Govt revises GST rates, 66 items to cost less now

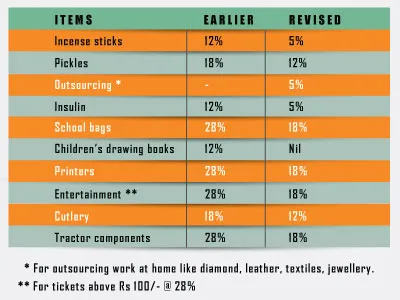

Among industries that petitioned against the proposed increase in slab rates, incense, insulin, school bags, notebooks, and movie tickets below Rs 100 have had their rates revised downwards, benefiting end users.

The Centre has revised downwards the rates of 66 items out of the 133 being considered at Sunday’s Goods and Services Tax Council meeting.

The prayers of the incense industry and diabetics seem to have been heard as well as the load of school kids been lightened with GST on school bags, notebooks, and drawing books having been reduced.

There is more on the plate as cutlery has been reduced from 18 to 12 percent and printers from 28 to 18 percent. With tractor components shifted to 18 percent from the previous 28, farmers have also been kept in mind, probably due to the latest agitation sweeping many states.

Pickles, cashew, and movie tickets below Rs 100 will also be taxed at a cheaper rate.

"The 133 representations received were considered at length and the committee has reduced the slab rate in 66 cases,” Finance Minister Arun Jaitley announced.

The minister said the reduction had been considered keeping two objectives in mind—to maintain equivalence with existing taxes and because of the changing nature of the economy and consumer preferences.

The All India Agarbatti Manufacturers Association (AIAMA) had reacted sharply as GST moved the daily prayer item—incense sticks—from zero to the 12 percent bracket. They had indicated that they would be happy to be in the five percent bracket as some states were already charging them at this sales tax rate.

AIAMA Vice President Arjun Ranga told YourStory,

We are extremely delighted and thankful to the Centre for understanding our industry. The GST Council went into great detail when they met us to understand our handicrafts industry and reasons for reducing the slab rate. Of course, they had done their research too. We gave a representation to Mr Jaitley when he was in Bengaluru and Mr Hasmukh Adhia who heads the GST Council too gave us a patient hearing just like Karnataka Agriculture Minister Krishna Byre Gowda who represented the state in this matter.

“It was a pleasure dealing with a government that takes the industry view seriously,” he added.

The tax on cashew has been cut from 12 to five percent while packaged foods—food and vegetable products such as pickles, chutneys, ketchup, and instant food mixes—earlier taxed at 18 percent, will now be taxed at 12 percent.

Among other goods, the Council took some child-friendly measures with school bags lowered from 28 to 18 percent, exercise books (notebooks) from 18 to 12 percent, and children’s drawing books from 12 percent to zero.

On Entertainment Tax, Jaitley said that following representations from the film industry, the GST Council has decided on a two-slab structure for cinema tickets. Those costing less than Rs 100 would be taxed at 18 percent, while those above will attract 28 percent tax.

In sectors like diamond, leather, textiles, jewellery, and printing where jobs are outsourced and done in homes, the GST rate has been reduced to just five percent.

The government plans to roll out GST from July 1. So far, 24 states and Union Territories have passed the State Goods and Services Tax (SGST) Act in their respective legislatures. Karnataka is among the seven states that are yet to pass the SGST law which has to be passed by September 15, 2017, failing which they will lose their taxation powers.

Karnataka CM Siddaramaiah, who also holds the state’s finance portfolio, introduced the bill in the ongoing legislature session and said: "It is true that those states that were collecting more taxes may face some issues, but the Centre has promised that if the collection is less than average, such states will be compensated.”

Only taxes on petrol, high-speed diesel, aviation turbine fuel, crude oil, and natural gas will be levied by states.