Microsoft to acquire LinkedIn for $26.2 billion in an all-cash deal

Microsoft Corp. and LinkedIn Corporation on Monday announced that they have entered into an agreement under which Microsoft will acquire LinkedIn for $196 per share in an all-cash transaction valued at $26.2 billion. This is inclusive of LinkedIn’s net cash. As a part of the deal, LinkedIn will retain its brand, culture and independence.

According to the announcement, Jeff Weiner will remain CEO of LinkedIn, reporting to Satya Nadella, CEO of Microsoft. The company blog also added that Reid Hoffman, chairman of the board, co-founder and controlling shareholder of LinkedIn, and Jeff both fully support this transaction. The transaction is expected to close this calendar year.

Story so far

Positioned as the 'World Largest Professional Network' LinkedIn allows users to create business connections, search for jobs, and find potential clients.The company was founded in 2003 by Reid Hoffman , Jean-Luc Vaillant , Allen Blue , Konstantin Guericke , Eric Ly , Lee Hower. At the time of the acquistion LinkedIn claimed to have more than 400 million members. The company has offices around the globe and recently opened a Bengaluru office. The company also announced their mobile app strategy at India office launch.

Related read: LinkedIn sharpens mobile and content strategy for its second largest market – India

Over the past year, LinkedIn:

- launched a new version of its mobile app that has led to increased member engagement;

- enhanced the LinkedIn newsfeed to deliver better business insights;

- acquired a leading online learning platform called Lynda.com to enter a new market;

- and rolled out a new version of its Recruiter product to its enterprise customers.

LinkedIn claims that these innovations have resulted in increased membership, engagement and financial results, specifically 19 percent growth year over year (YOY) to more than 433 million members worldwid and a 9 percent growth YOY to more than 105 million unique visiting members per month. Satya Nadella said,

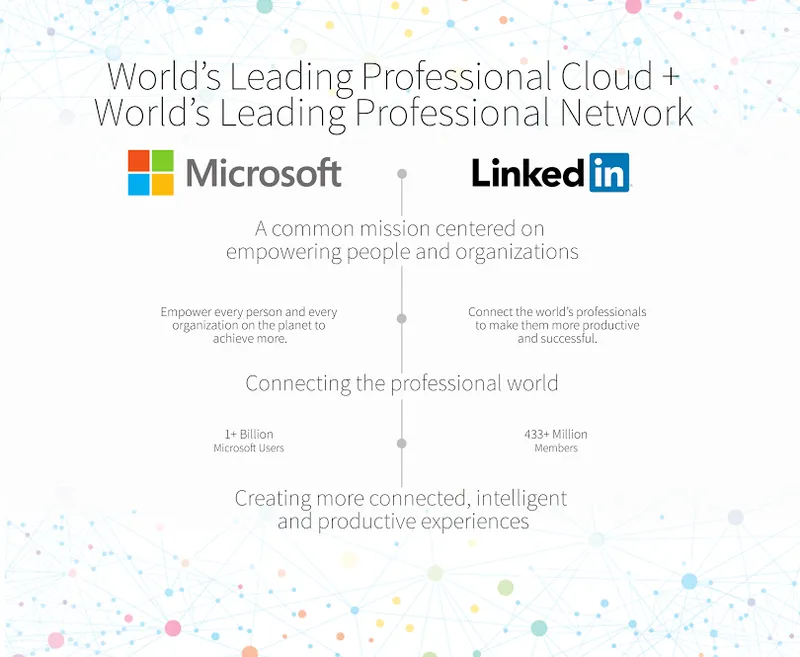

The LinkedIn team has grown a fantastic business centered on connecting the world’s professionals. Together we can accelerate the growth of LinkedIn, as well as Microsoft Office 365 and Dynamics as we seek to empower every person and organization on the planet.

“Just as we have changed the way the world connects to opportunity, this relationship with Microsoft, and the combination of their cloud and LinkedIn’s network, now gives us a chance to also change the way the world works,” Weiner said. “For the last 13 years, we’ve been uniquely positioned to connect professionals to make them more productive and successful, and I’m looking forward to leading our team through the next chapter of our story.”

The transaction has been unanimously approved by the Boards of Directors of both LinkedIn and Microsoft. The deal is expected to close this calendar year and is subject to approval by LinkedIn’s shareholders, the satisfaction of certain regulatory approvals and other customary closing conditions. Reid considers the acquistion to be a re-founding moment for LinkedIn. He said,

I see incredible opportunity for our members and customers and look forward to supporting this new and combined business. I fully support this transaction and the Board’s decision to pursue it, and will vote my shares in accordance with their recommendation on it.

LinkedIn though had faced tough times recently after their most recent earning's report. The company reportedly lost the faith of Wall Street traders as the company's stock plummeted and it lost $11 billion in value, according to a recent Reuter's report.

What next for LinkedIn?

Microsoft will finance the transaction primarily through the issuance of new indebtedness. Upon closing, Microsoft expects LinkedIn’s financials to be reported as part of Microsoft’s Productivity and Business Processes segment.

The technicalities

Microsoft expects the acquisition to have minimal dilution of ~1 percent to non-GAAP earnings per share for the remainder of fiscal year 2017 post-closing and for fiscal year 2018 based on the expected close date, and become accretive to Microsoft’s non-GAAP earnings per share in Microsoft’s fiscal year 2019 or less than two years post-closing.