Singapore's Grab raises $750mn led by SoftBank, increases total capital position to over $1B

Southeast Asia's leading ride-hailing platform, Grab announced on Tuesday that it had raised $750 million in equity financing, increasing its total capital position to over $1 billion. The release also noted that SoftBank, a long-term strategic partner to Grab, led an expanded, oversubscribed round, with participation from both new and existing investors.

Story so far

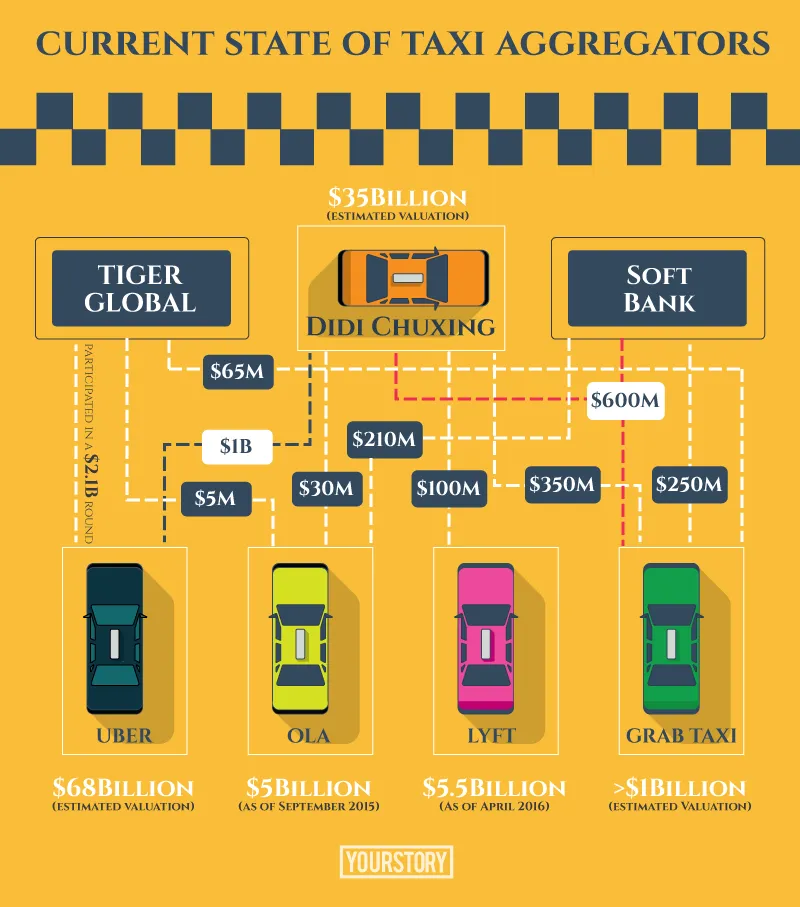

Founded in 2011 by Tan Hooi Ling and Anthony Tan, the company was initially called Grab Taxi before it rebranded to Grab. Over the past five years, the company has raised five rounds of VC funding led by investors such as Vertex Ventures, GGV Capital, Tiger Global and SoftBank. Grab had previously raised a Series E round of $350 million in August 2015.

Today, Grab offers private car, motorbike, taxi, and carpooling services across six countries and 31 cities in Southeast Asia. It also claims to clock a total of 1.5 million daily bookings across all the markets.

Going forward, Grab aims to leverage its $1 billion capital position to continue expanding its transportation services in Southeast Asia, which is home to 620 million people, and a rising population of middle class and mobile users, especially in Indonesia. In addition, Grab also aims to significantly invest in mobile payments capabilities, in regions with low banking and credit card penetration and limited cashless payment options. Tan, Group CEO and Co-Founder, said:

This latest funding, the largest in the history of Southeast Asia consumer technology, strengthens our ability to pursue long-term goals as we continue to build on our market leadership. We are particularly excited about the growth opportunity in Indonesia, where we see an almost $15 billion market for ride-hailing services alone, as well as the potential to extend GrabPay’s platform regionally. I am confident in our technology, data science and machine learning platforms, which have continued to scale to support our bold ambitions in the region.

Given the market opportunity in Southeast Asia, Grab will continue to invest in:

Growing Indonesia: With 250 million people, over a third of the region’s population based in Indonesia, Grab aims to further expand the diversity, density and efficiency of its services in Jakarta, a congested city with 30 million people, where it believes that their services such as GrabCar, GrabBike, GrabTaxi and GrabFood are relevant and transformative. The company notes, "In Indonesia, our GrabCar and GrabBike services grew 250x in one year as of the end of 1H2016, and continue to grow exponentially. In addition, Grab is excited to bring its localised services to more major cities across Indonesia."

Developing GrabPay: With an estimated 43 percent of the population unbanked, Grab believes that Southeast Asia will remain a largely cash-based transaction economy with room to develop better mobile payment options. With GrabPay, it aims to provide a seamless mobile payment solution for users and has partnered with Mandiri, Indonesia’s second largest local bank, to offer a mobile wallet service. Grab also recently partnered with Citi to enable cardholders to use Citibank points to pay for Grab rides.

Driving efficiency with technology, machine learning (ML) and data science capabilities: Grab aims to continue investing in data science and ML capabilities to support Grab’s growth and enable services like predictive demand and driver and user targeting. Grab also aims to continue to hire international talent in its R&D centres in Singapore, Beijing and Seattle, develop features like Flash that pools cars and taxis, improve back-end routing capabilities, and build its proprietary Point-of-Interest (POI) mapping database.

Tan added, “Grab has grown tremendously over the past year. This round of funding shows the confidence and optimism investors have in Grab’s market leadership and long-term potential in Southeast Asia. We are blessed to have great partners like SoftBank, many of whom have unparalleled track records of investing in leading internet businesses in emerging markets, and seeing those companies become the core of internet ecosystems in each market.”

Since its Series E funding in August 2015, Grab claims that it has nearly quadrupled its total number of drivers and active users, as well as rides volume. Today, the Grab app has been downloaded onto over 21 million mobile devices and users have access to over 400,000 drivers to meet their transportation needs. Masayoshi Son, Chairman and CEO of SoftBank Group Corp, said:

Grab is the clear winner in the Southeast Asia mobile space. Anthony and his team have made impressive progress in building out Southeast Asia’s largest mobile internet company. We are committed to supporting local champions like Grab that have a vision for a next-generation internet ecosystem, and look forward to participating in their long-term success.

Global scenario

The taxi aggregator space has seen a lot of activity over the past year. In December 2015, Didi along with Ola, Grab and Lyft had formed a global alliance to provide 'seamless ridesharing coverage for travelers in India, China, SE Asia and the US' to take on Uber.

The Uber versus Didi rivalry reached its peak in June 2016, when Uber announced a massive $3.5 billion funding round led by Saudi Arabia’s sovereign wealth fund. Barely two weeks later Didi announced that it was raising a $7 billion round, which included 4.5 billion in funds from multiple investors (including $1 billion in funding from Apple, $600 million from China Life Insurance) and a $2.5-billion debt package from China Merchants Bank Co.

With Uber struggling to make headway in Didi's hometurf - China - the company decided to withdraw from China by selling the Chinese subsidiary of its business to Didi Chuxing, while Didi reciprocated by investing $1 billion in Uber.

Earlier reports in August 2016 had suggested that Didi and SoftBank were in the process of leading a $600 million round in Grab, but as noted earlier the funding round was oversubscribed by $150 million.

Related read: Uber-Didi merger: Ola must be bothered, but guess who is excited about the development?