YES FINTECH

View Brand PublisherYES BANK to help Fintech startups create million dollar businesses through its focused Business Accelerator programme

E-wallets, M-wallets and other online payment solutions are redefining how citizens and businesses in India are managing routine financial transactions. This, despite the fact that until two years ago, 233 million Indians were unbanked.

Industry experts and observers believe that India’s financial ecosystem is on the cusp of sweeping transformation after decades of being wary and cautious about innovations for security and regulatory reasons. Several key factors and their congenial interplay have fuelled this transformation. The key growth drivers include rising mobile and internet penetration, a new generation of startups that are capitalising on technology and innovation, an increased push for cashless transaction by the government, and greater collaboration between government, industry bodies and large and small businesses.

According to a 2016 KPMG and NASSCOM report, the Indian fintech software market is forecast to touch $2.4 billion by 2020 from the current $1.2 billion. The report also states that the transaction value for the Indian fintech sector is estimated to be approximately $33 billion in 2016 and is forecast to reach $73 billion in 2020 growing at a five-year CAGR of 22 per cent. Yet another industry study supports this prediction. According to another study, commissioned by internet giant Google and Boston Consultancy Group (BCG), it is predicted that Indians will use digital instruments to make payments worth $500 billion by 2020, contributing to 15% of the country's gross domestic product (GDP). Additionally, payments through digital channels will accelerate in the next four years, resulting in non-cash transactions overtaking cash transactions by 2023.

Despite these encouraging indicators, the Fintech landscape has challenges that needs to be dealt with. When it comes to the scale and maturity of the market, fintech players are way behind the global counterparts. There are gaps when it comes to regulatory understanding, industry collaborations, and support.

In what is considered among the ‘hottest sectors’ in the country today, there are thousands of nimble organisations and startups leading innovation in the Fintech sector. And YES BANK is one of India’s leading banks when it comes to being at the forefront of collaborating with players in the Fintech ecosystem to address gaps in the sector and catalyse disruptive innovation.

By partnering and supporting more than 100 disruptive Fintech startups in India, YES BANK has gone on to implement a number of novel digitised banking solutions to address the needs of customers across the spectrum right from Corporate Banking to Retail Customers including solutions addressing financial inclusion.

YES BANK believes this strategy which they like to call A.R.T – Alliances, Relationships and Technology creates a win-win. Because, on one hand while Fintech startups and organisations are the ones who are leading innovation in the sector, YES BANK has its own strengths, platforms, compliance, and governance and above all a large and robust customer base to offer. The combination of the two helps to deliver unique, innovative banking, and financial solutions.

Accentuating this approach further, YES BANK has established a Fintech-focused Business Accelerator programme - YES FINTECH, powered by T-Hub and ANTHILL and Knowledge partner is LetsTalkPayments.

The programme is creating a platform for the bank and Fintech startups to co-create innovative solutions and together take the solution to the bank’s vast retail and corporate customer database.

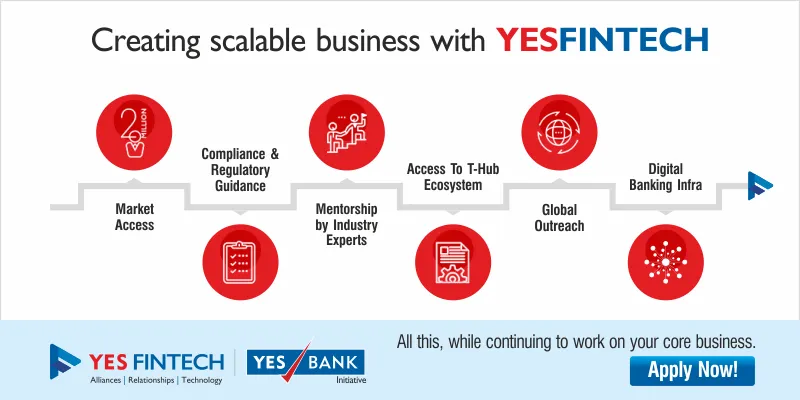

What makes this programme unique is its clear focus on building solutions relevant to use-cases identified by YES BANK, providing Fintech startups access to YES BANK’s network of 2 million + retail customers, 10,000 SMEs and 5,000 corporate customer base and more importantly no upfront equity commitment being sought from startups.

If you are a technology-focused startup (India or globally based) innovating in payments, lending, trade finance and Forex solutions, wealth management, reg-tech, customer value added services and other key areas of the financial services industry, this industry focused accelerator programme is for you.

Apply for the YES BANK FINTECH accelerator programme today.

3 reasons why you should apply for the YES BANK FINTECH Accelerator

Market access

In addition to a testing environment, YES Fintech gives each of the Fintech startups that are part of the cohort, access to the Banks’ digital infrastructure through APIs and BIN sponsorship as well as access to YES BANK customer network

This opens doors to an enabling ecosystem for sharing and exchange of ideas. This access would not just be limited to the retails clients of YES BANK but to SME as well as corporate clients.

Industry partnerships that make this programme score on impact and value

YES FINTECH and T-Hub, India’s fastest growing start-up engine catalysing innovation , have embarked on a strategic relationship to create high-value, high-impact programmes in the fintech space.. Startups that are part of the cohort will have access to the T-Hub ecosystem of incubators, innovation labs, as well as industry guidance. More importantly, T-Hub has the potential to enable access to government bodies as well as academia.

Joining the two organisations is Anthill and LetsTalkPayments. Anthill brings in its ‘speed scaling interventions’ that is sure to help startups scale fast. It will also open up its network amongst the right funds and family offices globally for the start-ups to seek funds and funding guidance. And, as knowledge partner, LetsTalkPayments will bring in global Fintech market network expertise, as well as Fintech experts as mentors to the programme though its MEDICI platform.

A well-designed programme curriculum that enables startups achieve scale and sustainability

As a business accelerator, YES FINTECH’s primary objective is to extend the bank’s A.R.T philosophy and provide an enabling ecosystem to Fintech startups and organisations, co-create innovative solutions, and take the solution to the bank’s retail and corporate customers.

The 15-week programme comprises four phases with three weeks of onsite intervention and 12 weeks’ offsite interventions, with each stage focussing on creating a market-ready product and a sustainable business model. The key focus areas of the programme will be: Payments, Lending, Reg-Tech, Trade Finance, Forex & Capital Markets, Customer Value Added Services, Wealth Management and Core banking solutions.

Through a tailored curriculum, expert mentors, a packed events calendar, and best-in-class facilities, the accelerator intends to help entrepreneurs turn their products into scalable and sustainable multi-million dollar businesses. Throughout the programme, startups can continue working on their core business.

Unique benefits for startups

In addition to the usual benefits, an accelerator programme provides like industry connects, co-working spaces, startups that are part of YES FINTECH stand to gain:

Compliance and regulatory guidance: In addition to patent filing guidance, the programme will also help startups imbibe the key compliance and regulatory aspects, as well as provide support in all related areas.

Global outreach: Through YES BANK’s partners, startups will have access to a comprehensive global Fintech network and direct guidance from angels, VCs, and financial investors.

Showcase and visibility: Through the bank’s national and international media and knowledge partners, which includes Carnegie Mellon University and global Fintech festivals, startups will get an opportunity to showcase their products around the world.

An opportunity to pivot solutions: With access to real customers across the corporate, SME and retail banking spectrum, the programme will not only give startups a sandbox testing opportunity, but also the opportunity to validate and alter the products and business models.

Win clients: YES BANK will co-curate the startups’ products and also help them bag contracts post the completion of the accelerator programme.

Also, it is interesting to note that the programme does not seek any equity commitment from startups that are part of the cohort, but will give them access to necessary funding through programme partners such as Anthill Ventures.

Get ready to grab this opportunity! Applications for the YES BANK FINTECH accelerator programme are open from 9 January 2017. Learn more about how you can apply for the programme here.