Why tech startups should grow up and start talking IPO

Like the wizarding world in the Harry Potter series feared uttering the word Voldemort, the Indian tech startup ecosystem is petrified of IPOs. But that shouldn’t be the case, say founders and CEOs of companies that went public this year.

Under 15 product tech and consumer internet startups have gone public in India in the past five years. This is especially odd as the number of companies that have gone the IPO route has only increased in the last few years.

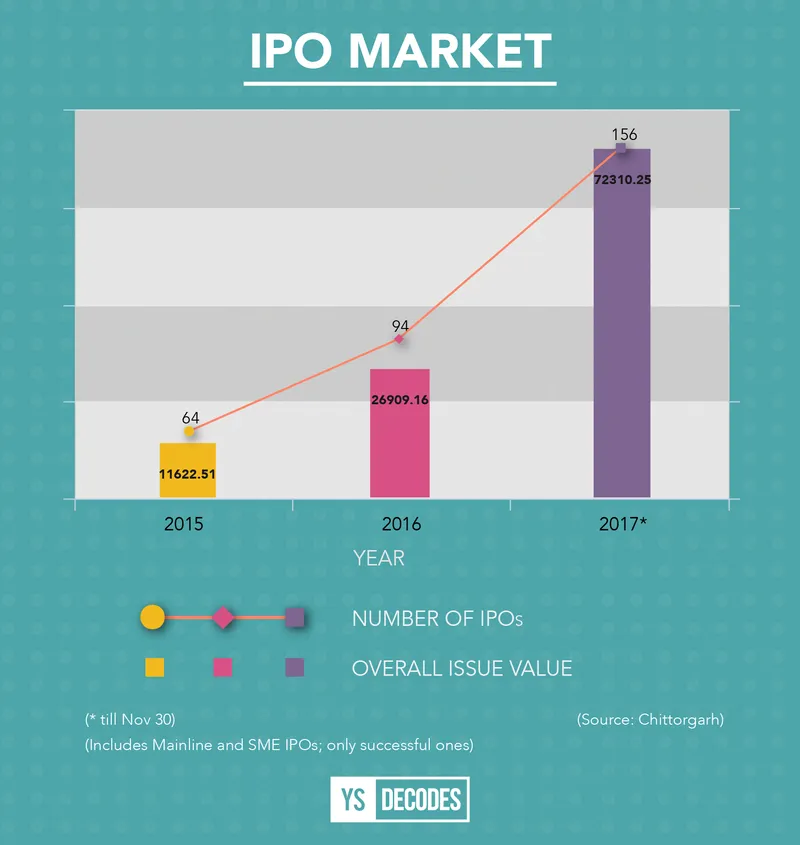

In fact, 2017 has been a blockbuster year for IPOs with 156 listings (including SME IPOs; until November 30), compared to 94 in 2016 and 64 in 2015. The 156 companies that went public this year mopped up a staggering Rs 72, 310.25 crore, according to data from IPO investment site Chittorgarh.

Of the over 10 tech companies that went public this year, only online matchmaking service provider Matrimony and optical networking products company Tejas Networks can be considered as from the startup ecosystem.

While an IPO is seen as an eventuality for traditional scaled-up businesses, it’s viewed as an option for tech startups. That mindset needs to change.

Maximising shareholder returns

One reason why this change needs to happen is the Indian startup ecosystem’s low number of exits. While the exit scenario has improved over the years, with over 180 exits in 2015 and 2016, and over 100 in 2017 until August according to CB Insights, it is still tiny compared to the US, which saw 3,358 tech exits in 2016.

TV Mohandas Pai, Co-founder of Aarin Capital, says,

Liquidity and exit events are among the biggest challenges for startups. Traditionally, in India exits have mostly happened through acquisitions by private equity firms or larger corporates. Startups need to keep in mind that a public listing is one big source of exits.”

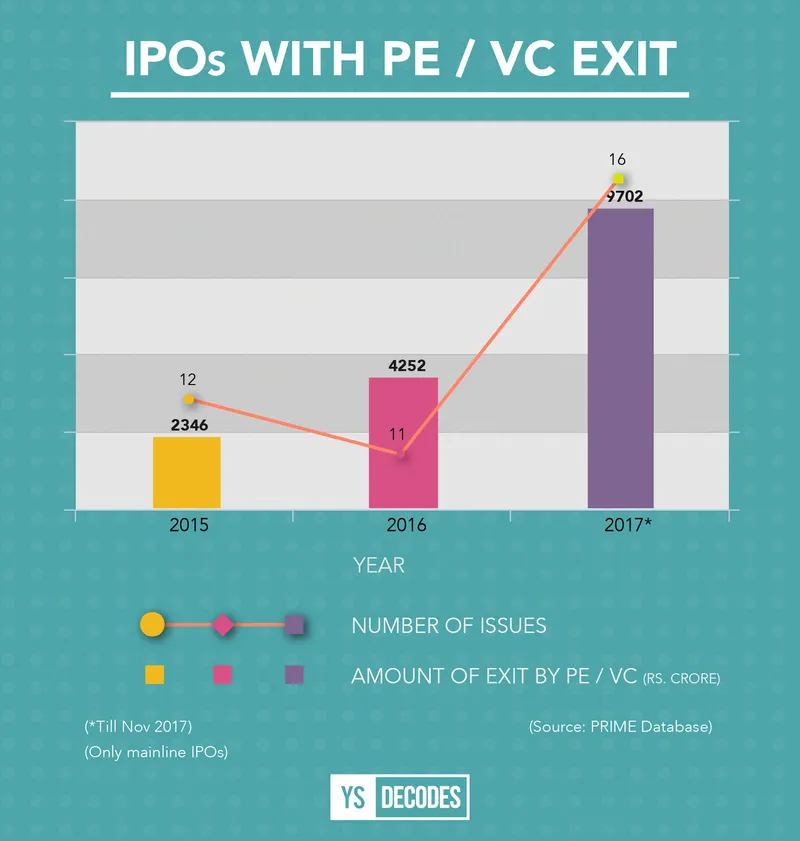

Private equity and venture capital investors have gained rich dividends through public offers.

Founders and promoters of companies also, of course, have seen their wealth increase considerably.

Just after retailer D Mart’s parent company, Avenue Supermarts, listed in March, the promoter group’s stake was valued at $5 billion. Similarly, when Just Dial listed in 2013, founder VSS Mani’s part exit and remaining holding were together valued at Rs 1,328 crore.

More important is the fact that this is one source of fundraising that companies are missing out on. Companies that have gone public have raised private funding at later dates as well, so it isn’t like a listing closes that door.

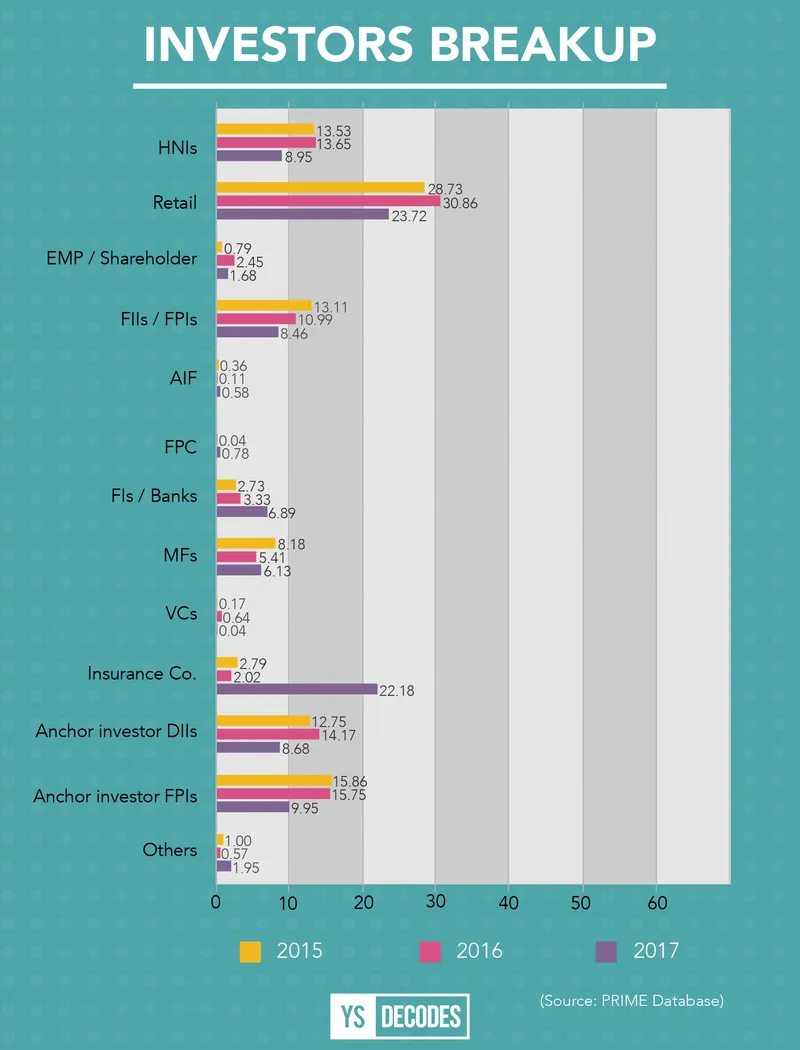

Every month over $3 billion is flowing into the financial markets in terms of Indian capital. A very large number of investors are investing in listed companies and are looking for high growth opportunities. The midcap space has investors looking for companies with high growth, which leads to high PEs too. Startups should take advantage of these opportunities,” Mohandas Pai says.

The appetite for investments in the public capital market is also growing. This year has seen some big issue sizes on the public markets.

The AU Small Finance Bank IPO saw the Jaipur-based company raise over Rs 1,900 crore in an issue oversubscribed 54 times. Avenue Supermarts mopped up Rs 1,870 crore, while Tejas raised over Rs 770 crore. Matrimony had a Rs 500 crore IPO and it was oversubscribed by a whopping 441 percent on the last day of the issue.

No one can now question the ability of the Indian public market to absorb large issues.

As mentioned earlier, IPOs are one of the best means of maximising shareholder value.

Sanjay Agarwal, Founder of AU Small Finance Bank, says: “I could only say this with a lot of humility that right from our first valuation milestone of Rs 50 crore in the year 2008, when we got capital from Motilal Oswal Private Equity, all our subsequent capital raises, the one in 2010 by IFC, in 2012 by Warburg, the pre-IPO secondary round in 2016, and lately in our IPO, we could create a lot of wealth for our investors and employee shareholders. With conversion into a Small Finance Bank, the real unlocking of shareholders wealth happened when the company was valued at more than Rs 15,000 crore on the day of listing.”

Benefits of being public

But there are other reasons why companies should consider an IPO.

Murugavel Janakiraman, Founder and CEO of Matrimony.com, says getting a company listed is a significant milestone for an entrepreneur and the pinnacle of his entrepreneurial journey.

You can keep raising money in the private market and provide exits to early investors. But at some point, you have to move beyond that. Listing provides credibility. You need to ensure profitability, consistency, and ensure all corporate governance practices are in place within the firm before you can take it public. The process involves detailed scrutiny of each and every aspect of the company. So a listing is almost a validation – you are publicly disclosing that the company is going in the right direction,” says Murugavel.

Murugavel says there are multiple reasons for going public. The ability to raise funds, greater visibility, enhancing credibility, and increased discipline are just some of the benefits. He shares that after listing the talent pool Matrimony.com has access to has improved.

Rituraj Sinha, a promoter of private security and facility management services firm Security and Intelligence Services (India) Limited, says the IPO in July, which was subscribed over seven times, was the perfect means and opportunity to re-capitalise the company’s balance sheet.

At the time of the IPO, the company’s promoter group sold off 1.91 percent of the pre-offer capital, amounting to Rs 106.84 crore, while investor CX Partners offloaded shares worth 5.05 percent of the pre-offer capital, amounting to Rs 282.89 crore. The PE investor got over four times return from its stake sale at time of the IPO.

Sanjay Nayak, CEO of Tejas Networks, says their IPO strengthened the company’s balance sheet and enabled it to make larger sales and marketing investments in international markets of Africa, South East Asia and the Americas.

Our primary listing objective was to use the IPO proceeds to make increased investments in R&D and to reduce our working capital,” Sanjay says.

Tejas has seen its share price soar on the back of strong financial results. At close of trading on December 7, the share price on NSE was Rs 398.05; on listing in June, the share price was Rs 257 per share. Tejas more than doubled its net profit at Rs 47.31 crore in H1FY18, and registered 33.5 percent growth on revenues at Rs 415 crore.

AU’s Sanjay Agarwal shares that listing was an aspiration for him.

We firmly believe that listing is the true test and validation of the business model and endorsement of an organisation’s abilities, management team, and its acceptability amongst public and wide range of investors. Listing, on one hand provides liquidity to existing investors and gives an opportunity to retail investors to become part of a company’s growth; on the other hand, it further increases transparency, disclosures and governance levels,” he says.

But going public is not easy. The company should be prepared to be completely transparent about every aspect of its business when going through the process. For this, the company must prepare well.

Murugavel says a company needs to do its preparation right for a successful IPO. The pre-IPO process takes at least a year, which is a big commitment by itself.

“You need to ensure that everything—all the paper work, agreements, processes—are in place and in order. It is like building a house—every aspect of the building, from plumbing to roofing needs to be done right and tested,” Murugavel says.

For smaller companies, the stock exchanges now have an SME platform. November saw the 100th small and medium enterprise being listed on NSE EMERGE, the SME listing platform of the National Stock Exchange. A new NIFTY SME EMERGE Index was launched to track the performance of these listed SMEs to help investors benchmark the performance of these companies.

Vikram Limaye, MD and CEO of NSE, says at least 40-50 more companies are expected come on board the NSE EMERGE in the next six months.

There is also the EMERGE Institutional Trading Platform now. The process is much simpler than a regular IPO.

However, to get the full benefits of a listing, the main platform or the SME one remain the best bets.

There are risks and challenges to public listing, like much greater scrutiny, need to be profitable and poor performance leading to share prices tanking and the company suffering.

“But the private market also has its risks. In the private market, funding is based on negotiations and valuation is based on two parties signing a contract. In the stock market, the price is derived from the market and the market is driven by a large number of buyers and sellers. The risk is that the price is subject not only to the company’s performance but also to other factors like overall market liquidity and world events,” Mohandas Pai says.

But to those entrepreneurs who worry about the risks and the high requirement for transparency and regulatory scrutiny, Murugavel says:

They need to decide whether to be boys or men. If you are not prepared, don't go for the IPO. If you want to grow and be responsible, you need to be prepared for the process and for life after an IPO. Remember that there is nothing like an IPO to show to the market that your company is now mature.”

(Disclaimer: T V Mohandas Pai is an investor in YourStory)