Perceived Biases of VC investments - VC Perception Survey Report

This is part 2 of the article exploring results of our VC perception survey. The first article is here.

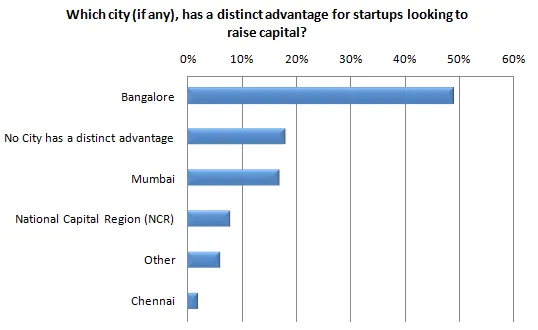

One of the goals of the VC perception survey was to explore the percieved biases in the investment strategies of VC funds. One question that always has come up is whether being based in a city is advanageous for startups, as being close to an ecosystem with mentors, investors and potential employees can bring benefits. When asked whether any city had a distinct advantage when it came to raising funding, Bangalore emerged as a clear winner, with over 50% of respondents picking Bangalore as the best city to be in to raise venture funding. This is despite the fact that only about 33% of respondents were from the city.

The other cities didn’t fare as well, with “No City has a distinct advantage” being the next most popular option, with 18% of the votes.

It is important to remember that these are perceptions of entrepreneurs, and do not necessarily reflect the actual data of investments made by Venture Capital funds in India.

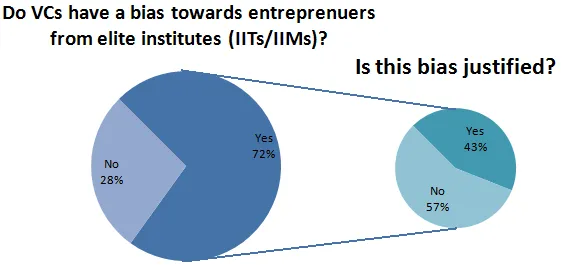

Anecdotally, we’ve often heard that if the founders of a startup are from the elite institutions of the country, they find it significantly easier to raise funding. We asked startups what their perception on this question was, and an overwhelming 72% of respondents agreed that VC funds tend to be biased towards graduates from the country’s elite institutions like the IITs and the IIMs. Interestingly, of those that perceived that bias, 43% agreed that the bias was justified, and 57% saying that VC funds shouldn’t by biased by the founder’s educational backgrounds.

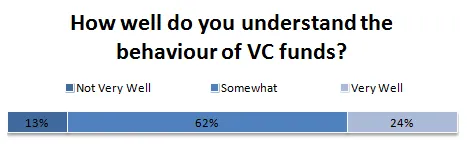

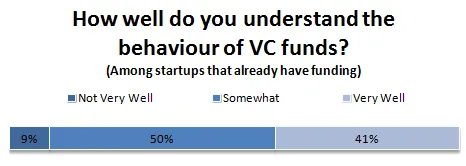

We often hear startups use an accusatory tone towards the activities of VC funds in India, so we asked startups how well they understood the activities of VC funds in India. Among all respondents, only 24% agreed with the statement, while 62% of respondents say they only “somewhat” understand how VCs work in India. Among startups that already have funding, the numbers improve a bit, with 42% of startups saying they understand how VC funds operate. However an overwhelming 59% of startups that have funding still say they only somewhat understand or don’t understand at all how VCs work in India.

We also asked entrepreneurs which stage of a startup venture funds were most likely to invest in. In the questionnaire, we explicitly made the distinction between VC funds and Angel funds, and explicitly excluded Angels. Roughly 37% perceived that growth stage startups were most likely to attract venture funding, and 34% of entrepreneurs perceiving Late stage startups to be the most likely target. Only 18% of respondents thought that VC funds invest in early or seed stage startups.

This is part 2 of the series of articles exploring the perceptions of VC investments in India. To get full access to the report, please send an email to [email protected]