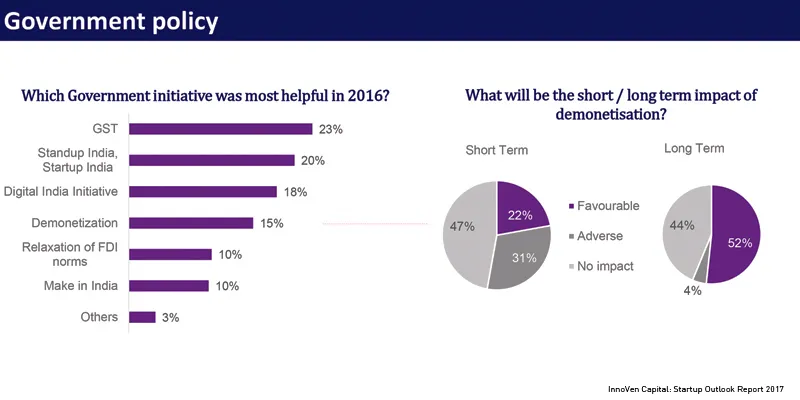

Only 22 percent of startups saw demonetisation as a positive impact in the short run

On Monday, venture debt firm InnoVen Capital released their India Startup Outlook Report 2017, highlighting the perspectives of founders and CXOs from 170 different startups, including both bootstrapped as well as funded ventures.

Ajay Hattangdi, Group COO and CEO India, believes that the startup outlook report is part of InnoVen’s continued effort to understand and communicate the nature of the Indian entrepreneurship ecosystem. He adds,

This is more of a touchpoint with founders to understand the mood and outlook of different companies in the ecosystem, while understanding the impact of the recent policy decisions made by the government.

Quickly speaking on the respondent demographic:

Revenues: The largest set of respondents, approximately 57 percent, saw early revenues of more than $1 million. While 29 percent of the respondents had just an idea or proof of concept, 5 percent had more than $10 million in annual revenues.

Moreover, 49 percent of the interviewed startup were bootstrapped, while 14 percent were Series A and B funded startups.

Founding year: While 36 percent of the interviewed startups started in 2016, 24 percent were founded in 2015. Only 23 percent of the startups had started in or before 2013.

The findings

With findings spread across aspects like fundraising, profitability, challenges and policy, the following are the interesting trends highlighted by the report:

1. Fundraising

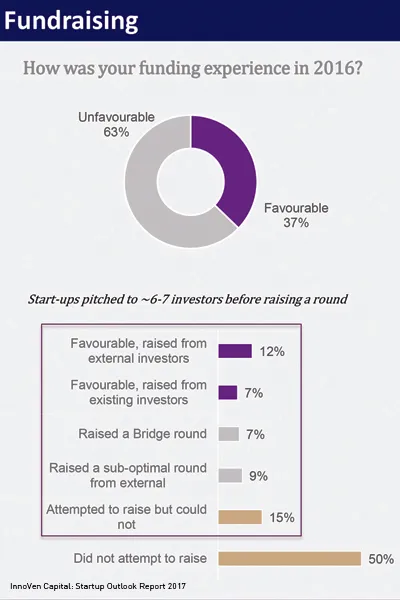

This could be since a good chunk (36 percent) of the respondents had just started in 2016.

- Startups pitched to at least six to seven investors before raising a round, the report claimed.

- Further, the report claims that 94 of the respondents were looking to raise total funding to the tune of $800 million in the coming year.

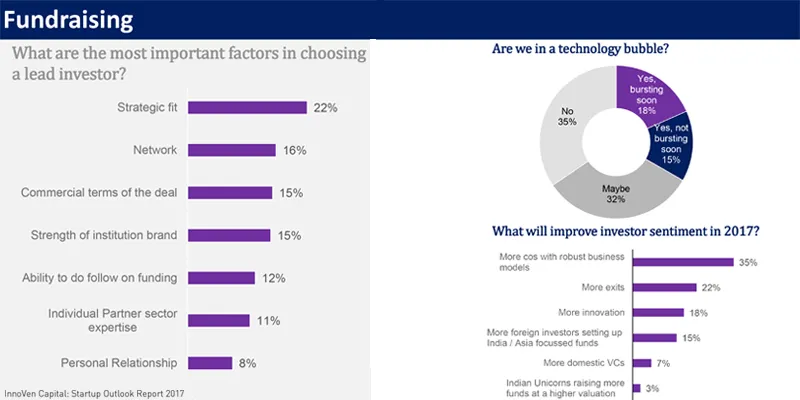

Also, for the entrepreneurs, strategic fit, active networks, commercial terms of the deal and strength of the brand (from where the money is raised) were key points in choosing a lead investor.

What is surprising is that 50 percent of the respondents agreed with or were neutral on the topic of them possibly living in a technology bubble about to burst.

But what does this technology bubble really mean? Ajay explains,

“The thinking might be that there are so many investments going only to the technology sector. Therefore, the sentiment says that there might be an attempt to gauge inside the bias.”

Thirty five percent of the startups believed that robust business models were key to improving investor sentiment. On asking Ajay whether this was an indicator of a restructuring in funding dynamics, he replies,

Well, the funding will be available for good companies. But we see a movement away from companies who haven’t been able to provide strong metrics of growth. Therefore, this year, we might see some conversations happening around consolidations. However, it will only see some modest growth, where investors will abandon some companies while trying to consolidate others across portfolios.

But Ajay believes that this is a good time for investors to invest at their preferred valuations owing to the down rounds. He also believes that the quality of startups has improved considerably.

2. Profitability

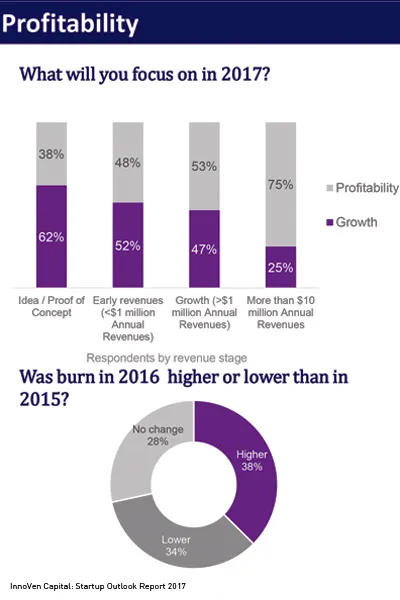

Fairly balanced, the majority of respondents, according to the report, stated growth as their focus area in 2017. VC-backed companies, however, rated achieving profitability in the next one to two years as the key objective.

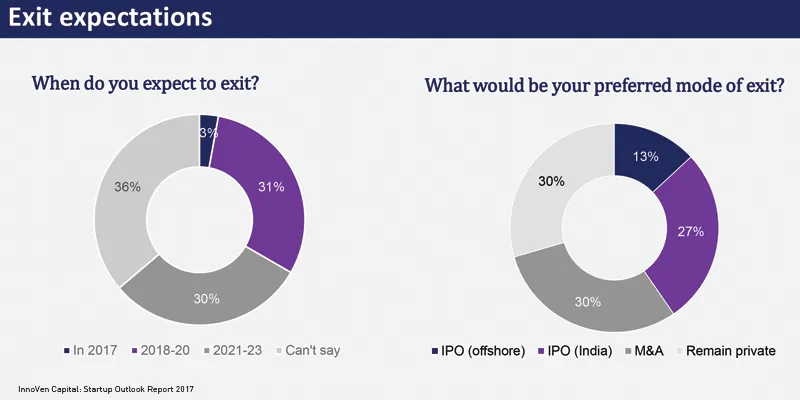

3. Exit Expectations

Seventy percent of respondents were open to an exit, with approximately 60 percent rating an IPO (offshore or in India) as the most preferred exit route.

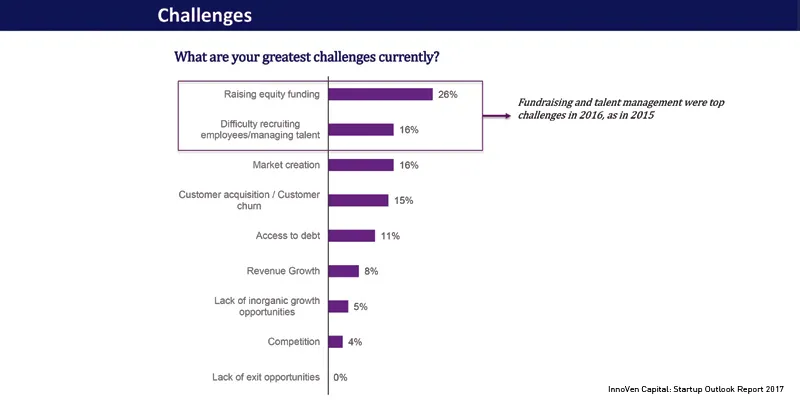

4. Challenges

Overall, raising equity, managing talent and market creation were voted the top business challenges going into 2017.

Looking at sectors, e-commerce and healthcare startups rated fundraising and revenue growth as major challenges, while enterprise players rated customer acquisition as such and Artifical Intelligence startups rated talent management as their major challenge.

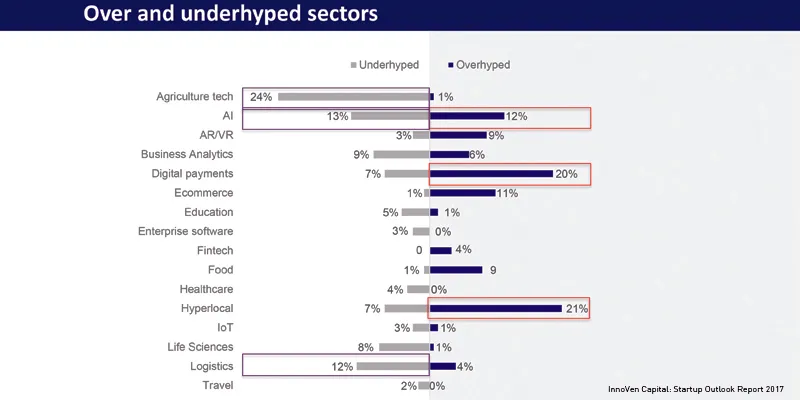

5. Over-hyped and Under-hyped sectors

On one end, while agritech, Artificial Intelligence and logistics were voted as the most under-hyped sectors, hyperlocal and digital payments were marked as the over-hyped ones, along with being the hot sectors in 2017.

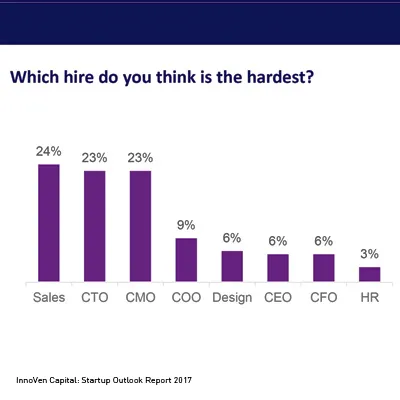

6. Talent and Hiring

According to the report, 42 percent of all respondents had women in leadership positions at their startups, up from 33 percent last year.

Chief Technology Officers and Sales Heads, meanwhile, were rated to be the toughest hires.

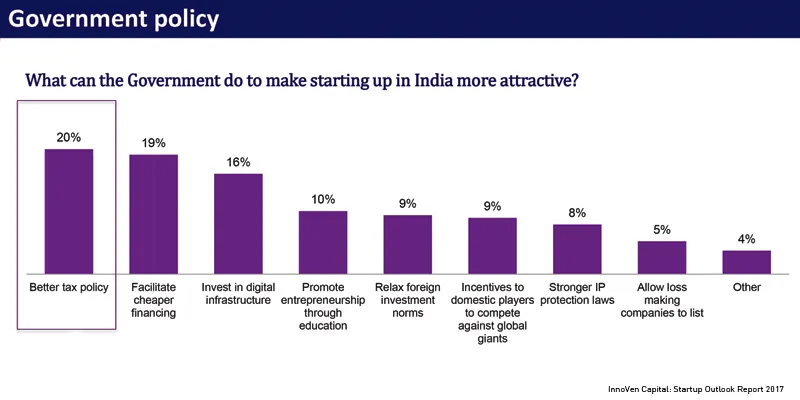

7. Government Policy

While the Goods and Services Tax was rated the most helpful government initiative by the retail and logistics sectors, media and content companies liked the government’s digitisation move.

“There has been a good positive validation from startups on the government’s initiatives. However, the startups feel that there are still things that can be done better; for example, the betterment of digital infrastructure and better taxation.”

Further, on the debate of protectionism raised by bigger players like Flipkart and Ola in the past, only 9 percent of respondents felt better incentives were needed for domestic players to compete against global majors, according to the report.

Also, asking whether the recent demonetisation affected the startup business in a bigger way, Ajay said,

“The impact of demonetisation is interesting. It has affected some and played well for others. There have been some positive impacts on startups in payments, food delivery and hyperlocal. We have seen some negative impact in terms of e-commerce for high value transactions, specialty pharma, as well as in the B2C space mobile applications. So a complete mixed bag in general.”

However, the report states that 22 percent of the startups felt that demonetisation was favourable in the short-term play, while 52 percent of the startups believe that the measure would have a long-term impact on things.