‘We sold insurance worth Rs. 21 crore in 3 years and turned profitable’: Abhisek Bondia, SecureNow

SecureNow is a fast growing insurance broking company based in Delhi. It helps institutional clients purchase employee benefits, property and liability insurance solutions. With unique features such as instant quotes for bespoke products, it has quickly made a name for itself.

Brainchild of Abhisek Bondia and Kapil Mehta, SecureNow has sold insurance with premium of Rs. 21 crore in the last three years and turned profitable last year.SecureNow’s Principal Officer and Director Abhishek Bondia (AB) speaks to YourStory on its plans for the future. Below are the edited excerpts of the interview.YS: It has been three years since SecureNow was started. Has it worked out as per the plan?

AB: SecureNow’s progress has been fantastic. In the past three years we have sold insurance with a premium of Rupees 1 crore, 5 crore and 15 crore respectively. This is a 15X increase in two years. We have 200 corporate customers and acquire 10 new corporate customers each month. It has been a rewarding journey.

YS: How have you coped with this rapid growth?

AB: It has not been easy. When we started we knew each of our clients personally. That’s no longer possible. We’ve done a few things to prepare for this rapid growth. First, we developed our own technology platform that allows us to manage the business effectively and from different locations. Second, we reorganized our team to have people focused on clients and equally important a separate team focused on the insurers. This gives us a huge leverage. Finally, we’ve cut down cycle times by building our own proprietary pricing tools. This helps reduce what used to be a two week long process to a day or so.

YS: How does that fare vis-à-vis competition?

AB: There are two tasks ahead of us. To increase the proportion of insurance sold through insurance brokers from the current 10% to 50 % as it is in other markets. The second aspect is to differentiate ourselves from other brokers. Our main focus here has been to tap and offer products suitable for SMEs. Our use of technology is also unique. Knowledge when codified properly is a huge competitive advantage in acquiring new clients. Although there are about 300 licensed insurance brokers in the market we end up competing with a much smaller group. This is the group that is now scaling.

YS: Has this growth come in a capital intensive way?

AB: We’ve grown profitably. When we started, our objective was to be cash flow positive as soon as possible. We were able to do this in our second year of operation itself. We are now profitable and scaling up.

YS: We keep hearing this debate about growth vs profitability, so are you sacrificing growth?

AB: We do not view this as one way or the other situation. Growth and profitability have to co-exist. We take each initiative at a time and push to make it profitable. Once a unit is profitable, we aim to replicate it several times over. We are very comfortable in investing capital once the unit has been proven profitable. Just to give you an example, two years ago we started online advertising. This was not a proven concept in our industry, so we were measured in our expenditure. Once we saw that customers were comfortable reaching out to us online, we increased our expenditure 10 times. The results have been very positive.

YS: What makes you different from other insurance intermediaries?

AB: Our core differentiation comes from our customer orientation and the business model designed around it. Traditionally, insurance has been a very push based model thus distribution units were designed keeping an insurer’s interest in mind. I will give you two examples where we have made this difference:

a) Reach: Today, there is no insurance intermediary in our segment who has a brand recall. If I ask you to name three insurance brokers that you will go to for your company’s insurance, you may not be able to do so. Existing firms have primarily relied on relationships to open doors.

If you look from a customer’s point of view, there are several touch-points besides agency relationships. Customers search online, talk to their CAs, and entertain cold calls etc. to get access to insurance advice. We have made sure that we are present in each of these mediums.

b) Product: Institutional insurances are bespoke knowledge-intensive products. Standard fire insurance for a BPO versus for an automobile factory needs to be designed differently.

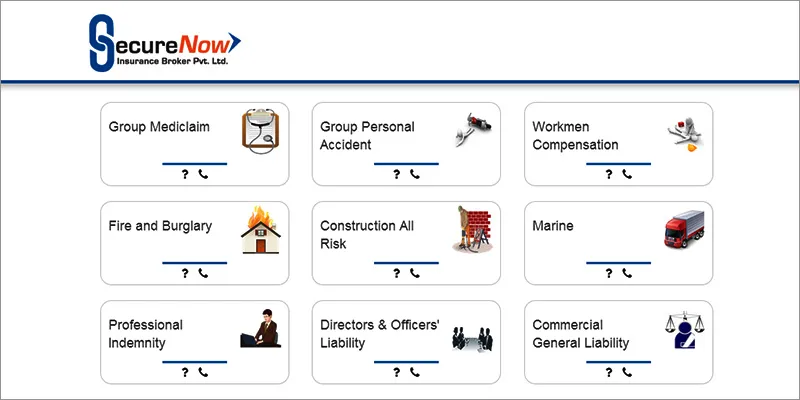

If you buy directly from an insurer or via a poor quality professional, you will end up getting cheated. We have codified the product knowledge which enables us to provide high quality advice in a packaged form to the client. Depending on the underlying risk, I can generate multiple insurance products instantly for the client, who can then choose the most optimal cover based on his budget.

YS: What is the role of technology?

AB: Technology has a large role to play in what we do. As a first step, we have introduced PAM (Policy Administration and Management) for our customers. This allows them to see all their insurances at one place. PAM allows them to view policies, make changes, file e-claims, and get alerts. Considering that a company may buy over 5 policies each from different insurer and make dozens of modifications in a year, this is a huge information life-line for the customer. This is a major area of investment for us.

YS: Where do you see SecureNow three years from now?

AB: Well we see ourselves as a nationally recognized brand for companies looking to procure insurance. We will have a much larger geographic footprint across the country. I see our technology systems being state of the art and effectively linking customers, sales persons, service executives and insurers. I think we will be able to maintain a growth of 150 to 300% each year. Our next milestone is to cross Rs 100 crore in insurance.