The future of finance, or a huge fraud? What the industry has to say about ICOs

Bitcoin finally did it! At the time of writing this, the world’s foremost cryptocurrency was trading at an unprecedented high of USD 10,664.67. Despite detractors and naysayers who question the value and future of bitcoin, the popularity of cryptocurrencies continues to soar. In the race to cash in on the craze of cryptocurrencies, many companies are using this opportunity to make money via a unique tool – Initial Coin Offerings (ICOs).

What’s an ICO, and why are they all the rage?

You’ve probably heard the term “ICO” in the news recently, particularly with the furore over China’s new ban on them. For those new to the world of cryptocurrency and its associated glossary, an ICO or Initial Coin Offering is essentially a way for a company to raise capital through the sale of cryptocurrencies. Some of the best-known ICOs are Ethereum and Karmacoin (both released in 2014), and the recent “big one” released in September 2017, Kik. According to ICOarray, there are about 50 new ICOs every day now. But what exactly does each of these “offerings” entail?

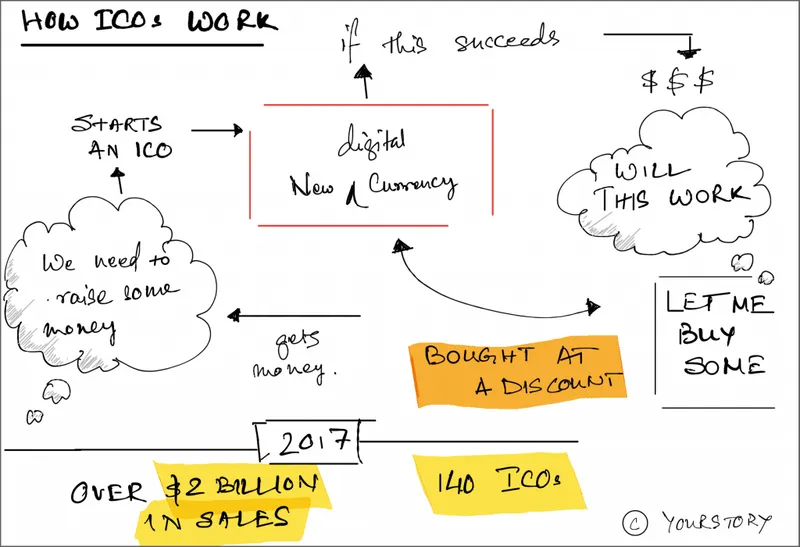

Unlike traditional IPOs (Initial Public Offerings) that give buyers shares or stock options in exchange for purchase, ICOs don’t give buyers any inherent cash flow dividends or “ownership” rights in the company. So how did ICOs manage to raise over $2 billion for various companies in 2017 alone? The answer, quite frankly, boils down to Bitcoin. With an ICO, buyers bet on the possibility of the new cryptocurrency rising in value in the future to generate returns. With Bitcoin’s exponential growth in value, more and more people are willing to bet on other cryptocurrencies and are open to the idea of investing in an ICO.

Given the nature of ICOs and the volatility of cryptocurrencies, it’s no surprise that opinions are sharply divided on the practice and its practicality. There are plenty of people from finance, tech, and regulatory environments on both sides of the fence who argue about the value of ICOs. We look at both sides of the coin:

The future of disruptive capital raising...

As previously mentioned, ICOs have managed to raise over $2 billion in 2017 alone, and this has convinced many financial experts, as well as venture capitalists and the like, of the potential of the tool. Venture capitalist Fred Wilson has been one of the most vocal supporters of ICOs, calling them “a new and exciting way to build (and finance) a tech company, and a legitimate disruptive threat to the venture capital business”. Another major proponent has been billionaire investor Tim Draper, of Draper Fisher Jurvetson, who also participated in an ICO earlier in 2017 for the digital currency Tezos.

J.R. Willett, popularly considered “the father of the ICO”, is also (understandably) a huge supporter. He launched the first ICO – Mastercoin (known today as Omni) – in 2013, after proposing the idea in a white paper called “The Second Bitcoin White Paper” in 2012. In a recent interview with Forbes, he said, “Token sales allow people to participate in a number of exciting projects at a very early stage.”

AngelList executive chairman Naval Ravikant recently remarked on the rising trend of entrepreneurs and tech startups turning to ICOs, saying, “I think the VC model really is in danger of getting squeezed down to a very small space.” His comments reflect a broader rising perception that the ICO model is here to stay, and may indeed end up disrupting capital raising processes in the future.

... or just a flash in the pan?

With the highly volatile nature of cryptocurrencies and the perceived lack of physical value offered by ICOs, there are more than a few people who consider the entire system little more than a passing fad. Among the most prominent detractors of ICOs is Wikipedia founder Jimmy Wales, who has called them “an absolute scam”. He said in a CNBC interview, “I think blockchain is a super interesting technology but there are a lot of fads going on right now... There are a lot of these initial coin offerings, which in my opinion are absolute scams and people should be very wary of things that are going on in that area.” His opinions closely mirror those of JP Morgan CEO Jamie Dimon who is known to have called Bitcoin a “fraud” and labelled the ICO movement as “worse than tulip bulbs” (referencing the ‘tulip mania’ of the 1600s).

Perhaps surprisingly, Ethereum co-founder Charles Hoskinson has also been critical of the ICO model, despite its success for Ethereum in 2014. He says, “People say ICOs are great for Ethereum because, look at the price, but it’s a ticking time-bomb... There’s an over-tokenization of things as companies are issuing tokens when the same tasks can be achieved with existing blockchains. People are blinded by fast and easy money.” Well-known venture capitalist Chamath Palihapitiya’s tweet shows he clearly feels the same way too:

So are ICOs here to stay?

The question of the future of ICOs is a difficult one to answer. Despite a large amount of trepidation and sarcasm about ICOs and those who invest in them, they continue to be wildly attractive. A case in point is UEToken, or Useless Ethereum Token, an ICO that, in its own words, offered users “absolutely no value” and still saw investments close to $200,000. Another major factor that will make a difference will be the formulation of regulation by governments, especially since ICOs currently function in a regulation-free environment. Is China’s ban on ICOs representative of wider regulatory wariness about these offerings? It’s difficult to say. Perhaps the best policy right now is to simply wait and watch.

Have you invested in an ICO? What are your opinions on this financial tool? Let us know in the comments!