Why have investors poured over INR 600 crores into the taxi market?

The radio taxi market has seen a lot of traction over the past couple of years. TaxiForSure recently raised $10 million with a focus on expansion to tier 2 and 3 cities. Uber has been aggressively launching across multiple Indian cities after starting in Bangalore just 8 months ago. The Indian radio taxi market is pegged anywhere between $6-$9 billion dollars by different estimates, and is forecast to grow at 17-20% annually. More importantly, only about 4-6% of this market is organized sector – the rest is by operators who own fleets of 2-50 cars and typically have a presence in one city.

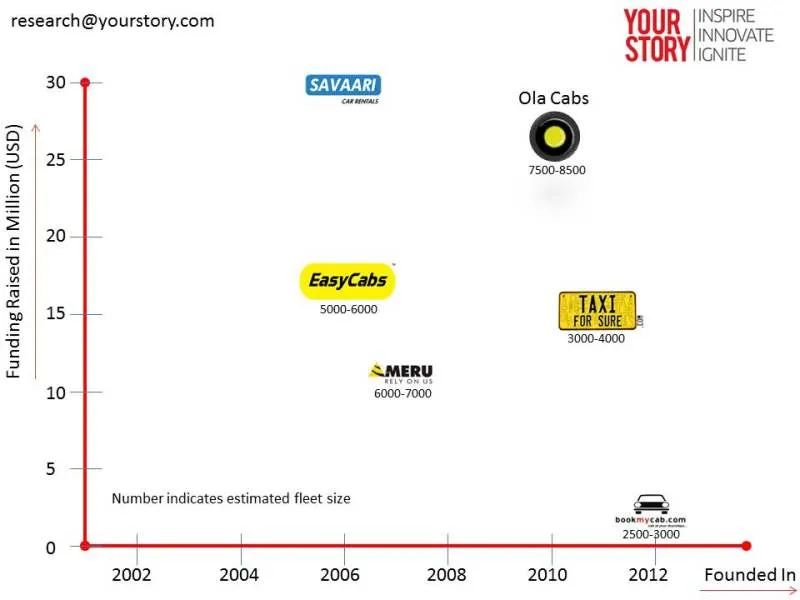

Evolution of Taxi Organized Sector in India

Mega Cabs and Fast Track Taxi came into existence in 2001 itself, with small fleets. However, the market started seeing traction only from 2006 onwards when Meru, Easy Cabs (owned by Carzonrent) and Savaari all came into existence almost in a span of one year. There are several competitors now in the radio taxi market, with their own respective war chests to build / aggregate their fleets, as shown by the image below.

(Note:

- The image does not include other companies such as Mega Cabs, Fast Track Taxi, Tab Cab, Your Cabs and Cabs 24x7 as they operate in specific regions and information is not comprehensive and verifiable

- Uber has raised $307 million globally, including from Google Ventures. Funds being allocated to the Indian market is not available)

Phase 1 – Inception

- Fleet Ownership: Fleet fully owned by the company, with the drivers working as salaried employees. Cars operate only on incoming bookings. Car loan EMIs and high car maintenance costs. Revenues directly accrued to the company. It is estimated that the average expenses in this model – driver salaries, car maintenance, loan EMIs – were INR 48,000 while the revenue was INR 30,000 per month. While this model facilitated rapid expansion, it also came at a huge cost. Caused high stress levels in drivers and there were driver strikes that affected the service

- Booking Model: Telephone calls only

- Payment Model: Cash was the dominant model

- Segmentation: The market only had one or two types of cars and per kilometre charges were pretty similar

- Pros & Cons: High control on service quality, but huge pressure on utilization rates since there is only one source of incoming bookings

Phase 2 – Transformation

- Fleet Ownership: TaxiForSure and OLA started the fleet aggregation model where small fleet owners or single car owners can put the company brand on the car, and get registered with them. Cars are free to take up non-company rides, but for every company-initiated ride, they pay the company a fixed percentage as commission.

- Booking Model: Telephone calls, Websites

- Payment Model: Predominantly cash, In-cab POS terminal for credit / debit cards

- Segmentation: Multiple segments opening up, with mid-sized sedans forming a big chunk of the fleet

- Pros & Cons: Asset light business with low capital expenditure. VCs loved this model. Company did not own the utilization headache, but the quality of service to end customer dropped because the company had no control on the cab availability and service quality from the private fleets

Phase 3 – Growth

- Fleet Ownership: Hybrid model where part of the fleet is owned by the company and part of the fleet is from an aggregation model

- Booking Model: Telephone calls, Websites, Mobile App

- Payment Model: Cash, In-cab POS terminal for credit / debit cards, Mobile App

- Segmentation: Segments expansion, including launch of hatchback cabs at a lower price point – such as OLA Mini and Uber X

- Pros & Cons: Better control on cab availability and service quality

What are the roadblocks to growth?

We have established that there is a large, unorganized market with a lot of room for growth. This has also been validated by the large investments that have been happening in this sector by leading investors such as Tiger Global, Accel Partners, Bessemer Venture Partners, Matrix Partners and so forth. But there are a few things that can throw a spanner in the works.

- Indians are famously price-conscious consumers. How do you get them to switch to a radio taxi when there are auto-rickshaws plying the road? The current pattern is that most official travels happen by radio taxis while private travels happen by auto / air-conditioned buses. Radio taxis are taking on the autos by providing them similar rates on their hatchback fleets, thus trying to win consumer mindshare. But there is a long way to go before the average consumer thinks of a radio taxi for a fun night out over the weekend

- Meru even now gets about 80-85% of their payments by cash. Usage of plastic money (cards) is still low. This can be a big deterrent for Uber especially, since they have traditionally succeeded in markets where mapping software accuracy, mobile penetration and credit card usage are extremely high

- Passenger safety, cab tracking using GPS, mobile app etc. started off as innovations but soon become the norm. Consumers simply expect these hygiene factors to be in place before they use them. So this is no longer the differentiator in the market

Our view: Where is the market headed?

- The market has huge headroom for growth and far from saturation. So we won’t be seeing any Amazon-Flipkart type price war any time soon. At least 8-10 major players with fleet sizes of 10,000-15,000 cars will consolidate their positions in the next 18-24 months

- Uber will be forced to innovate for the Indian market and accept different modes of payment and booking if they are looking for broader adoption rates as stated in their official communication

- More and more hatchback cars will be inducted into the fleets so as to be available at lower price points for intra-city travel. This is especially true given that intra-city average distances in India vary from 10-18 kilometers

- Auxiliary software products for fleet management, fleet tracking and utilization reporting, driver management and so forth might arise to service the growing primary market

- Companies might also expand into providing cabs for weekend-only outstation trips to maintain high utilization rates

- Service assurance & quality and convenience will emerge as the long-term differentiators. Discounts, technology (GPS tracking etc.) and other factors are just initial marketing tactics and will gradually become cyclical in nature, to coincide with special festivals and occasions