Why Flipkart & Snapdeal should be worried about the Big Daddies of global retail

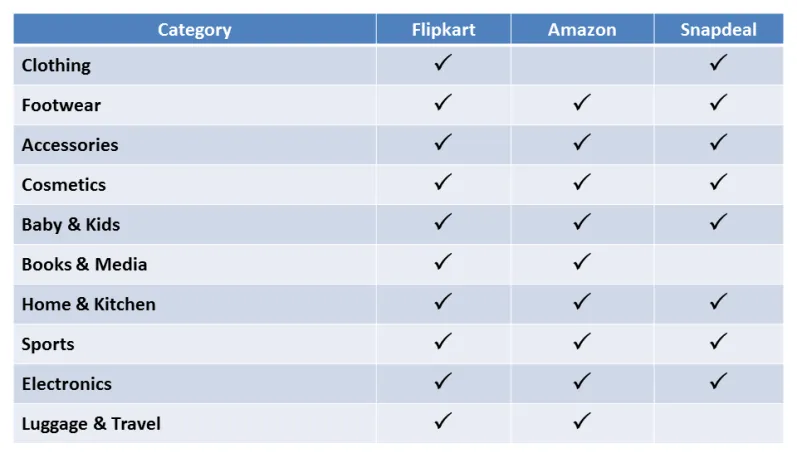

The news of Flipkart and Myntra being in talks to merge together – either fully or at least financially – have been doing the rounds for many weeks now. The thought process in the media is that the common investors namely Accel and Tiger Global have been insisting that the two merge in order to optimize operations and increase efficiencies. After all, what is the point in pumping money into two similar e-commerce ventures? As the image below shows, Flipkart and Snapdeal are pretty much stocking the same categories, but Myntra’s leadership position in the highly profitable fashion category can add more income in Flipkart’s cash flow statement.

(Story update: Amazon has launched the clothing category too around the time this story was published)

But there is more to the story than just the common investors pushing for optimization. The big daddies of global retailing – Amazon, eBay and Walmart – have been making quiet but aggressive plans for the Indian market.

Amazon

Cash Reserves: $12.5 billion, Annual Revenue: $74 billion

- Started off with Junglee.com, a comprehensive price comparison engine for online and offline sellers, in 2012. Leveraged this for gaining a deep understanding of the market and the evolving consumer behaviour with respect to e-commerce

- Built the fulfilment alternatives, supply chain and the process back-end over the past 10-12 months. Stocks 15 million products as against Flipkart’s 10 million products and Snapdeal’s 4 million products

- Expected to reach GMV of $1 billion in the next 12-18 months, the milestone that Flipkart reached last month

- If Flipkart pioneered and pushed Cash On Delivery (COD), Amazon innovated both on the consumer side and the seller side. For consumers, they launched ‘next day delivery’ for nearly 50% of their usual demand (Flipkart launched it 5 days later) and also tied up with kirana stores for delivery of packages when the recipient is not at home

- For sellers, they have eased the registration process (1 day against Flipkart’s two weeks) and are reportedly charging less commission compared to the competition. Further, for sellers who do not have the fulfilment capability they are experimenting with a tie up with BPCL’s convenience stores in petrol pumps so that sellers can drop their products there and Amazon will pick it up

Case Study: In Germany, the six-decade old Otto group was the leading retailer for many years. Otto was a pioneer in mail order catalogue business, and also adopted online commerce as early as 1995, the same year that Amazon did. But once Amazon entered Germany, there was no stopping the juggernaut. For the first time, in 2013, Amazon ($10.5 billion) surpassed Otto Group’s ($9 billion) revenues, just a few years after entering Germany

Ebay

Cash Reserves: $9 billion, Annual Revenue: $16 billion

- Ebay has a history of constantly looking outside their US base, with 61% of global revenue coming from non-US countries. It has a focus on all BRIC (Brazil, Russia, India, China) countries, not just India as stated in many of their annual filings and official communication. They have a target of 25% of total active users and 12% of global sales revenue to come from BRIC countries by 2015

- Ebay has been steadily increasing its shareholding in Snapdeal. Led a $50 million Series C investment, followed by another $134 million on its own. It was believed that Amazon was vying for a share of Snapdeal too

- This made perfect sense – ebay was the global pioneer in marketplaces and Snapdeal’s origins aligned with this fact. Further, ebay.in floundered with 5 million users while Snapdeal had 20 million users. They have steadily increased their shareholding in the $400 million Snapdeal to take it to the next level

Case Study: Ebay Russia generated $400 million revenue in 2012 and is one of the fastest growing markets in Europe currently. The official line is that among the BRIC countries, Russia is the number one priority currently, while the groundwork is prepared in other countries

Walmart

Walmart, after many false starts since 2009, seems to be getting comfortable with two clear models for cash-and-carry business, in the absence of any clear policies on FDI in retail. One, to launch 40-50 wholesale stores in the next 3-5 years, and launch an e-commerce platform, again for the wholesale side. This might not directly affect the growth of the retail e-commerce players, but this could be a start to their retail operations depending on the Indian Government policies post elections.

Our view

In the short-term, there is going to be a price war and margin war as all the big players Flipkart, Myntra, Snapdeal, Jabong etc. scramble to keep pace with Amazon. Once steady state is reached in 6-9 months, there is going to be the next round consolidation, with some of the existing e-commerce players merging or getting acquired, since efficiency is the name of the game in e-commerce for long-term survival.