Losses, leadership exits and now Shopo shutdown – is Snapdeal about to snap?

Can you remember the last time you heard some positive news about Snapdeal? Well, it might be easier to recollect the setbacks suffered by the online marketplace over the past one year.

Around May 2016, Snapdeal’s high-profile hire from Silicon Valley, Anand Chandrasekharan, Chief Product Officer, quit barely a year after joining the company. Two months later, Snapdeal lost fashion portal Jabong, which it was in final talks with for acquisition, to Flipkart-owned Myntra, and then GoJavas – the logistics firm it has a stake in – to Pigeon Express. Come August, and Snapdeal shut down its premium fashion platform Exclusively.in within 18 months of acquiring it.

Despite spending Rs 200 crore on rebranding in September 2016, Snapdeal was not able to beat its arch rivals Flipkart and Amazon in the festive season sale in October. And while co-founder Kunal Bahl keeps talking about profitability being close at hand, losses have been mounting for the online marketplace – they have more than doubled from the previous year to Rs 2,960 crore for the financial year ended March 2016, as per documents filed with the Registrar of Companies.

Snapdeal’s much-celebrated omni-channel strategy which was announced in December 2015 never took off either. Vice President Badal Malick who headed it left Snapdeal in September 2016. Nothing was heard of their multi-lingual efforts which was launched along with the omni-channel strategy.

And now comes the news of the shutdown of Snapdeal's C2C marketplace Shopo. According to Bloomberg Quint, Shopo in an email to its sellers announced that the platform will close operations by February 10. Sandeep Komaravelly, who was senior vice-president at Shopo, left recently too.

Snapdeal’s blog post said: "The e-commerce market in India will continue its robust growth. However, we realise that it will take some more years for a broader ecosystem to develop around the C2C segment. It is tempting to go on, but it is often beneficial to pause, take stock and plan ahead for greater success. It is time for us to pause the Shopo journey for now."

Shopo: In memoriam

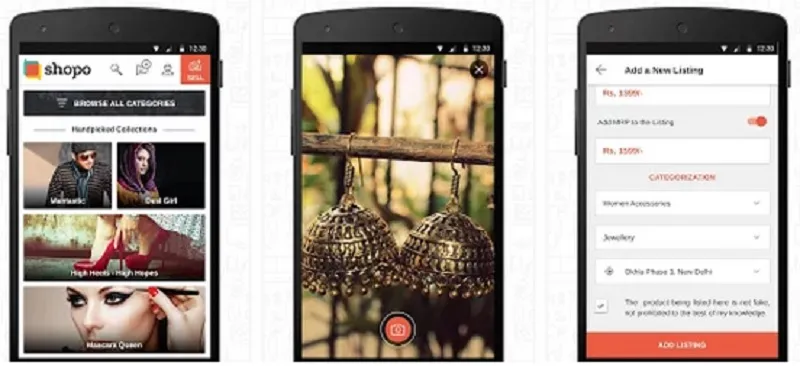

Snapdeal acquired Shopo, an online marketplace for designer handicraft products, in 2013. By July 2015, announcing an investment of $100 million over two years, they re-launched Shopo as a mobile-only marketplace where sellers and customers can chat.

Sandeep Komaravelly, Senior Vice President at Shopo, had told YourStory in an earlier interaction that out of all the sellers reaching out to Snapdeal, only 20 per cent was getting through. “We needed a platform to enhance their chances; Shopo was the answer,” Sandeep had said.

Shopo did not provide logistics, but gave references to sellers on the kind of courier partners they could use. Similarly, they assisted sellers with payment support by giving them the options of cash on delivery and online payment methods. They integrated FreeCharge to Shopo a few months ago to enable merchants and consumers to chat, shop and pay.

Having acquired one lakh sellers in the nine months since its inception, Shopo was targeting a 10x growth to integrate one million shops by March 2017, about four times the number of sellers with Snapdeal. When Shopo celebrated the first anniversary of its relaunch, it claimed to have 200, 000 sellers and five million listings.

Shopo controlled few processes unlike Snapdeal, and operational costs were thus lower. They had no ad sales although zero commission marketplaces usually monetise ads, services, and provide working capital loans. Shopo’s predecessor in China, Taobao – launched by Alibaba group in 2003 – succeeded as a zero commission marketplace by monetising through advertising.

Story of losses

According to a report in Livemint, Snapdeal’s losses more than doubled to Rs 3,316 crore in fiscal 2015-2016, while its revenue growth slowed sharply. [Snapdeal posted a 150 percent increase in losses from Rs 1,328 crore in the year to March 31, 2015. Revenue grew by 56 percent to Rs 1,457 crore from Rs 933 crore in the same period, according to documents filed with the RoC.]

Snapdeal’s biggest investor SoftBank has now written off around $475 million in the combined value of its shareholding in Snapdeal and taxi aggregator Ola. [Both have been the Japanese investor’s biggest investments in India.]

Although Kunal has claimed that Snapdeal is not looking for funds at the moment, media reports have said that the Jasper Infotech-owned company is looking for funding at a lower valuation due to severe fund crunch. A year ago, Snapdeal was valued at $6.5 billion when it raised $200 million from Canada's Ontario Teachers' Pension Plan, among others. A report in Business Standard said that Snapdeal was in talks with Softbank to raise fresh funds at a lower valuation of $3 to $4 billion.

It’s not just Snapdeal that is struggling, rival Flipkart is also looking for funds, facing top leadership changes, revenue losses, and exits. In fact, the total losses from Snapdeal, Flipkart, and Amazon together are to the tune of Rs 5,052 crore, thanks to cash burn with discounts and uncharged deliveries.

With a rival like Amazon – with deeper pockets and wider experience – e-commerce biggies in India will need to fight harder, and discounts will not suffice. While the Indian e-commerce market is estimated to be worth $28 billion by 2020, horizontal marketplaces are slowly shifting their focus from growth to profitability. If Snapdeal is not able to work along a decent pace of growth for itself, the next news piece on Snapdeal might be an uglier one.