How this Mumbai-based startup is building an alternative investment platform without owning any assets

Technology has changed the way traditional businesses work and, in some cases, has made new-age businesses more easily scalable and accessible. In early 2015, Tom Goodwin, VP of Strategy and Innovation, Havas Media, noted,

Uber, the world’s largest taxi company, owns no vehicles. Facebook, the world’s most popular media owner, creates no content. Alibaba, the most valuable retailer, has no inventory. And Airbnb, the world’s largest accommodation provider, owns no real estate.

Technology has been able to disrupt businesses across the spectrum, bringing tremendous savings in time, costs and efforts to consumers and businesses alike. With depressed returns provided by traditional asset classes, the current global scenario is more receptive to investing in alternative assets. Altflo, a Mumbai-based startup, aims to be a global alternative investment platform without owning, managing or controlling any assets or capital.

What is it?

Altflo Technologies is a private marketplace for alternative asset and investment management. It is a digital engine that uses technology to accelerate deal-making in, and enable efficient management of, alternative assets.

“Any asset that is not stock, bond or cash is an alternative asset,” explained co-founder Abhinandan Balasubramanian, adding, “Well-known alternative assets include private companies, distressed securities, investments funds like venture capital, private equity, hedge, secondary, etc., real estate and infrastructure, financial derivatives and art and wine.”

Currently, Altflo is a networking, deal-origination and SaaS platform and is operating well outside the regulatory framework, with its suite of three products and services. In 12 to 18 months, the startup estimates that its product will become more scalable and will enter the regulated sector and apply for all the necessary Indian and international licences, such as merchant banking and broker-dealer licence.

Story so far

The founding team at Altflo consists of Abhinandan, Aadit Devanand, Saravanan Shanmugam and Varun Agarwal. After many months in stealth mode the startup was incorporated as a Private Limited in December 2015.

Abhinandan and Saravanan were earlier the co-founders of ChefHost, an online marketplace connecting chefs and they exited the company in 18 months, giving a 2x return to their investors. Abhinandan was also one of the founding team members of Liquity, backed by high-profile hedge fund bankers and others. Saravanan, the CTO at Altlfo, was previously the tech lead and employee number one at Local Circles. Prior to that he had worked at eBay and Walmart Innovation Labs in Silicon Valley.

Aadit, on the other hand, is an IIM-Bangalore graduate, a qualified CA, CFA and was earlier a banker with Bank of America ML, and had worked with Deloitte Haskins & Sells on audits. Varun, a NALSAR alumnus, is the CMO at Altflo. He was earlier a lawyer with S&R Associates and Herbert Smith Freehills and had co-founded Lex Consilia, an on-demand legal research firm.

Altflo also has a panel of advisors from iBank, institutional funds, law firms and unicorn startups guiding them with the building of the product and introductions. Talking to YourStory, Abhinandan explained why he believes in the founding team. He said,

Saravanan and I are from the startup ecosystem. We bring fresh perspectives and innovative ideas to the table. Aadit and Varun have worked on multiple billion-dollar transactions in the capital markets, M&A space and advised some of the biggest investment banks globally. We have all worked directly with the thought leaders, movers and shakers of the financial world, and are now accumulating all that knowledge and experience into developing Altflo.

How does Altflo work?

The Altflo platform is an ‘engine’ consisting of two key components – a marketplace and a SaaS section. The marketplace is powered by two functions – dealflo and consultflo.

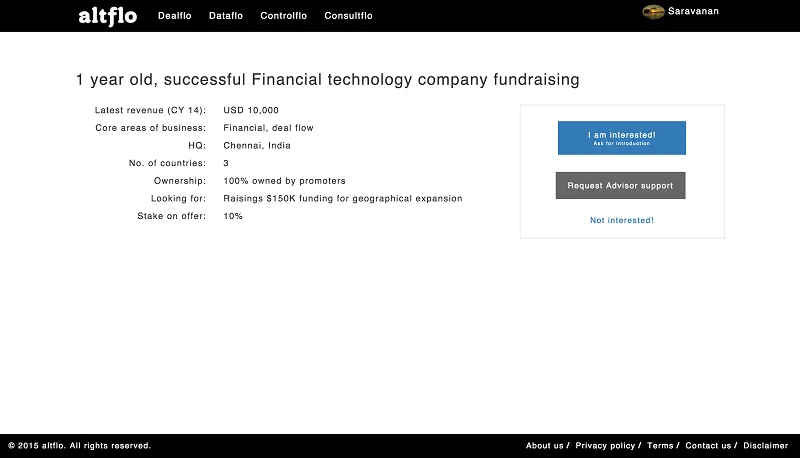

Dealflo – Is a deal-making marketplace where the buy-side and sell-side meet. It is anonymous and based on opt-in introductions.

Consultflo – Is an on-demand advisory network which gives users access to lawyers, accountants, financial advisors, valuation services and escrow/custodial services, on an as-per-need basis.

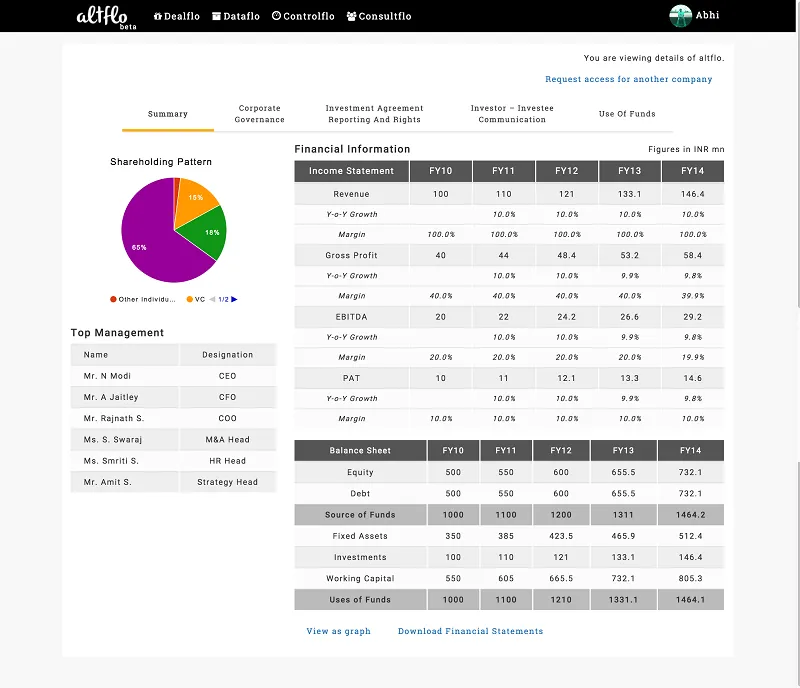

The SaaS section is powered by two functions – controlflo and dataflo.

Controflo – Is the asset management function where users can manage and monitor their assets- portfolio monitoring, investor relations, equity management, and corporate governance.

Dataflo – Is a virtual data room used to store documents. It claims to provide bank-grade security and streamlines the data filing.

Altlfo is aimed at private company directors, deal-makers, individual investors, investment funds, advisors and other professionals. Every user on the platform is verified by the Altflo team.

Once signed up, a user is free to access the various features on the platform as per their requirements. Talking about the use cases, Abhinanadan explained, “A private company director might want to raise funding, there could be an institutional investor who wants to use the platform to monitor his/her portfolio. On the other end of the spectrum could be deal intermediaries and advisors who might want to access the platform to network and originate new business, or support their clients.”

Another way to look at Altflo is by the three types of clients that makes its target market:

The seekers – private companies, alternative investment funds or turnkey projects that are looking to raise funding or exploring exit options.

The providers – Ultra high net worth individuals (HNIS), institutional investors and funds or syndicates looking to invest capital in various asset classes.

The enablers – investment banks, law firms, accounting firms, financial advisors, deal intermediaries, service providers.

Altflo confirmed that they are currently generating early revenues from both their core products- dealfo and controlflo. Abhinanadan said, “We’ve helped private companies raise approximately $4 million in our private beta. Through controlflo, we’ve delivered bespoke services to users and monetised already. More recently, we have a healthcare company raising $3 million, a production house raising $100 million+, a sports venture raising $10 million, and three venture capital funds raising between $20 and 50 million.”

Sector overview

Globally, the alternative investment ecosystem is estimated to be worth trillions of dollars. Through their personal experience in the space the founders found that the ecosystem suffered from inefficiency, lack of transparency, inaccessibility and illiquidity. They believe that there is a large enough market that needs to be managed, monitored and controlled more efficiently as the world economy depends on it. Aadit added,

Allocation towards alternative assets is at an all-time high and everyone from institutions to individuals are all directly investing their funds these days. A recent report by one of the big 4s reveals that the estimated capital available is a few $100 billion per year and the size of the alternative asset market is well over $10 trillion.

Altflo is competing with service providers who fall into two, almost mutually-exclusive, categories - traditional, offline players with high domain expertise, but low penetration like the big ibanks and emerging, online platform. Currently, Altflo isn’t operating on the crowdfunding model and doesn’t look at the startup space. Angellist and Let’s Venture are popular platforms that cater to startups through crowdfunding. Then there are platforms like CBInsights and Tracxn that help startups and investors understand the ecosystem better through analytics and insights.

Future plans

Currently bootstrapped, Altflo’s focus is on generating revenues through the mandates that it currently has on the platform, which represent large, bespoke investment opportunities. Based on the interest they have received so far, they aim to go after institutional investors for strategic investments and try and avoid going to VCs.

The startup expects to operate as a boutique in the first year and focus on certain geographies, sectors and assets. After which it aims to become agnostic towards these criteria and become an aggregator/enabler in a truer sense. Altflo is currently looking to hire and expand its team to 10 employees by Q2 2016.

The startup's long-term vision is to focus on four aspects:

-Make the private market more efficient and effective.

-Create a ‘new class’ of alternative assets that are liquid.

-Leverage technology to streamline workflow, automate processes and be an alternative to the mainstream investment banks.

- Be a global alternative investment platform without owning, managing or controlling any assets or capital.

Website: Altflo