3 months short of 2017, Delhi-NCR races ahead of Bengaluru with $1.12 billion in startup funding

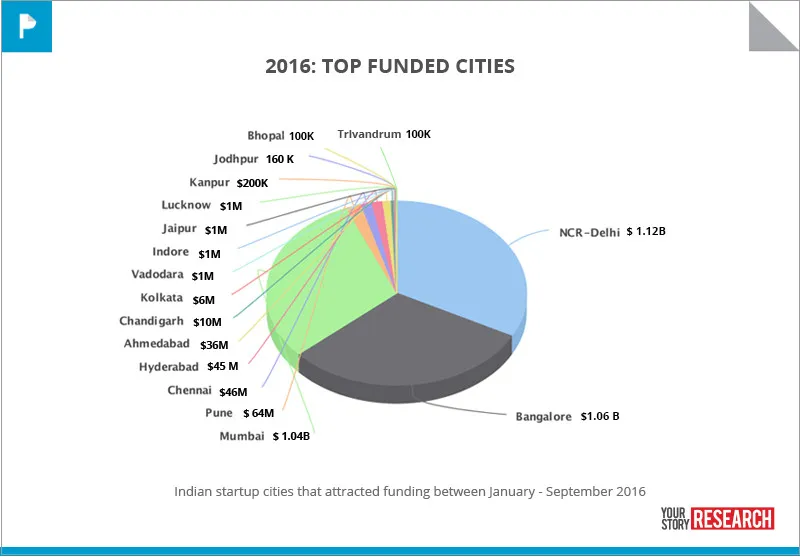

The National Capital Region (NCR – New Delhi, Noida, Gurgaon, and adjacent areas) has edged out Bengaluru in terms of startup funding – deals and total amount raised – for the nine months ended September 2016. In terms of deal value, NCR attracted $1.12 billion in funding, followed by $1.06 billion in Bengaluru and $1.04 billion in Mumbai. The three cities together grabbed the lion’s share (92 percent) of all startup funding raised in the country.

Among the four unicorns based out of NCR (Snapdeal, Zomato, ShopClues, and Paytm), three scooped up significant amounts this year in advanced-stage funding. Shopclues raised $150 million January, marking its entry into the unicorn club with a valuation of $1.1 billion. Snapdeal followed with a $200 million round in February, while Paytm raised $60 million in August at a $5 billion valuation.

Delhi-NCR also leads the number of deals so far this year – 278, with Bengaluru a close second at 223 in Bengaluru. Mumbai came in third with 149 deals. While the Silicon Valley of India, Bengaluru is well-known to nurture most number of startups having ranked in the in the top 20 cities in the world in the startup ecosystem.

In Bengaluru, companies that raised funding include foodtech player Zzungry (seed funding from Silicon Valley-based investors), fitness startup BYG – BookYourGame, which raised an undisclosed amount via Let’s Venture, while Zenify snapped up $1 million from HNIs in a pre-series A round. Native mobile apps and products creator Hashtag got an equal amount in angel funding.

The Mumbai startup ecosystem races ahead

The city of dreams, Mumbai is also the wealthiest city in the country with a GDP of $278 billion and a per capita income (PPP) of $7,050 (as of 2015). Unlike Bengaluru (GDP of $85 billion as of 2014 and PPP of $5,051) where startup ecosystem has been booming, Mumbai made its presence felt as a startup hub only four years ago.

In an earlier interaction with YourStory, Angel investor and Co-founder of CoCubes, Harpreet Singh Grover said, “Starting up was unheard of in Mumbai till SMS GupShup happened in 2008. It evolved only in the last three-four years, with more funding, and the creation of Housing and Ola.”

The financial capital of India, Mumbai has also evolved in terms of producing a handful of fintech startups with the likes of Mswipe Technologies, Transerv, Epaylater, Neogrowth, and CreditVidya. According to a recent report by KPMG and Nasscom, the Indian fintech market will double in size in the next four years to $2.4 billion from $1.2 billion.

Mumbai-based LoanTap raised $3 million in a Series-A round this year in August. Others that raised angel funding include Truckola, a technology-focused cargo transport company (Rs 4 crore) and White Shadow Technology (Rs 2.5 crore).

Other cities are yet to catch up with the big three

The startup ecosystem in other tier II and III cities is yet to mature. Factors like limited infrastructure, dearth of talent, lack of awareness of competition and a smaller client base pose several challenges. TC Meenakshisundaram (TCM), Founder and MD, IDG Ventures India, told YourStory, “The strong angel network, mentoring startups in those areas, and supportive role of incubators and accelerators are the need of the hour to elevate the ecosystem.”

While 76.4 percent of startups that have raised funding in 2016 YTD are from Bengaluru, Mumbai and the NCR-Delhi region, Pune attracted $65 million across 39 deals, Chennai $46.5 million over 23 deals, Hyderabad $46 million funds from 29 deals, Ahmedabad $36 million across 17 deals, and Chandigarh $10 million from 4 deals. Smaller amounts were raised in Kolkata which mopped up $6.9 million off 4 deals, Vadodara $1.4 million from 4 deals, Indore $1.3 million from 6 deals, and Jaipur raised $1.1 million from as many as 13 deals.