Amazon is upping its war chest to Rs 31,000 Cr to win the India battle

On Wednesday, it was reported that Amazon has invested close to Rs 2,900 crore into its Indian marketplace arm, Amazon Seller Services.

This is third such capital infusion in a year, with Amazon India receiving funding of Rs 1,680 crore earlier in June and Rs 1,620 in September.

According to the data by Registrar of Companies, Amazon Seller Services has also passed a resolution to increase the authorised share capital from Rs 16,000 crore to now Rs 31,000 crore (close to $4.7 billion).

But there are some obvious reasons behind Amazon move to up its ante?

- Funding the behemoths

The news comes at a time when Amazon’s Indian rival, Flipkart, has mopped up $4 billion from Softbank Vision fund along with the likes of Tencent, eBay, and Microsoft, earlier in August.

On the other hand is Paytm Mall, which has supposedly initiated discussions to raise Rs 3000-Rs 4000 crore. Setting its eye on the number three slot in the Indian e-commerce scene, Paytm Mall had raised $200 million from Alibaba and SAIF Partners.

This makes it even more pertinent for Amazon to up its ante and resources in the country.

- Flipkart seems to be trumping

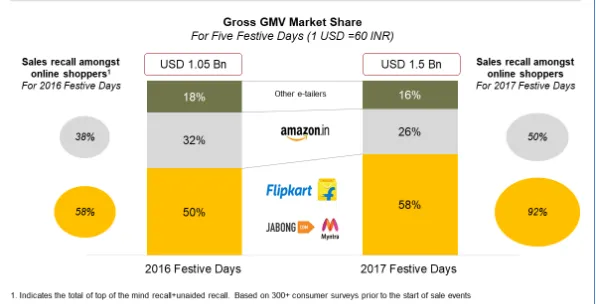

In the festive season sales concluded in September, Flipkart emerged a strong market leader with a market share of 58 percent versus Amazon’s 26 percent, according to research and advisory firm Red Seer Consulting.

Overall, online retail firms had sales of $1.5 billion.

In an article, YourStory stated that Flipkart had claimed doubling of its Gross Merchandise Value (GMV) during its five-day Big Billion Days (BBD) sale this year compared to the same sale last year. This would put the number at over $900 million.

Further, Amazon’s market share came down this festive season from 32 percent last year.

- E-commerce battle is now moving to grocery

The e-commerce battle now seems to be transcending to the grocery segment. In a recent interview with YourStory, Saurabh Srivastava, Director of Consumables and FMCG at Amazon India, says,

“If you want to transform a person’s shopping experience you need to look at where a customer spends the most time. The answer is FMCG and grocery. Customers interact and engage on a daily basis in this category. You don’t buy a mobile phone or a fridge on a daily basis.”

Flipkart CEO Kalyan Krishnamurthy told YourStory that the company is also planning to soon launch grocery.

However, Amazon seems to have a head start in the segment.

Earlier this year, Amazon got government approval to invest $500 million in food retail in India. The government had allowed 100 percent FDI in food retail in the country last year.

Paytm is also not far behind in the battle.

In July, it was reported that Paytm might team up with investor Alibaba to pick up a minority stake in online grocery retailer for about $200 million. This seems to be a reality. Just yesterday, the news came out that Chinese e-commerce company Alibaba has sought approval from the Competition Commission of India to acquire a stake in online grocery supplier BigBasket.

While the battle for being the Indian e-commerce king is on, Amazon is also not far behind in pushing its product line to India. Last month, Amazon announced three Alexa-enabled devices: Echo, Echo Plus, and Echo Dot, launched in India.

In September, Amazon had also inaugurated its fifth Fulfilment Centre in Telangana to widen its reach and also prepare for the upcoming festive season.