Thanks Honorable Prime Minister for infusing a seismic shift in adoption of digital payments in India

On November 8th, Prime Minister Narendra Modi announced that, effective from 12 am on the 9th, all currency of Rs 500 and Rs 1,000 denominations would no longer be considered as legal tender. The will instead be circulating new Rs 500 and Rs 2000 notes. The PM made an impassioned appeal to citizens to accept the hardship ahead and support the move for the good of the nation.

Points to Note:

- Rs 500/Rs 1,000 notes will no longer be legal tender

- Old notes need to be exchanged for legal, valid denominations

- New notes are in limited circulation

Deconstructing the Impact:

India is a highly cash-intensive economy. The value of notes and coins in circulation as a percentage of GDP is 12.04%.

- Total currency in circulation is .

- Total bank notes in circulation valued to $240 billion, of which nearly 86 percent ($210 billion) was in Rs 500 and Rs 1,000 notes.

The RBI has strongly encouraged citizens to adopt electronic payments to manage expenses (FAQs here).

The PM sighted two major reasons for the move:

- Nullifying black money hoarded in cash.

- Curbing the funding of terrorism with fake notes.

However, analysts and economists have pointed out that this is a well-planned ‘Surgical Strike on Cash’, which could lead to a significant evolution of India to a less cash-dependent country.

Let’s examine the ‘why’ a less cash dependency for India is beneficial and why this time is absolutely right to go for the jugular and cause widespread change

From a study The Countries That Would Profit Most from a Cashless World

From The Countries That Would Profit Most from a Cashless World, two key takeaways help accentuate the necessity to disrupt status quo in India.

A) The cost of cash to consumers, based on average transit time and cash access costs is high

The Cost of Cash in India is a widely researched and debated subject. This report by MasterCard’s Center for Growth, offers detailed insights into costs, risks, habits, and how households access cash.

Some mind boggling facts to ponder over

- Cash is expensive, literally, to print and use

Data from a Right to Information answer by the RBI in 2012 shows it costs

- Rs 50 to print each Rs 500 denomination note

- Rs 17 to print a Rs 1,000 note.

The demonetization move (removing the old notes and replacing them with the new ₹500 and ₹2,000 notes) will incur the exchequer a total of at least ₹12,000 crore. This figure is likely to go up since additional security measures, which the new notes are set to have, will only add to the cost of printing.

- The RBI and commercial banks face a total of ₹ 21,000 crores in currency operation costs annually

- From, the Cost of Cash in India Report, Households pay differently for access to cash according to their place in society, determined by income, employment, age, and place of residence. They also hold widely differing views on the risks of cash and strategies for risk management.

For example - the residents of Delhi together spend 6 million hours and ₹9.1 crores (US $1.5 million) to obtain cash. Hyderabad, which is smaller, spends 1.7 million hours and ₹3.2 crores (US $0.5 million) to do the same, which corresponds to fees and transport costs about twice as high as Delhi on a per capita basis

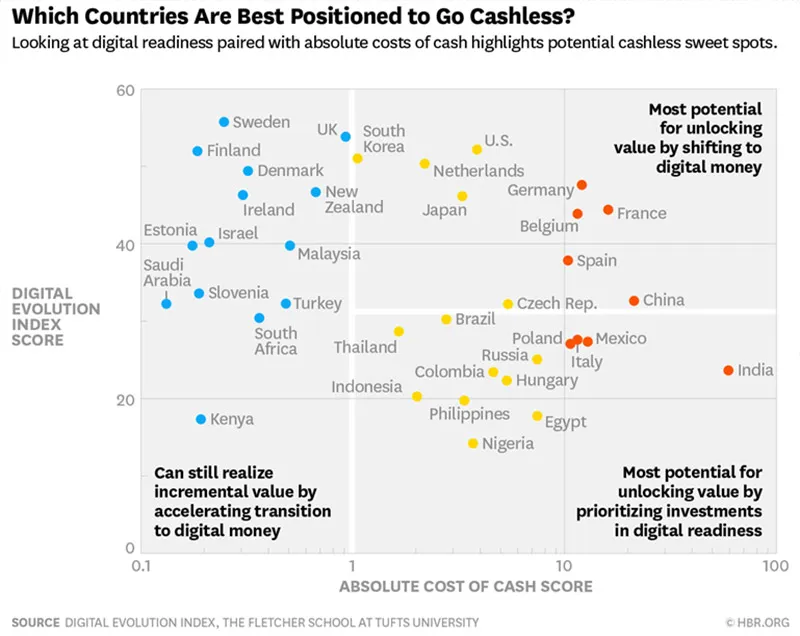

B) India falls into a group of countries that needs to improve their level of digital readiness and become more “digitally inclusive” before they can realize value from going cashless. Hence, it has the potential but just not yet¸ while U.S., Netherlands, Japan, Germany, France, Belgium, Spain, Czech Republic, China and Brazil have the greatest potential for unlocking value by policy and innovation led migration to a cashless society.

From, the Cost of Cash in India Report, the current outlook on Digital Inclusion is

Most Indians currently lack the means to use non-cash payments, even if they want to.

The growth in value of ATM transactions has far outpaced the growth in the value of card payment transactions.

Despite its prowess in the telecommunications field, India has been left behind by its peers in mobile payments.

This highlights tremendous opportunity areas for Digital Payments Players to work with others to solve known challenges in Digital Readiness and ride on the momentum offered by the Demonetization announcement by the Government of India

Key Drivers of the Tectonic shift in Digital Payments

- Shift of COD (Cash on Delivery) to Digital – The Largest e-commerce merchants (Flipkart, Amazon) stopped accepting COD orders immediately after the PMs Announcement forcing customers to pay electronically for future transactions. Indian ETailers have been pioneers in promoting COD to tide past trust concerns of consumers and establish themselves in a largely cash intensive India. However, the forced trial due to policy not promotional discounts will lead to interesting consumer behavior insights and support merchants to devise consumer experiences to make the electronic payments habit stick in the longer term.

- Activation of Debit at POS & Debit Use electronically: Activation of Debit cards in India is a low 10% , for a country with over 660M Debit Cards, there is a big opportunity left untapped because while enabled with a financial instrument to purchase offline/online, majority remain deprived of its direct benefits thereof. By significantly impacting activation rates as short supply of cash forces customers to withdraw using ATMs (not necessarily their banks) and also use it for everyday purchases. Customers have been forced into learning a new way (for them) to pay with benefits that extend far beyond the physical world and can be expected to benefit significantly from digital payments. Leveraging mobile savvy customers to use mobile payments sounds easier than it is and globally there are case studies of the best user experience backed by savvy players has not lead to major uptake. Hence, this must be a priority if a real dent has to be made.

- Merchant Acceptance will grow to encompass low cost solutions: Food and entertainment, Organized retail are top use cases for payments at POS. however, there is a large unaddressed opportunity associated with everyday use cases like travel & transport, recharges, movie ticketing, quick service restaurants that are best suited for mobile payments at POS. High costs prohibit large scale adoption of contactless NFC terminals, apart from KYC and acquiring norms, however, this means the field is wide open for low cost acceptance solutions that are low (or zero) in cost, require minimal KYC and offer an easy breezy user experience to allow quick low value payments. Definitely one segment to keep a hawks eye on and analyze how a consumer behavior shift leads to an increased demand for paying by plastic or electronically and effectively moves merchants to a better customer payment solution

- Accelerated entry of Non-Traditional Payment Players: India is the place to be for businesses all over the world. Let it be any economic indicator: GDP, Investment by PE’s, growth of Startups etc all remarkably only underline this fact further. This has made global digital giants take notice and plan their entry to India. It’s well known that our regulatory environment is tough hence a planned market entry takes time and diligent planning. It’s fair to assume that every single interested and serious digital giant must have fast tracked their roadmap for an India launch to take advantage of the Demonetization move and try to land grab with all means available

In conclusion, while great barriers to digital payments adoption will exist (habituated use of cash, lack of financial literacy associated with using payment instruments such as plastic debit/credit cards and mobile wallets, fragmented payment ecosystem with too many me too’s driving customer acquisition with deals not differentiated value proposition) the time is ripe for the players in Digital Payments to finally cease the opportunity towards a #DigitalIndia and make India a leading player and disruptor in this space.

I look forward to hearing from you and welcome your feedback. Do not hesitate to leave a comment here or tweet to me on twitter @jasuja.

Thank you for reading my post. Hope you enjoyed it. If you did, please remember to share it on LinkedIn/ Facebook/Twitter/or leave a comment. It motivates me to continue writing for more stories like this one and yes it helps people find this post too. You can “Follow” me here for my latest posts on topics I enjoy writing about. Thanks!

(This article expresses author's personal views, and not those of any of her employers — past, present or future.)

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)