Will Flipkart, Ola, Paytm follow the investment path set by China’s big three?

Baidu, Alibaba and Tencent invigorated the Chinese startup ecosystem with their investments. Can India's top three funded private companies do the same for the Indian ecosystem?

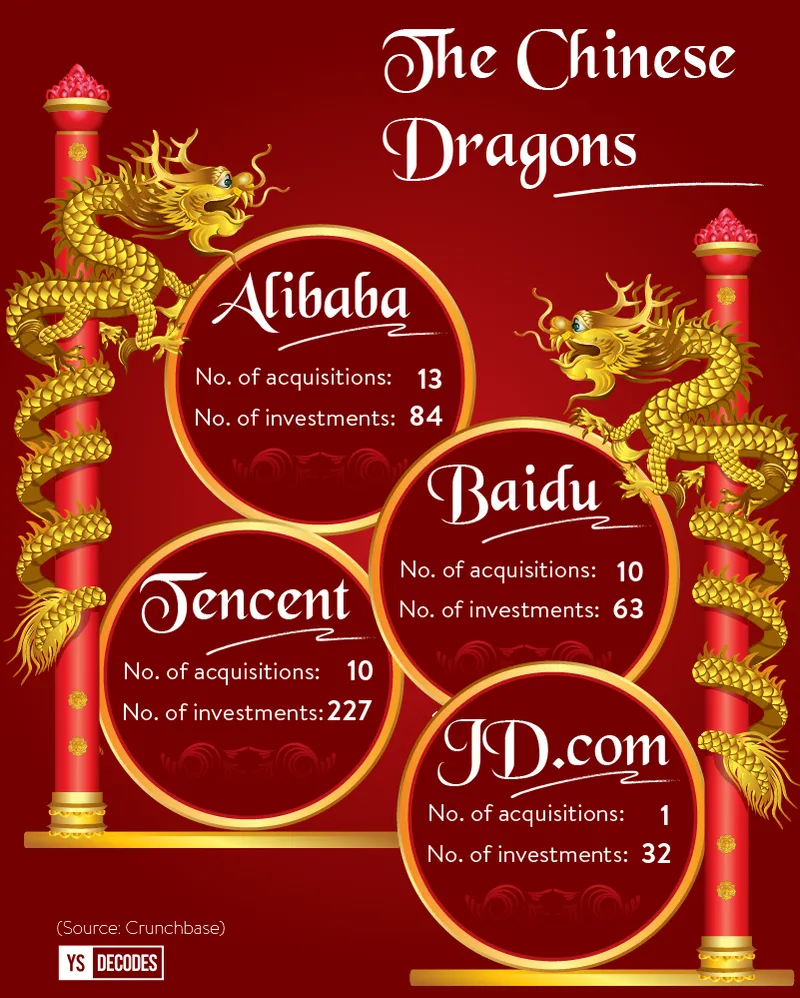

In 2014, China’s Baidu, Alibaba and Tencent entered into 48 deals as investors, making them among the largest investors in Chinese startups that year.

Tencent alone invested around $3.5 billion in eight companies between September 2013 and May 2014, most of them in China. Of course, much water has flown under the bridge since then, and now the BAT, as Baidu, Alibaba and Tencent are collectively known, has moved beyond Chinese shores to explore newer territories as powerful global investors.

While the trio has made many splashy acquisitions, like Alibaba’s $4.7 billion UCWeb buy in 2014, the three have also made many investments in smaller startups. For instance, Alibaba spent over $1.72 billion buying at least 50 small startups between 2013 and 2017, according to Nikkei Asia Report. These three companies, through their investments and acquisitions, have deepened and widened the Chinese startup ecosystem.

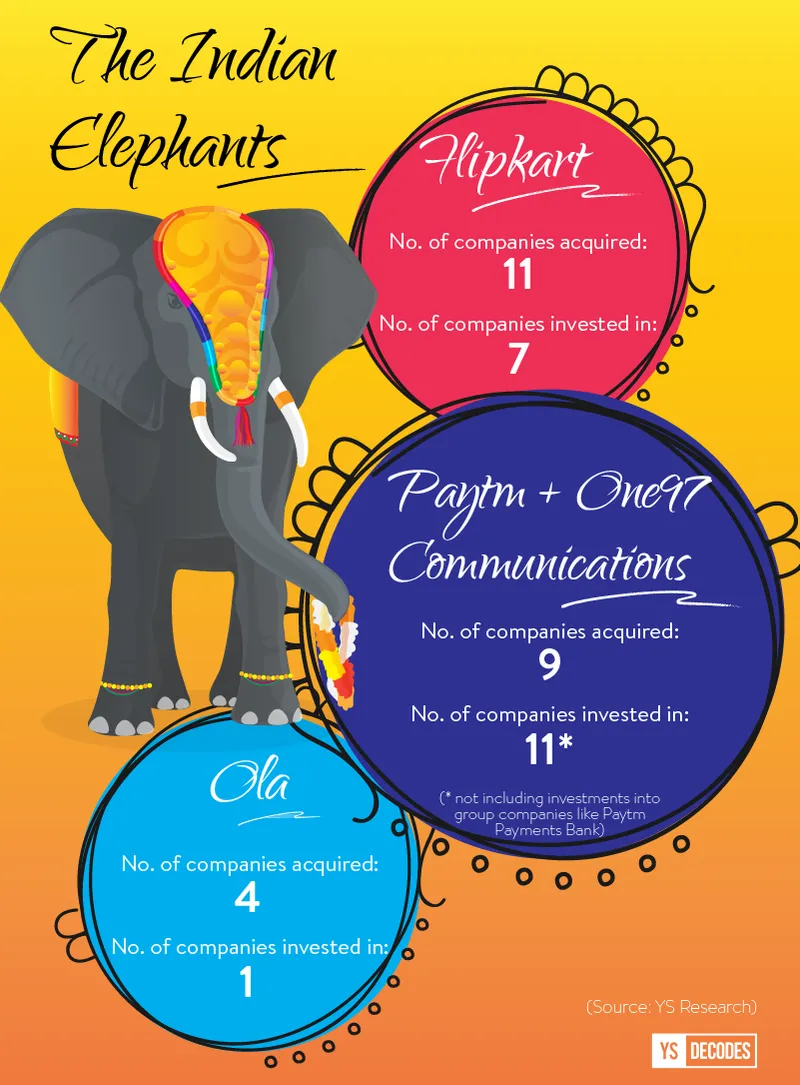

With India’s (current) big three—Flipkart, Ola and Paytm—raising over $7 billion in 2017 (including some debt financing), there is some hope now that they will start looking outside their businesses, and grow through their investments and acquisitions.

Overall, the progress of the three companies (Flipkart, Ola and Paytm) is a great sign, and endorsement to Startup India! These large fund raises validate that valuable companies are being built in India and is indicative of the maturity of the ecosystem. I definitely see the capital percolate down to strategic investments and M&As for startups, ones that are creating strong technology platforms or are building alternative channels that enable these industries,” says Vani Kola, Managing Director at early-stage venture capital fund Kalaari Capital.

Talks, though, are already underway. “Flipkart is talking to startups in almost every online and related category, including us,” the founder of a top consumer-focused tech startup says on condition of anonymity. Paytm, along with Alibaba, is set to invest in e-grocer BigBasket. Last month, Ola acquired online food delivery firm Foodpanda, just months after rival Uber launched its food delivery service in India.

Of course, these three companies have been investing and acquiring for some time now. The expectation, now, is that the speed and size of these investments will increase.

Strategic fit

What are these companies looking for when they look to invest? This short interaction YourStory had with Madhur Deora, Paytm’s CFO and SVP, throws up some answers:

YS: What does Paytm look for in a startup when investing? What criteria should a startup meet?

Madhur: We typically partner with companies that have solutions that can either benefit our large consumer base find better products and features on Paytm, or benefit our merchants who can use technology to expand their business or make it more efficient.

We always look for a great management team that has a high level of commitment to solve the problem that it has chosen to work on. We believe the best founders will figure out the right solutions and the right roadmap if they have conviction, and the right partners.

YS: Will Paytm look at primarily seed/Series A level investments, or will it look at later stage investments too?

Madhur: We are not a venture investor, and don’t look to make investments only for financial returns. We make investments if there is strong rationale for Paytm to have a strategic investment in a company, and we believe such a partnership can benefit the investee company’s roadmap, and help our merchants and/or customers.

We are agnostic to the stage of the company, or whether it has raised institutional funding earlier.

YS: How does Paytm decide which company to invest in, and which one to acquire?

Madhur: For us, the most important criteria is the strategic fit and alignment with the founders.

We are flexible about the stake we take, although we find that our partners want us to take a meaningful stake where we have a high level of strategic rationale for the partnership.

YS: What role does Paytm see itself play as an investor?

Madhur: We believe in backing founders to build their company. We want these founders to have full freedom in running the business operations, and their product and technology roadmaps. We look to contribute to our companies in ways which could include access to our customer base and/or merchant base, technology insights and expertise, product integrations, and access to our network of partners among others.

Platform plays

It is clear that the three biggies (Flipkart and Ola declined to participate in this story) are looking at startups that can help them grow their user base, and service this base better.

We only need to examine past investments made by these companies to understand what they are looking for.

Flipkart, especially, has used the inorganic route for faster growth. It acquired LetsBuy in 2012 to get into the electronics category, and later Myntra to scale up in fashion. It is, in fact, thanks to Myntra that Flipkart is the online fashion leader today.

Its acquisition of Jeeves in 2014 helped Flipkart provide effective installation and after-sales service in its appliances and furniture categories. After many missteps in the payments side, with acquisitions like ngpay not working out for the company, Flipkart finally has found a fit in UPI-based payments app, PhonePe, which it acquired in 2016.

Ola bought out competitor TaxiForSure in 2015 for $200 million in one of the largest acquisition deals in the Indian startup world. Its Foodpanda acquisition last month is seen as a direct response to Uber launching its Uber Eats service in India.

Paytm, which has made multiple investments and acquisitions, has not been part of big ticket deals, unlike its two well-funded peers. It recently acquired deals platforms Nearbuy and Little. Paytm had invested in the latter in 2015. At the time of the strategic investment, Paytm Founder Vijay Shekhar Sharma had said the company would be able to offer a greater selection of deals to its customers. The company also planned to cross-sell deals by Paytm’s existing base of merchants on Nearbuy and Little.

Flipkart and Paytm, especially, have clearly stated their intent to become super apps—offering multiple products, services and features to consumers. Ola, with its Foodpanda acquisition, is also showing an inclination towards this strategy.

2018 will see these bellwethers make even more strategic bets, and execute towards becoming large 'platform plays', like their global counterparts,” says Tarun Davda, Managing Director at early-stage investor Matrix Partners.

Flipkart and Paytm are especially looking at companies in a wide variety of areas - ranging from single-vertical e-commerce companies and online services companies like food delivery and ticketing startups, to logistics and technology disruptors.

Why this might not work

Entrepreneurs and early stage investors are hoping these biggies turn into voracious investors. While the big three are willing to invest and acquire, can they follow the ‘BAT’ strategy easily in India?

There are primarily two challenges.

An entrepreneur, who is also an angel investor and holds stake in one of the big three, explained the first:

Apart from the top companies that have scaled up and are ultra-funded, and who are expected to initiate the M&A, the ecosystem should have another rung of startups who are poised to reach this stage in some time. There are very few such startups in the Indian ecosystem right now. The big guys don’t want to buy someone too small. They are looking for companies that have shown good product-market fit, have established some leadership position, have a great team, and can be a good and easy fit for them. How many such companies are there? There is a Swiggy; how many else? There is a dearth of quality startups at this rung that will make sense for a Flipkart.”

The other problem is linked to this first challenge. Flipkart, Ola and Paytm are not the only ones on the hunt - Amazon and even Uber and Google could look at scaling up investments in Indian consumer-focused internet and tech startups.

In fact, Google has already made an investment in daily task management app Dunzo.

For Flipkart and Ola, there is the added competition of Alibaba, which will be investing in India in consortium with its flagship India investee, Paytm.

This was not the case in China. The ‘BAT’ faced little competition from global majors as the Chinese economy is a closed one for all practical purposes, with the likes of Amazon, Google and Facebook being kept out of the country.

Unfortunately for Flipkart, Ola and Paytm, the American and Chinese giants are all in India, and all of them are bidding for a much smaller pool of ‘interesting’ startups.

Investments could, hence, become more expensive. We have already seen this play out in the US. With multiple bidders, Whatsapp’s valuation soared to $19 billion. But then, in the US, the pool of startups is much bigger.

Also, the ‘BAT’ became aggressive investors only once they were well-established, and knew they faced little competition. Again, this is not the case in India. None of the three Indian biggies are safe from competition and still need to spend heavily on customer acquisition and retention and to out-market competition.

In the short term, it might make more sense for Flipkart, Ola and Paytm to be fund receivers, than investors. But, in the long term, they could lose out if they miss on strategic investments now.