Winds of change in the multi-billion dollar eyewear market

Six out of 10 people in the developed world wear glasses, contact lenses or have had corrective eye surgery.

Six out of 10 people in the developing world are also vision-impaired, but have little or no access to eye care or eyeglasses (source). When extrapolated in proportion to the global population, these are staggering figures.

Who makes so many glasses? To anyone in the eyewear industry, 'Luxoticca' would be a common name, but not to the general population. But everyone has heard of Prada, Giorgio Armani, Versace, Lenscrafters etc. Either Luxoticca owns these brands or it makes sunglasses and prescription frames for them. Luxottica Group is an Italian eyewear company founded in 1961 that has a marketshare of over 80 per cent of the world's major eyewear brands. The group owns Ray-Ban, Persol, Lenscrafters, Pearle Vision etc. It also makes sunglasses and prescription frames for a multitude of designer brands such as Chanel, Prada, Giorgio Armani, Burberry, Versace, Dolce and Gabbana and more. Luxoticca has more than 7,000 retail stores and had 2014 EBIDTA of $1.7 billion. Apart from Luxottica, there are other biggies like Safilo, Marchon and Derigo.

The online angle

When we come to talk about the online space and disruptors, Warby Parker is the front-runner. Valued at a massive $1.2 billon in April after raising $215 million across rounds, Warby Parker is an online eyeglass retailer that acquires customers online and also has physical stores across USA. The company has marketed and built a brand by selling designer frames under $100. It also has a model to donate one pair of glasses in the developing world for every pair bought in the USA. Although the company has a massive valuation, it is still a fraction of the likes of Luxoticca.

What’s happening in India?

In India, GKB Opticals is a large Indian retailer of optical products (sunglasses, eyeglasses, contact lenses and accessories), and operates multiple retail stores in India. Headquartered in Kolkata, the company has over 60 stores across India and employs over 600 people. There are other upcoming optical retail chains like Ben Franklin (which recently raised Rs 40 crore). In the online space, Lenskart is the major company which started in 2010 under the umbrella of Valyoo along with Jewelskart, Bagskart and Watchkart. The company raised a round of Rs 135 crore in January 2015 and decided to focus only on Lenskart, and shut all other portals. Along with the online channel, Lenskart has about 100 branded shops in 66 cities and is planning to increase the offline push.

Innovations and new ventures

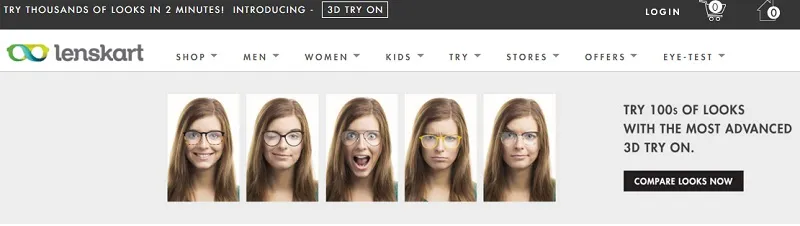

Lenskart has recently launched its ‘3D Try On’ feature on the website wherein users can try on various frames virtually. The tool asks users to use the front camera and move the face to record the details of the features. The tool then allows the user to put on various frames and displays the results on the screen.

There are new ventures that are exploring the space now. Glassic and Gorgeye have entered the online fray in the past year.

Started by Kailash and Devesh Nichani, Glassic builds on the founders’ family business into retail optical dispensing. The company is currently only operating online and it also has the virtual try-on feature. “We've received great feedback about our site, products and services and we've had no returns till date,” says Kailash.

Gorgeye is another startup in the area, initiated by Keshav and Nidhi Gupta. The company is seeing a month-on-month growth of 45 per cent. Nidhi says, “In the last four months since we started our operation, we have steadily increased our CTR from 1.8 per cent to the current 3.2 per cent. We started with 30 models and now we have added more than 100 models to our designer collection. We are in process of adding sunglasses and power sunglasses to our collection.” Gorgeye is targeting to process 1,000 orders per month by the end of 2015 and has a revenue target of around Rs 10 lakh per month.The future

The eyewear industry has been in the hands of a few for decades and that is finally changing now. Similar to how other sectors are shaken up by technology, the eyewear industry too is is seeing a new wave of efforts to take on the traditional giants in the business. The aim is the improve access and give a better experience to the customer.

Millions in the developing economies don’t have access to eye care and startups are coming up to solve these problems. For instance, Forus’ flagship product 3nethra is an integrated, intelligent, affordable, rugged and portable eye screening device that can screen a patient in less than five minutes for common eye problems. For companies delivering eyewear, there are big underserved markets in the country and globally where they can create an impact.

(image credit: ShutterStock)