Decoding M&As in the Indian startup space - Shashwat Kumar of Khetal Advisors

With the Indian startup ecosystem getting increasing attention, hot deals are in the air. The recent report of iSpirt and Zinnov on the Indian M&A (mergers and acquisition) scene speaks of 30 times growth in deals since 2009, informs Shashwat Kumar of Khetal Advisors. In the last three years, India has seen growth in M&A, with 56 deals in 2012, compared to 44, in 2009, he adds. “Software and Internet companies accounted for 38% of all M&A deals in India. Further, in 2012-13, 49% of all the India technology M&A deals focused on SMAC (Social, Mobility, Analytics, and Cloud).”

In this exclusive interview with YourStory, Shashwat shares with readers some interesting insights on the M&A activity in the startup world (in the context of software products and services), and answers the top questions in entrepreneurs’ mind on this subject.

Can you describe how the startup M&A scenario has evolved from the time you started till date?

Lately the scope for M&As has increased in the IT sector and technology sector, with the double-digit growth in these sectors in India. There is also an increasing interest among venture capitalists now, with many planning to invest in India.

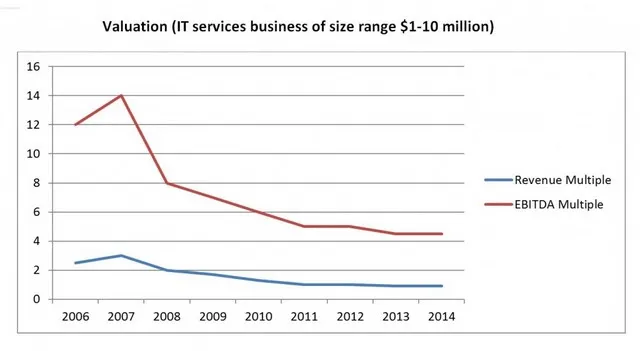

The following graph talks about the valuation trends for SME software services firms over the last few years:

On the demand-side trends for startup M&As, which industries are the acquiring companies coming from predominantly? What are their typical selection criteria for shortlisting startups to look into? Are the acquisitions more focused on acquiring talent or acquiring IP? Do they take the VC view of retaining the founding team or do they prefer integration with their internal teams? Does this vary by industry?

Industries from which the acquiring companies come

On the demand side, Indian/ overseas companies with size of US$20 million and above are fairly acquisitive in nature, as they need to attain scale, build competency, and have strategic presence in geographical locations. Also, these are companies with access to capital to make acquisitions.

Typical selection criteria for shortlisting startups

Organisations are acquiring smaller companies to increase their expertise, global visibility, etc., within a short span of time with an additional investment. They are highly selective and assess multiple parameters before acquiring a company. Some of the key criteria include;

- Long-term contracts with their customers;

- Marquee customers (say, working with Fortune 1000 companies);

- Offshore engagement with project management control;

- Recurring revenue stream (e.g. working on support and maintenance projects vis-à-vis development or implementation projects);

- Strong second line and quality of talent pool; and

- Profitability in the range of 20-25%.

M&As are also done based on the following:

- Technology competency acquisition: When it’s difficult to build a competency in a new technology area, and there is opportunity risk associated with it, companies prefer M&A. A few of these areas include SAP consulting, Oracle consulting, SalesForce, remote infra management, business analytics, enterprise mobility etc. Examples of such transactions are Kellton Tech (web application services) acquiring DbyDx (enterprise mobility), SoftTek (large services firm in Mexico) acquiring Systech Integrators (SAP consulting firm Bangalore), and Synova acquiring Enteg (SAP).

- Developing global footprint: When companies need to build offshore capability, market presence or delivery scale across different geographies, they prefer M&A. It is the number one reason for inbound cross-border transaction. Companies in Europe and the US need to build offshore delivery centres so that they can compete effectively with local companies that already have delivery centres in India. Examples of such transaction are Allgeier (Germany) acquiring Nagarro (Noida), 3PillarGlobal (US) acquiring BrickRed (Noida), and Idhasoft (US) acquiring GMI (Pune/Mumbai).

- Access to strategic accounts/ customers and scaling up: Smaller companies can offer personalised services and shorter response time to their clients. Some customers, who work with smaller companies, become really big, over time. Due to the strong relationship built during the initial days, these accounts continue to grow and now larger firms want to get into such strategic accounts, too. Hence, larger firms prefer acquiring these companies. Examples are Globallogic acquiring Rofous (which had FB as customer), and Symphony acquiring Proteans (with many clients at over a million USD yearly run-rate).

Focus on acquiring talent or IP

Acquisition is heavily people-dependent. IP has little value unless IP is already generating user traction and revenues.

Retaining the founding team, or integrating with internal teams

The organisation that acquires usually insists the acquired company to stay back for a minimum 2-3 years and deliver on the business metrics promised at the time of transaction. This step is taken by the buyer, mainly to facilitate smooth transition, without affecting the existing customers or business. Most industries follow this process.

On the supply side, startups from which industries/ lines of business are more suited for acquisition in the Indian ecosystem? Which industries or segments (e.g., consumer Internet, enterprise software etc.) are more mature and structured from a financial perspective, making them attractive for acquisition? What needs make the founding team look at M&As as an option in most cases – is it access to capital, access to customers, or access to new markets?

Industries more suited for acquisition

Startups from the IT and technology sectors are prone to get acquired, as they are built on innovation that is attractive, but sometimes, they lack the required funds to scale-up.

Industries or segments more mature and structured from a financial perspective, making them attractive for acquisition

Some specific verticals that are growing - IT outsourcing, analytics, cloud and mobile services are attractive for acquisition.

Why the founding team looks at the M&A option

The top 4 reasons that make the founding team at companies look for M&As as an option are:

- Challenges to scale up the business;

- Lack of VC/PE capital available to services businesses;

- Fatigue of running a services business and need to move on to something more exotic; and

- To monetise the venture.

What are the common ‘soft’ parameters that companies look for – such as the quality of entrepreneurial team from an education pedigree perspective?

Many of the startups in India are started by graduates from leading educational institutions, such as IITs, IIMs, etc., hence education of the entrepreneur was significant in acquisitions. Lately, the trend is slowly changing, with startups rising, based on innovations, innovative products and services, without any formal education/ experience of the entrepreneur taken into consideration.

Professional experience in startups

Since the startups are smaller setups with higher levels of innovation and delivery, the professionals working in such smaller companies have had the hands-on experience to address challenges at all levels. In the process, they would have developed new and relevant skill sets. The experience of such professionals is valued, especially when they become entrepreneurs. Companies run by such individuals do well, with every aspect of the business being addressed in detail, thus leaving less room for mistakes.

Ability to attract talent and management quality

Only when the top management stays involved to some extent in the recruitment process, it will be easy to attract the right talent; more so, in the case of senior level recruitment. The entrepreneurs must also put their best employees in positions of influence. Companies with such initiatives are run well and remain attractive for acquisitions.

In terms of mergers, how do these trends vary?

Merger happens when two companies agree to move forward as a single brand or a new company. The advantages of mergers are: Economies of scale, tax benefits, entry in global markets, growth and expansion, facing competition, increased market share and research and development (R&D). In the case of mergers, both the companies are almost of equal size and strength.