Why start up anything but not online publishing

Four years ago I was advised by a growing Asian tech publisher that start up anything but not publishing. The founder, who is a role model in Asia, was not stopping me but making me aware of the harsh realities of starting and scaling up an online publishing business. Now four years later, I’m echoing the same words – "start up anything but not online publishing."

Even if you’re thinking of building another clone of a Buzzfeed/ScoopWhoop, then think 10 times before doing it. While listicles draw more attention with dropping user attention span online, the challenges remain the same for them too. Things are worse for the traditional publishers, just see the below screengrab. That’s the article page of a well-known Indian publisher!

Very soon Lighthouse Insights will complete half a decade of existence. In these five years, we have gone through hell like any other startup. We have survived only because of our constant focus on objective laced with nonstop hard work.

There are these challenges (listed below) which are making life tough for most online publishers. There might be more interesting problems depending on the scale, please pardon me as I’m still learning the business.

Ad blindness and ad blocking

The above screengrab is an excellent example how readers are no more clicking on irritating ads and hence the ad blindness. To overcome this, there are enough Indian publishers who have come up with an innovative hack that lets the reader do the hard job of finding content lying beneath the horde of ads. From large publishers to smaller ones, today most of them have accepted that users are no more clicking on ads and the golden age of making dollars from Google Adsense has also gone.

There are publishers that are making good money from ads but then they are in the pageviews game. However, I have spoken to quite a few publishers and most of them understand that the reader is digitally quite equipped, and hence not interested to even look at irritating ads, which kill their user experience.

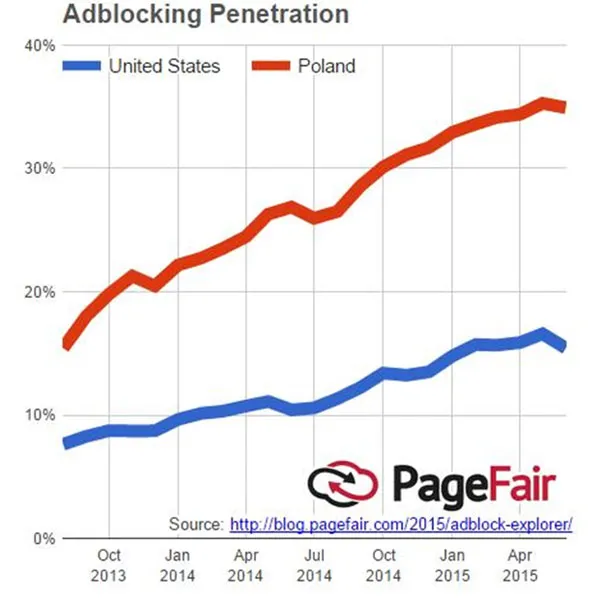

This has led to the growth of the biggest problem for publishers: ad-blocking. Ad-blocking will lead to almost $22 billion of lost advertising revenue this year, according to the report put together by Adobe and PageFair, a Dublin-based startup that helps companies and advertisers recoup some of this lost revenue. That represents a 41 percent rise compared to the previous 12 months, and the levels of ad-blocking activity now top more than a third of all Internet users in some countries, particularly in Europe, the report said.

The latest news is that Apple’s iOS – iOS 9 – is going to include ad blocking capabilities for the mobile Safari browser. This has got the attention of marketers and publishers because mobile had been seen as something of a safe haven from ad blocking tech, reports MarketingDive.

Research from Genesis Media found 24 percent of respondents used ad blocking software on home and work computers, but only three percent had ad blocking tech installed on their mobile devices. The news about iOS has given the various players in the space new concerns about the technology and the mobile channel.

To overcome the problem of ad-blocking, publishers like Mic are cutting deals with these companies, Vox Media and Quartz are investing in more appealing ad formats that consumers might better accept. On the other hand, 'Washington Post' is experimenting with blocking access to readers who give ads the stiff-arm and Interactive Advertising Bureau (IAB) is considering whether to sue software companies that provide such ad blocking services.

However, ad-blocking will continue expanding its wings and publishers are to be blamed for this problem. To slow the adoption of ad blocking and make the Internet a better place, we will have to make advertising better.

Mobile revenues are struggling

Mobile is the first screen today from entertainment to consuming information. Earlier this year, the influential Mary Meeker report in its annual assessment of the Internet economy highlighted that 65% of Indian Internet traffic is dominated by mobile.

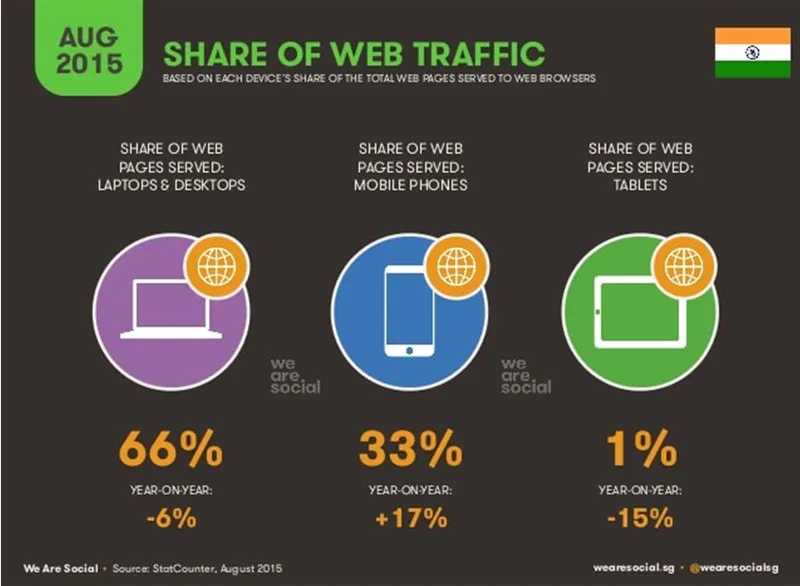

In India, mobile is the primary reason for driving the new Internet users dominated mostly by Tier 2 and 3 cities. Mobile is definitely opening up gates of the Internet for first time users in the country, but web still rules, states the We are Social digital report on India. Share of webpages served by laptops and desktops account for 66 percent whereas mobile stands at 33 percent year on year. It is interesting to note that even though the web holds the ground, it is seeing -6 percent fall year on year, whereas mobile is witnessing a positive growth of 17%.

Growing consumption trends over mobile saw Google making a serious effort to ensure websites are as mobile-friendly as they can possibly be. In April, Google unleashed what was dubbed “Mobilegeddon” on website owners. Essentially, its algorithm started favoring mobile-friendly websites and ranked them higher in its search results. The message was clear: if you are a content creator on Internet and if it isn’t mobile friendly you are dead.

Mobile definitely is the way forward, but the five-inch screen has posed way many problems than desktop for publishers. A leading Indian publishing house recently told me that more than 50% of its traffic comes from mobiles but mobile revenues are struggling at five-10 percent.

At New York Times Co., more than half visits to the company’s digital properties now come from smartphones and tablets. However, those devices accounted for just 15 percent of the company’s digital ad revenue in the second quarter. “[Mobile revenues] are definitely lagging audience. No question,” Chief Revenue Officer, Meredith Kopit Levien, told WSJ.

It is a similar story at News Corp’s Dow Jones & Co., publisher of 'The Wall Street Journal'. More than half of unique visits to The Wall Street Journal Digital Network—which includes the Journal, MarketWatch, Barron’s, and WSJ Magazine—now come from non-desktop devices, but mobile accounts for less than 20 percent of the network’s digital ad revenue, according to a person familiar with the matter.

The problem again has been given birth by publishers, as most of them are pushing the same web ad strategies on mobile.

Paid content is struggling

In 2009, The Wall Street Journal commissioned GfK Research Worldwide informed that survey respondents believed all Internet content should be free and without advertising (33 percent) or all Internet content should be available for free. Only 12% of survey respondents said they would pay for online content.

A latest report done by Reuters informs that just 11 percent of US consumers are paying for online news, according to the report, and there has been “virtually no increase” since 2013. This statistic is replicated around the world, with only about 10 percent paying for news.

The rest of the world isn’t as generous and India is no exception. India, where Internet penetration is just 27 percent i.e. 350 million out of 1,285 million total population, goes by the general belief that anything on Internet is for free. Indian publishers motivating users to pay for the content that they read is only a distant dream.

Challenges with native advertising

Native is one of the hottest topics in digital media, and advertisers and publishers are taking notice. By creating advertisements that are in the same format as the content audiences are there to consume, marketers and publishers hope to provide a much less disruptive advertising experience.

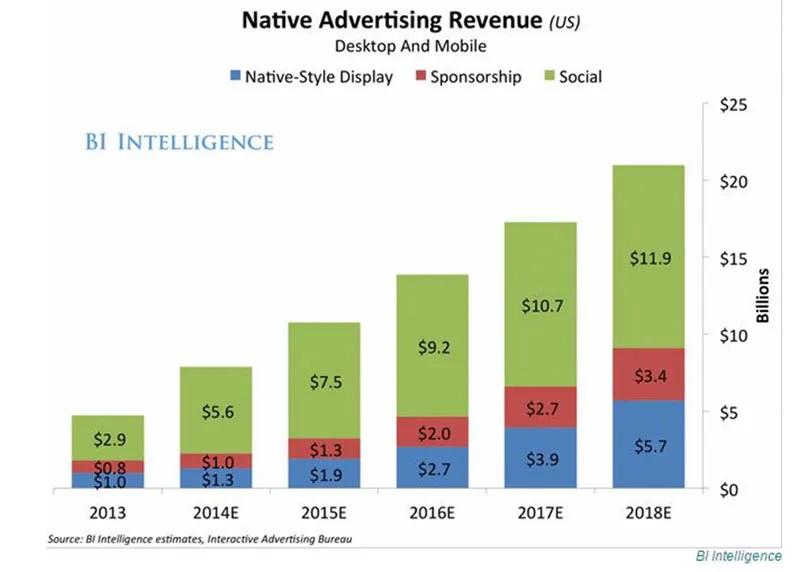

BI Intelligence finds that spending on native ads will reach $7.9 billion this year and grow to $21 billion in 2018, rising from just $4.7 billion in 2013. Times sold up to $18 million worth of native ads in 2014 resulting $182.2 million digital ad revenue. The popular listicle site Buzzfeed hit $100 million revenue in 2014, while it is not clear how much was made by native advertising but it is a known fact that native and videos are a strong-arm of the new age publisher.

Indian publishers such as ScoopWhoop, The Huffington Post, The Quint and others have started taking a keen interest in native advertising.

But again native comes with its own set of challenges and image problems. With scale being a major problem for native, maximizing revenue while preserving and protecting editorial integrity and user experience is another one.

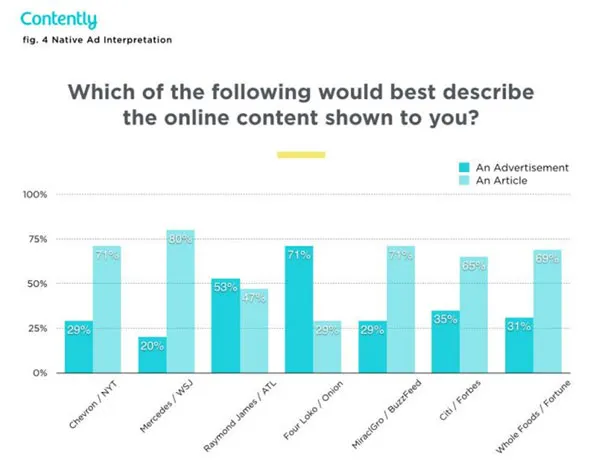

Another big debate is that native is misleading readers since native ads in the form of content are blended with regular articles. A recent report from Contently states that consumers continue to confuse sponsored content (aka native advertisements) with actual articles. “Generally, respondents said they were less likely to trust sites that publish brand sponsored content.”

However, Adam Singolda, CEO, Taboola, considers the main challenge for native is that while it’s a massive opportunity for marketers and publishers, it’s still a small market. “We need to keep innovating as an industry and help $60 billion of display advertising flow toward this area and help marketers find a similar or better return-on-invested that they already see in display or search.”

Social Networks are the new publishers

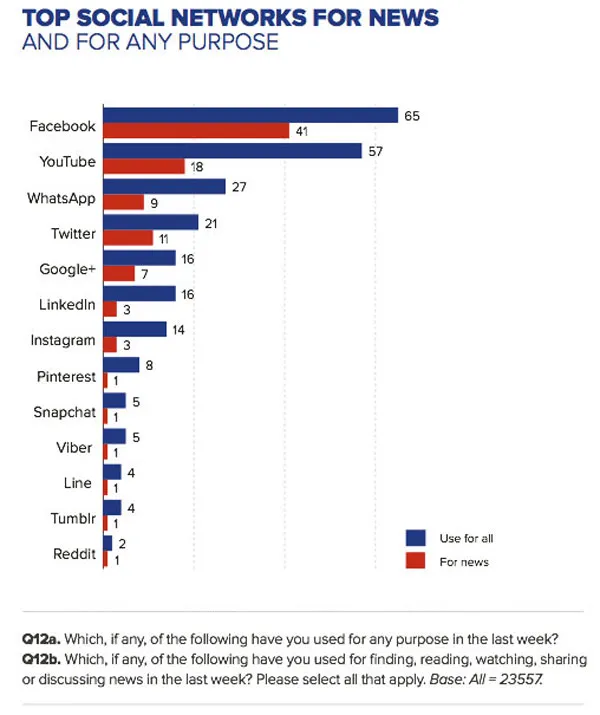

Social networks are the new publishers. Some 41% of people around the world get their news from Facebook each week, a number that towers over Twitter (at 11%) despite the media’s obsession with the Twitterverse.

Reuters Digital News Report 2015 also highlighted the fact that WhatsApp, a mobile messaging platform bought by Facebook in 2014, is a popular source of news consumption in Spain and Brazil. And search isn’t going away. It remains strong in Italy, Spain, and Germany, countries where more than 50 percent of users say their news discovery starts with search engines.

From 2015, we have already seen popular social networks such as LinkedIn, Facebook, Google, Twitter all of them want to be publishers – so users spend maximum time on these networks. LinkedIn, which is focusing on content models for future revenue sources, has a million plus members publishing on LinkedIn.

This isn’t a big news for publishers as LinkedIn over time has been slashing referral traffic. LinkedIn obviously wants to push itself as a publishing platform after the success of its influencer program but publishers are not very happy with this move. At a recent presentation, Quartz revealed that it has witnessed a sharp decline in LinkedIn traffic in 2014.

Social networks want the traffic to remain in their walled gardens. Earlier this year, Facebook launched Instant Articles, a new product for publishers to create fast, interactive articles on Facebook. Instant Articles debuted with rich-media stories from The New York Times, BuzzFeed, National Geographic, and six other outlets that will be globally visible from Facebook’s iPhone app.

Facebook recently touched a billion users in a day, why would any publisher say no to such a lucrative deal? The catch here, however, is that publishers will have to host content on Facebook and also share 30% with the social network if it sells the ads.

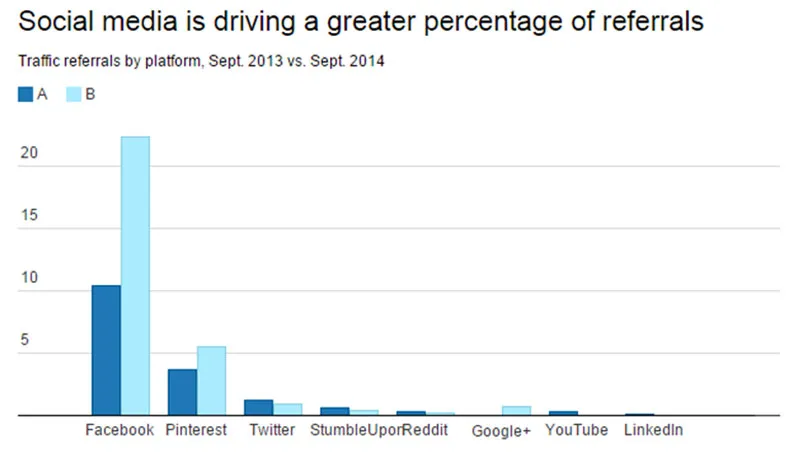

In addition to this, social networks like Facebook, Twitter are the source of the biggest referral traffic for publishers. Facebook, for the second time in this year moved ahead of Google in Parse.ly’s rankings.

In September 2013, the eight biggest social referrers drove 16.4% of traffic to publishers’ sites, according to Shareaholic, which measured traffic across more than 200 sites of varying audience sizes. A year later, that number had nearly doubled, to 29.5%. Facebook is in a class of its own: It drove more than 22 percent of referrals to publishers, with Pinterest a distant second.

Twitter, meanwhile, favored news publishers, according to NewsWhip’s analysis. The BBC was the most-tweeted site in December, with nearly 3.8 million tweets.

But how long would Facebook allow the traffic to go beyond its closed walls? LinkedIn is already slashing the referral traffic and Facebook will follow suit. If not then it defies the dream of networks to be publishers.

Earlier this year at SXSW, BuzzFeed CEO Jonah Pretti had informed that as long as his content is sitting on social media he isn’t bothered. Buzzfeed might not be bothered but Brian Fitzgerald, co-founder and president of Evolve Media thinks that giving up content over to Facebook is dangerous. “The danger of all these big platform plays is, they open it up, they encourage you to put your content on their platform, they aggregate the audience, but at the end of the day, they’re building loyalty and engagement for your content on their platform,” he said.

“It’s extremely difficult to pull people off YouTube. The more publishers put content on Facebook, the less they will depend on any one particular publisher.”

There would be more challenges down the road like for any other startup. “No one said that the ride is going to be a smooth one.” So my humble advice would be – “Start up anything but not online publishing.”

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory)