Why is India waiting to get into the semiconductor business

In this series, Sramana Mitra shares chapters from her book Vision India 2020, that outlines 45 interesting ideas for startup companies with the potential to become billion-dollar enterprises. These articles are written as business fiction, as if we’re in 2020, reflecting back on building these businesses over the previous decade. We hope to spark ideas for building successful startups of your own.

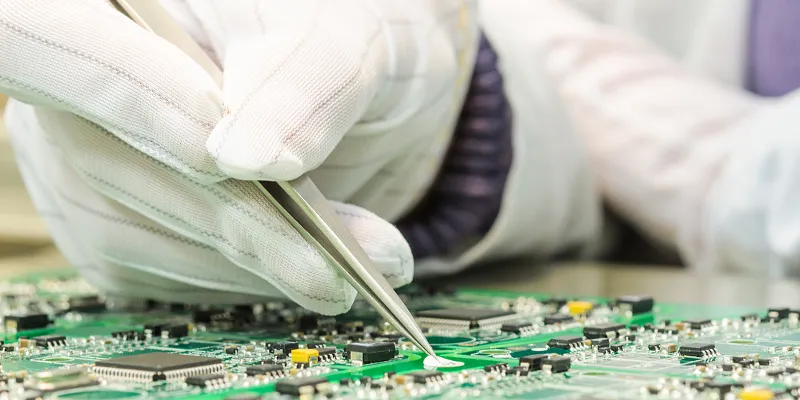

As the end of a decade approached, I felt, more than ever, that India also needed to strengthen its semiconductor industry. Indian innovators had driven such a significant portion of Silicon Valley’s semiconductor movement that it seemed out of the question for India itself to be left behind.

To be fair, India was already working on chips. Large semiconductor companies like Intel, Texas Instruments, Motorola, ST Microelectronics, and Infineon had hundreds and thousands of engineers toiling at their labs in Bangalore and Noida. But they were, often, doing layout, synthesis, verification, and other time- and labor-intensive implementation tasks, while the architectures and designs were conceived elsewhere.

And so, I looked to the future in search of a product idea to put India on the semiconductor innovation map of the world. My gut instinct was to look in the domain of convergence – an area that was, at the time, going through rapid innovation. Convergence was taking place on multiple dimensions, from home entertainment to mobile phones to cars to security.

India in 2009 was seeing tremendous mobile penetration, adding 10 million subscribers a month while forecasting 450 million subscribers by the end of the year. PC penetration, in contrast, was relatively low. It was becoming clear that India’s access to the global information superhighway was happening through the mobile phone. But the phones responsible for this phenomenon remained low-end.

In parallel, the West was seeing a rapid adoption of smartphones –convergence devices –with music, video, camera, Web access, even gaming console capabilities on top of the basic communication and personal data storage functions. The smartphone, for all practical purposes, was a miniaturized, hyper-integrated computer –and Apple had led the trend by putting its powerful Mac OS on the handheld, offering tremendous leverage in terms of software and user interface. The components, however, were still expensive, and to achieve this level of functionality in a convergence device such as the iPhone, the price point of the product stayed quite high by Western standards and unattainably high by Indian standards.

Yet, the applications were obvious. Indians loved Bollywood, and they loved music and music videos. Millions of people commuted on buses and trains for hours a day, a dreadfully boring experience that could easily be made more pleasurable by listening to Shreya Ghoshal or watching Ash dance around the trees with Abhishekh Bachhan. This market, without a doubt, was ready and waiting.

But they were not the only ones. Another industry seeking to reap the harvest of ingenuity on the mobile phone was banking. The banking and credit card industry in India faced enormous scaling challenges as they attempted to bring banking to the unbanked rural millions. Scaling challenges ranged from setting up retail outlets in every little town and village, to wiring up ATMs to traverse the Indian heartland. The industry would scale much faster if the smartphone was equipped with a radio frequency identification (RFID) chip, allowing the phone to function as a credit card. This phenomenon of wallet phones had already been widely adopted in Japan, with 50 million Japanese buying products directly off their phones, using the convergence device for much more than just calling and texting. If India could transition the mobile phone into a wallet phone, it would find yet another killer app.

Of course, there was a chicken-and-egg problem, as retailers needed the RFID readers to participate seamlessly in this mode of commerce. To answer this problem, I needed stakeholders from multiple industries to join hands –from the cellular handset makers, to banks and credit card companies, to a large and fragmented chain of retailers. Cellular carriers, by acting as visionaries, were in a position to significantly augment the adoption rates, delivering lasting change.

In all honesty, this was a job that Intel and Nokia were in a better position to take up. Companies like mChek and Airtel were already collaborating on mobile payment infrastructure, and Nokia had teamed up with Obopay to further push this forward at the software level. But if the smartphone became a physical credit card, it would open an immense range of possibilities –though the company that focused on building the chipset would have to accept a lower margin business structure due to the low price point of the final product, which Intel was not excited about.

That was the premise that led us to building the Nucleon chip, packing in all the sophisticated functionality of the high-end smartphones, alongside a secure payment capability and an ultra low-power design, which in itself was a huge technical challenge. Our architects took a systems view for the design and started with an architectural-level specification that took into account PCB, package, and component-level design. Each offered the narrowest opportunities to impact the overall power budget for Nucleon. However, it also required agreement from our handset vendor customers – Nokia in particular –to be able to make those design decisions. Nucleon designers clashed with Nokia’s architects on issues such as multi-chip packaging and non-critical path optimizations for yield. Every architect on their side had a big ego, and at one stage, the design discussions simply became ego battles. But those battles were worth fighting. The total impact was significant, with power reductions of more than 50%.

The most important guiding principle of Nucleon was that its entire engineering miracle had to be achieved within an unprecedented cost equation, even after assuming a set of subsidies from banks and carriers. Our challenge was to do far more by doing far less.

Well, we took that challenge. Our architects went through a grueling 12-month design cycle, interacting with every EDA vendor and foundry on the planet to see what they could offer in terms of cost-saving techniques in design and process. An obvious one was built-in self-test (BIST), a practice of putting testers on chips, which significantly reduced the follow-on testing time and cost. But we really had to squint hard to find hundreds of such cost-squeezing mechanisms. It exhausts me just thinking about the sheer number of papers our team read and conferences they attended.

When we started on this journey, neither Intel nor Nokia believed we would pull it off. We approached 27 VCs, who all turned us down, citing the obvious reasons: too ambitious, too much risk, too capital intensive.

Eventually, we came up with a nifty tactic. Instead of approaching Intel and Nokia’s venture capital arms, we went to their marketing. We explained that if they invested in our project, it could become a huge PR opportunity for them, internationally. Furthermore, we argued, $33 million between them over three rounds was not that much money. In fact, if they invested and partnered with us, we could get VCs to cough up as well. To Nokia, I even proposed an “album” of 500 Bollywood super hit songs built into the phone which would make rural India salivate.

To our surprise and delight, one sultry August in 2010, the Nokia marketing people started getting it. They found our ideas for the handset go-to-market strategy compelling and the wallet phone possibilities exciting. It was they who then convinced their own venture capital arm, as well as Intel’s.

Of course, there was the technical challenge of what we were embarking upon. There, we tackled the objections by recruiting as chief architect one of the key architects of Intel who was doing due diligence on us. An Indian by birth, she was so excited by the idea that she told the VCs she would join Nucleon, move back to India, and help make it happen.

We also had financing from several major banks, all quite active in the Indian retail banking market. Their interest: to bring banking to the masses.

They had, at some level, probably all bargained for a write-off of their investment, but they were eventually moved by the sheer force of our conviction. Every time they sent a no in our direction, we caught it and threw it back with an ingenious “but what if?” Eventually, they could no longer slow us down. And in 2012, after 24 months, we finally had a chip that met the price-performance targets we had set for ourselves.

In 2013, Nokia brought to market the first set of convergence devices based on the Nucleon chip. The chip was problem-free, but the handset had a battery problem. We held our breath, expecting at any moment to be made a scapegoat. But Nokia showed integrity, recalled the product, and never dismissed us.

A year later, the re-launched device blew through all of their most optimistic forecasts, gaining tremendous adoption not only in urban India, but also in rural India, where entertainment was less readily available. Nokia marketed the phone with a 5,000-song collection of Bollywood super hits pre-loaded into the device. This was the idea with which we first caught their attention.

After Nokia’s success with Nucleon, we were unstoppable. We had what seemed to be a bottomless patent portfolio protecting our engineering feat, making it near impossible to design around and achieve the same set of results. Thus, we were the only company with a chip at this price point, with this level of functionality and performance. The low-power technology alone was protected by a portfolio of 15 patents.

Not surprisingly, by 2014, we had Samsung, LG, and Motorola selling handsets based on Nucleon. In fact, by 2016, Nucleon had picked up 15% of the Indian handset market before growing to a mind-boggling 35% by 2020. In addition, each handset vendor also marketed complementary versions of their products, including receiver/reader technology for the RFID.

Three times in the last two years, Nucleon’s management team has been invited to dine with the CEO of Intel. Each time, acquisition is the topic of discussion. Each time, we enjoy a lavish meal and politely convey our joy at having them as a major shareholder, but our even greater joy at being independent. We remain a relatively small team of 350-odd people –nimble and ecstatically working in the culture of excellence we’ve created.