How Shipping Exchange cuts out middlemen and acts as a price aggregator for freight ships

The knowledge of trade is with the middleman in India. There are middlemen in farms, in the movement of goods, across the country, and also when goods are leaving the country. The mark up of the cost is sometimes close to 150 percent, and businesses have to pass this cost onto the customer. All this happens because small businesses are not aware of the processes involved in shipping a product across the world. Perhaps there is a need for an Ola-Cabs-kind-of disruption. The taxi service aggregator brought the power of entrepreneurship and pricing to the cab drivers. They were no longer in the clutches of the operator who denied them payments for long periods. An almost similar scene is being played out in Indian ports. Shipping Exchange, the two-year-old startup, is trying to make shippers discover real pricing, across all ports in India, on its portal, while exporting or importing a product. In the process, it is reducing the time taken to get ocean transportation deals and for the product to reach the market. It is also increasing the bottom lines of SMBs because of the fall in the cost of logistics.

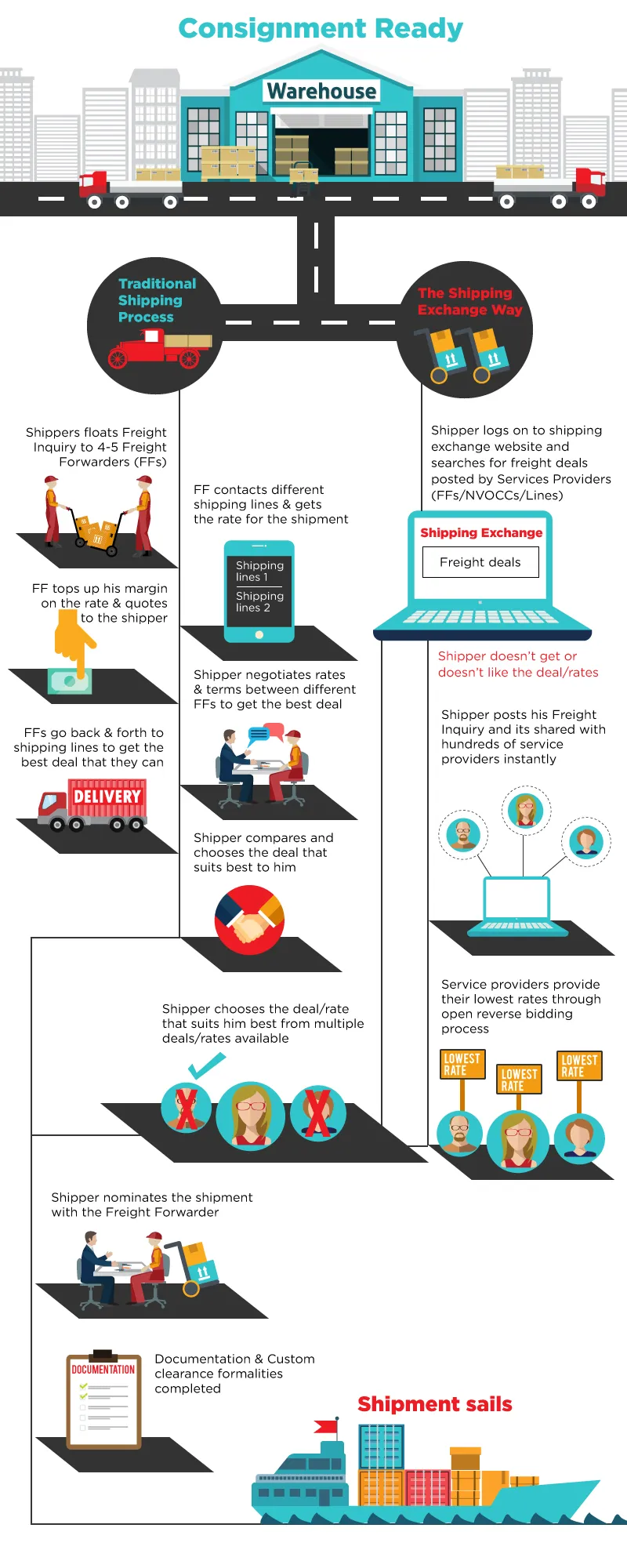

Shipping Exchange brings freight forwarders, non-vessel operating common carriers (NVOCCs) and shipping lines on a common platform. It is eliminating the need for agents and small-time services businesses, who are adding on to the cost without offering transport solutions. The pitch was perfect for large freight forwarders and liners, because they could get more customer leads from one platform rather than having to deal with multiple small companies.

“Most of the containers that go out are only 60-percent full, so we tell the freight forwarders that an SME’s products can fit into the container and the freight forwarder gets extra revenues in the process,” says Ashutosh Shrivastava, CEO, Shipping Exchange. He adds that in this case, apart from the shipping companies getting leads, the SME gets a price benefit, handles less bureaucracy and gets the goods shipped to location faster.

The beginning and business model

Ashutosh was working as an IT sales executive in Australia, in 2014, when he met Harmeet Kohli at a party. After an engaging conversation on how they could disrupt the shipping industry, they began to meet regularly to chalk out a business idea. Harmeet, who had over 15 years of experience in the shipping industry, told Ashutosh that the industry needed a price aggregator for small businesses. By the end of 2014, the company was founded.

According to data provided by the Ministry of Commerce, SMEs account for nearly 40 percent of the country’s exports. The Central government has recognised 108 clusters as export promotion zones and the government has set an ambitious target of increasing SME exports to $900 billion from the current level of $600 billion. Also, 73 percent of the global trade is made by SMEs. Obviously this segment spends at least 12 percent on logistics cost, which amounts to $72 billion. It is very high because of the number of middlemen involved before one gets to the freight forwarders and shipping lines.

The business model for Shipping Exchange works on a subscription fee for companies or SMEs, on an annual basis, which allows them access to deals. The startup also charges a percentage of every transaction made with a freight forwarder or NVOCC. They have 25,000 shipping companies and freight forwarders onboarded, along with 77,000 registered users. Once the deal is signed by the SME, all the tracking services are provided by Shipping Exchange. “This business is not limited to India alone; we have signed up global players across different countries,” says Ashutosh.

Investors see the potential in such platforms, but point out the need to step up and not just be price aggregators. “There are opportunities for technologies to intervene in legacy businesses. But startups should go beyond just price discovery by adding services and they should test their ideas,” says V Ganapathy, CEO of Axilor Ventures.

Although a logistics business like this is an opportunity, it involves its own set of challenges. The traditional players are still the gatekeepers of the shipping industry and control the pricing. The competition are small-time consulting companies that do documentation services and also act as brokers. No wonder Ashutosh and Harmeet are trying to make that group inclusive and increase the order base with them too. They are also trying to build an app to make it accessible to logistics managers. To get the system to move to the Shipping Exchange platform there must be a consistent user base of SMEs. Logistics is a business that will continue to be a large opportunity for startups. Shipping Exchange will need to spend money on signing in SMBs, freight forwarders and shipping lines. At least for now they are onto a big thing.

Website: Shipping-Exchange