Ex Heavenandhome co-founder launches fashion private label for women- StalkBuyLove

Tushar Ahulwalia, a London School of Business alumni finds himself fortunate enough to be a part of Germany based incubator Rocket Internet. Tushar led Heavenandhome (Bamarang.in) which later merged with Fabfurnish in India. “I am very lucky to have had the opportunity to learn from the best very early in my life and I can only recommend Rocket Internet as the best and true school for entrepreneurship on this planet,” says Tushar. After Heavenandhome Tushar clubbed with Rashmi Ahulwalia to launch StalkBuyLove - a digital fast fashion private label, which translates into hyper trendy, wearable, affordable clothing at good quality for young women globally. With bases in New Delhi, Berlin, and London, the startup seeks to present a wide range of apparel and accessories that suit the tastes and preferences of fashion forward ladies.

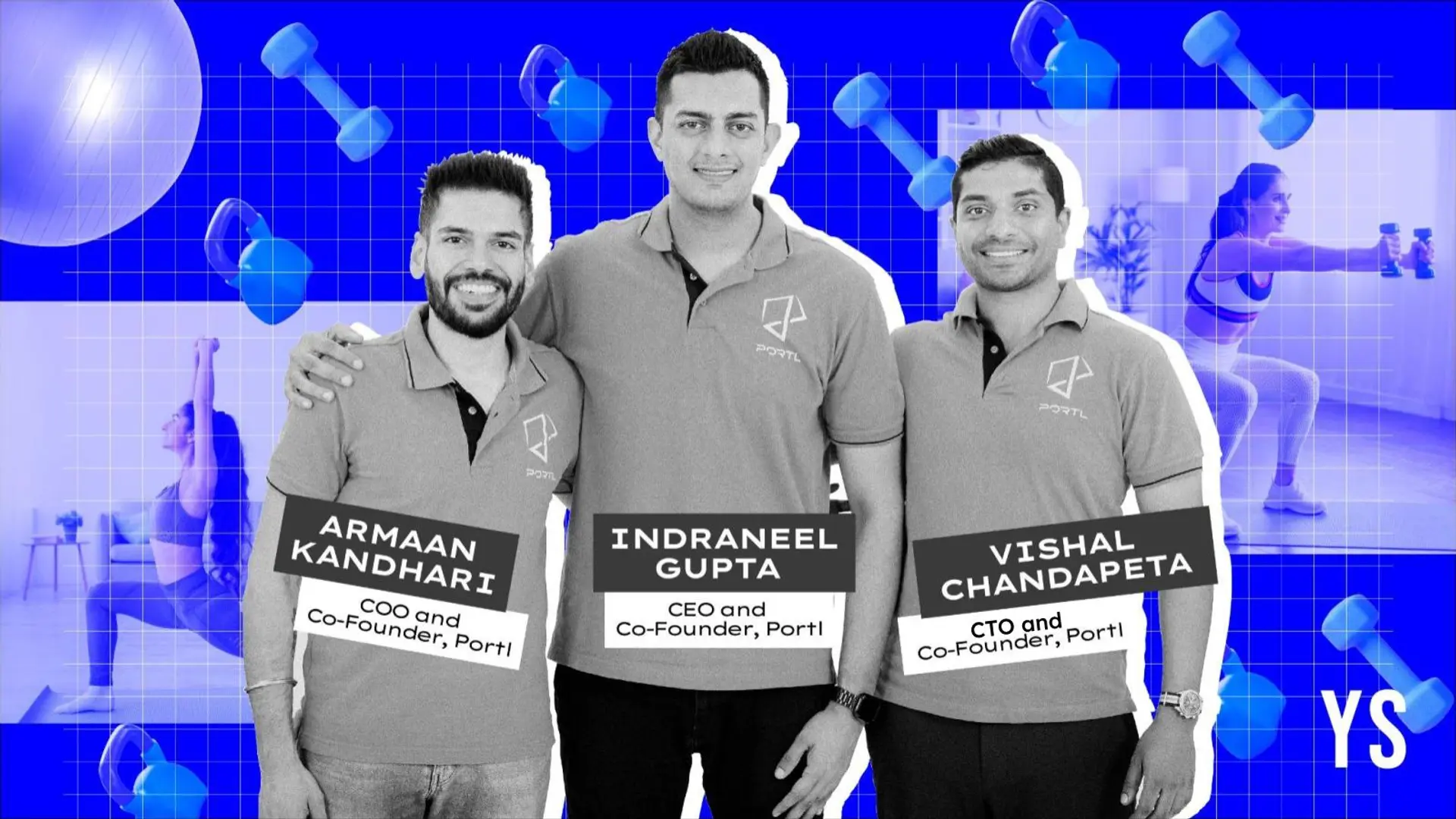

Team behind StalkBuyLove

Besides Tushar, Rashmi is the other co-founder of the company who brings in 25 years of experience in commercial fashion to the team. StalkBuyLove strongly leverages her knowledge of western fashion on its product side. She is also the co-founder of Lugani GmbH & Group, one of the biggest suppliers of fashion of the 1980's, 1990’ and early 2000' to major European retailer such as Zara, Lindex, H&M, C&A, Otto, Carrefour, Metro, etc.

How it’s different from other private labels?

StalkBuyLove differentiates from other private labels in online space (Zovi, YepMe & Freecultr) on a number of grounds on product side. Firstly, all its products are designed in-house and inspired from international catwalks and trends. Additionally, vertical integration allows StalkBuyLove to be on the pulse of time; it takes 6 days from product design to actual upload to the website, which results in a very short ‘time-to-market’ for the company.

“We are in the business of fashion trends, therefore we can’t allow ourselves to have long lead-times for collections. We have new products everyday, for a private label we maintain a great variety of products and value-for-money,” adds Tushar. The fashion content is one of the major USPs of StalkBuyLove. The inspiration comes from international catwalks, while the designs are sampled and finalized in India (Delhi).

Traction & focus on international markets

StalkBuyLove backed by an Indo-European business family from the fashion space, and the duo believe that they will not require institutional funding until early 2015. Currently the company is transacting 150 orders with an average basket size of 1400 INR. It claims to have 20% month-on-month growth during the last few months.

“We are internationalizing our website front-end to the UK in the next few months as part of our first step to internationalize, informs Tushar. Though the entire head count and production back-end will remain in India. StalkBuyLove aspires to build a global fast fashion company out of India, that will compete with H&M, Zara, Forever21, Asos in their respective target markets.

Competition and revenue model

“We are not competing with a Jabong, Myntra, or Koovs. Those companies are placed horizontally at the end of the value chain, while we are placed vertically along the value chain,” adds Tushar. India is long term game for the company. Within the next decade India will most likely develop into one of the biggest consumer markets of the world and StalkBuyLove is here to grab this opportunity.

StalkBuyLove doesn’t position itself as an ecommerce company, for them ecommerce primarily is a retail channel. “We are a product-centric fashion company,” adds Tushar. From a business perspective StalkBuyLove snaps up superior margins (70%+) including superior customer lock-ins (increased rebuying pattern). The vertical approach reduces inventory exposure and customer acquisition costs due to unique fashion content of product.

Road ahead

With 60 people strong team including blue collar the company eyes to launch in UK and Germany by March and August respectively in 2014. In terms of scale StalkBuyLove plans to achieve INR 2 crore (GMV) by the end of August next year.