include Karnataka Gramin Bank, LendingKart, TrueCredits, FlexiLoans, Scripbox, Protium, Freight Tiger, and Vinculum. Fyno also has three customers from the US, including SigningBook, Glow Currency, and another New Zealand-based client.

“We use AI mainly for analytics and insights right now,” Jain says. The platform helps enterprises track deliverability issues, performance trends, and gaps in their communication flows. But the team plans to expand its AI initiatives over the next few months, including template generation, automated content suggestions, and agent-driven approval workflows.

The startup operates on an annual licence model. “For BFSI clients that need on-premise deployments, we provide the full platform while they use their own infrastructure,” he says. The average contract value is around $100,000, depending on the number of features and deployment complexity.

In late 2023, Fyno announced that it had raised $4 million in seed funding from 3one4 Capital and Arkam Ventures.

“Our funding supports product expansion and international growth, particularly in the Middle East, and a region the team expects to prioritise in the coming year,” Jain says.

According to Jain, Fyno competes with a few established players in India and abroad. In the Indian market, the biggest competitor is Sinch, which offers its Axiom platform. Globally, Fyno also competes with Courier.com, and Knock.

According to a Grand View Research report, the CPaaS market was estimated at roughly $19-22 billion in 2024 and is projected to reach about $58-86 billion by 2030.

Fyno is already benefiting from the demand. “We reported $2 million revenue in FY25, and are aiming for $5 million next year,” Jain says.

What’s next?

The pipeline is significant: the Fyno team is currently in PoCs with around 30 BFSI clients. Over the next five years, Jain hopes to onboard 100 BFSI customers globally, with around 50 from India and the rest from the Middle East and Southeast Asia.

For now, Fyno is focused on strengthening its core platform, deepening orchestration capabilities, expanding its AI layer, and scaling into new markets.