Bank of Maharashtra launches secure digital banking solution - MahaSecure

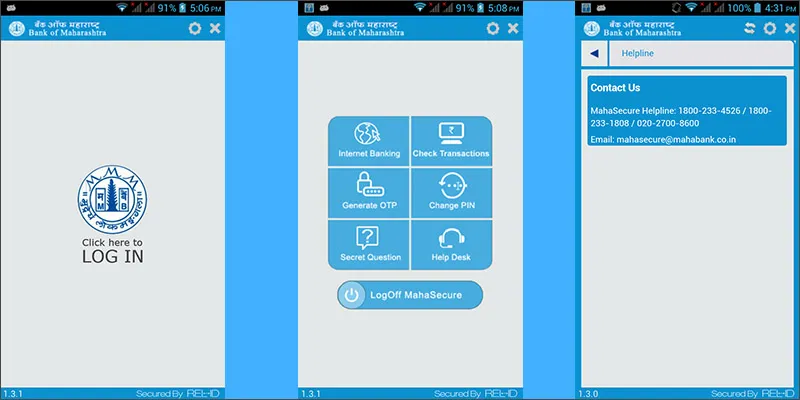

Bank of Maharashtra, one of India’s leading public sector banks, today announced the launch of MahaSecure, a next generation secure digital banking app, based on REL-ID – a digital security platform from Uniken. The MahaSecure banking app will enable secure access to Internet banking facilities for both retail and corporate customers of the bank. MahaSecure will protect Internet banking users from sophisticated online attacks.

Bank of Maharashtra’s initiative to launch the MahaSecure banking app is aimed at ensuring complete safety and trust in internet banking for all users as there is no dependency on any hardware tokens or SMS. The launch of MahaSecure also underlines the fact that the bank intends to offer greater customer convenience through alternative delivery channels such as the Internet banking while ensuring comprehensive security.

Indian Government currently holds 85.21% of the total shares of Bank of Maharashtra. The bank now has 15 million customers across the length and breadth of the country served through more than 1825 branches.

MahaSecure is based on REL-ID -a next generation digital security platform developed by Uniken Inc. REL-ID provides ubiquitous, consistent user experience across multiple digital channels, and creates a massively scalable secure digital banking ecosystem which provides maximum security to the customers.

Speaking on the launch, Mr. Narender Kabra, GM, Bank of Maharashtra said

As we focus on growth and start reaching out to more customers, we realize that our customer profile is changing. Traditional customer relationships are getting converted into digital relationships as more and more customers are switching to Internet banking. In this scenario, it was important for us to assure our customers of complete safety as they access-banking services online. We are confident that MahaSecure Appbased on the REL-ID digital security platform with inbuilt 2 Factor Authentication solution from Uniken will largely help us achieve this objective.

Uniken has been working along with BOM as security partners. Their flagship product, REL-IDTM platform has over a million users.

Excited about the partnership, Sanjay Deshpande, CEO and Chief Innovation Officer shared,

We are extremely happy and proud to have worked with Bank of Maharashtra. We believe that the positive step taken by the bank in leveraging Uniken’s REL-ID Digital Security Platform will drive faster adoption of their digital banking channels and provide better and safer online services to their customers.

Slowly Indian banks are making move towards digital platforms, small steps towards mobile money.