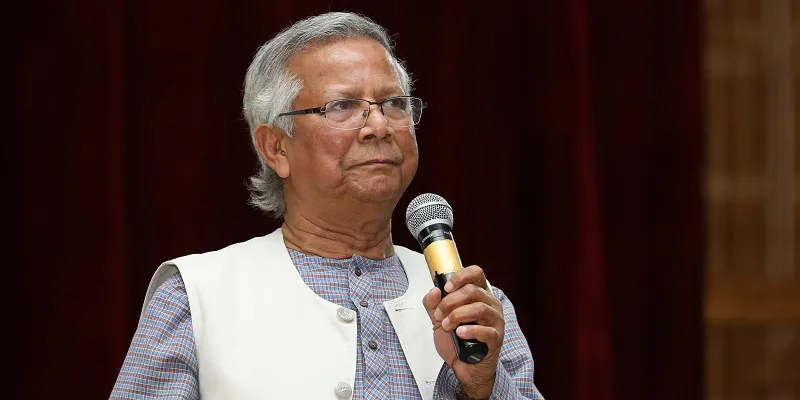

‘All human beings are entrepreneurs’, says the Nobel laureate who helped 2 lakh beggars run their own businesses

Winner of the 2006 Nobel Peace Prize, Prof Muhammad Yunus is well known for his groundbreaking work in alleviating a sizeable population of Bangladesh from abject poverty. Started in 1983, the Grameen Bank today has 90 lakh borrowers, 97 percent of which are women. The initiative started by Prof Yunus has also helped over 2 lakh beggars through microcredit and helped them start their own small scale business.

The NS Raghavan Centre for Entrepreneurial Learning (NSRCEL) at IIM Bangalore (IIMB) recently hosted a talk by Prof Yunus under its initiative ‘NSRCEL Social’. At the event, the social entrepreneur, banker, economist, and civil society leader shared his experience of building the Grameen Bank and how microcredit and microfinance have the potential of uplifting masses from the vicious cycle of poverty and hunger.

"It all started in 1971, when I was teaching economics at a university in the US. The Bangladesh liberation war was raging and my friends and I campaigned to raise US support for our country's liberation."

Coming back to Bangladesh

After the war was over, the young and idealist professor came back to his country and joined the Chittagong University as head of the Economics department. It was, however, the 1974 famine that changed his perspective forever. “Here you are teaching economic theories to students while people are dying in villages of hunger. Soon I realised that economics is a useless subject.” Nearly, 1.5 million people died in the famine.

He visited the famine-hit village of Jobra tried helping one person a day. The problem, however, was too large and needed to be solved at the fundamental level. "There was no food. Our farmers grew one crop a year and struggled with access to water," Prof Yunus recalls.

Soon Prof Yunus created a committee to provide water, seeds, fertilisers, and other necessary facilities to the farmers. The committee charged one-third share of the harvest. Earlier, the harvest was divided equally among the owner of the land and the share cropper, with the cropper paying for all the regular expenses.

"How about loan sharking? Money lenders give loans to farmers only to snatch everything back in return, a problem prevalent in the developing as well as the developed world," says Prof Yunus. "I had some savings from US, which I started lending to the farmers I knew, but that was not enough," he adds.

Prof Yunus came back and visited the bank in his University's campus seeking help and support. The bankers, however, refused to loan money to farmers as they were not 'credit worthy'. "'Banks do not give money to poor people', they said" Prof Yunus says with hint of irony.

After three months of constant perusal, the bank agreed to give a loan to the farmers with Prof Yunus as the guarantor. "The bank wanted to get rid of us, and gave us the loan, assuming we'll never come back, but we did. They thought our efforts will collapse and we'll never pay back. This lack of sincerity agitated me," he recalls.

Transforming women and beggars into entrepreneurs

"Fed up of the way banking works, we started our own bank and started providing credit and banking services to the poor living in Jobra and other nearby villages. We expanded to more districts, and were declared an official bank by the Bangladeshi government in 1983. Even today, we are the only bank in the world with no lawyers and no presence in cities."

Currently, Grameen Bank has nine million borrowers. Ninety-seven percent of these are women. "We wanted to enforce that at least 50 percent of our borrowers were women, since women handle money in a much better way. Soon we realised to focus only on women. My female students who once helped reach out to rural women are today senior staff members in the bank," Prof Yunus adds.

Grameen Bank does everything standard banks don't do. It focuses on lending to rural poor women and helps them become entrepreneurs. Prof Yunus adds, "We don't have lawyers. Our bank believes in going to the people and working with them."

Grameen Bank soon started focusing on beggars who have been living in abject poverty for generations. The beggars were given small loans to buy bags, merchandise, along with other necessary materials. Prof Yunus says, "We asked them to carry some merchandise – toys, cookies, etc., and asked them to sell these instead. At present, we have reached out to over two lakh beggars, many of whom have quit begging altogether." He adds,

"All human beings are entrepreneurs. We are not born to work for somebody else. From problem solvers, we have become order takers. That needs to change."

![[Startup Bharat] How this Jaipur-based skincare brand aims to lead the market by focusing on ‘transparency in beauty’](https://images.yourstory.com/cs/2/d72b5ef09db411ebb4167b901dac470c/minimalist-1632224585710.png?mode=crop&crop=faces&ar=1%3A1&format=auto&w=1920&q=75)