After Softbank and Alibaba boost last year, here’s what Indian e-commerce can expect in 2018

With SoftBank becoming the majority stakeholder in Flipkart and Alibaba investing in Paytm Mall, Indian e-commerce is set for a new turn this year.

Let’s face it: not a lot of e-commerce companies were funded last year. But huge amounts pumped into fewer companies grabbed the headlines. Flipkart alone got around $4 billion in its kitty from global players like SoftBank, Microsoft, Tencent, and Ebay. Gurgaon-based Paytm Mall raising $200 million at $1-billion valuation from Alibaba and SAIF Partners in early 2017 also made noise. But is it just the ten-digit numbers that make them significant? Well, yes and no.

Despite Amazon entering the Indian market almost five years ago and spending billions on branding, marketing, discounting and infrastructure building, Flipkart has managed to stay ahead in the e-commerce tussle between the two giants. In the past two years, Alibaba’s entry into India through investments has been making this game more exciting. With Tiger Global part-exiting Flipkart, SoftBank has taken over its position as Flipkart’s single largest stakeholder. What makes this interesting is the fact that SoftBank is Alibaba’s single largest stakeholder as well. SoftBank and Alibaba seem to be carving up the non-Amazon part of the Indian e-commerce landscape between them.

Now that these two have placed their biggest bets, into Flipkart and Paytm Mall, the industry is watching how these investments will impact the rest.

More money, more consolidation

Because Flipkart and Paytm Mall are sorted out in their funding – they just have to focus on utilising the money properly. This is where consolidation will become a priority.

Also read: Will Flipkart, Ola, Paytm follow the investment path set by China’s big three?

According to Sajid Fazalbhoy, Principal, Blume Ventures, the largest one or two players will receive capital from the deep-pocketed global funds that will help them move towards domination of a category.

He explains, “Companies compete not only for customers but more importantly for capital. There will be consolidation for companies that cannot raise money and hence will be out competed.”

However, he adds that investors are focused on profitability once user adoption has been established. “Consumer internet is a game only for funds with large reserves; hence smaller capital will stay away from the category unless it is a large niche.”

Verticals are where the game is now. As Sajid puts it, vertical e-commerce will always have room to grow and there will be capital chasing the top companies in most large categories.

Many entrepreneurs in e-commerce sector, like Vatsala of LoveThisStuff, also believe that 2018 will see consolidation in vertical e-commerce businesses that have not built a differentiation and rely solely on heavy discounting for sales. In fact, Vatsala believes that there would be fewer but larger ticket-size investments.

According to Anil Talreja, Partner, Deloitte, this year’s mergers will aim to capture higher market share, consumers, and data. He expects more and large investments in sectors like food, apparel, online shopping, and consumer goods.

“This may result in a temporary slowdown but will only lead to fueling growth and success of this sector in future,” he adds.

Of course, with all the investment from Alibaba and SoftBank, there is potential for consolidation for Paytm Mall and Flipkart. Paytm’syet-to-be-officially-declared investment in online grocery market leader BigBasket shows that high-ticket funding leads to more acquisitions in verticals.

Flipkart’s acquisition of Myntra, Jeeves and Jabong, and Snapdeal’s acquisition of FreeCharge, and Ola’s recent acquisition of FoodPanda are similar instances.

As Rajiv Srivastava, Co-founder and CPTO of online furniture seller Urban Ladder, says, all of the e-commerce companies have enough cash pull to do acquisitions and enough runway to get business to the right margin structures over the next two years.

But this does not point to merely online-to-online consolidation. With online and offline channels merging in retail, e-commerce major will need to acquire offline options too – especially in fashion. This has begun already – with Amazon tying up with Shoppers Stop last year.

In fact, Satish Meena, Senior Forecast Analyst at Forrester Research, believes that horizontal e-commerce players should tie up with not just big retailers but smaller ones too – in fashion as well as grocery. But he is not too hopeful about new startups getting high funding this year, and sees no potential IPOs in 2018 either.

Will SoftBank and Alibaba bring in more than just cash?

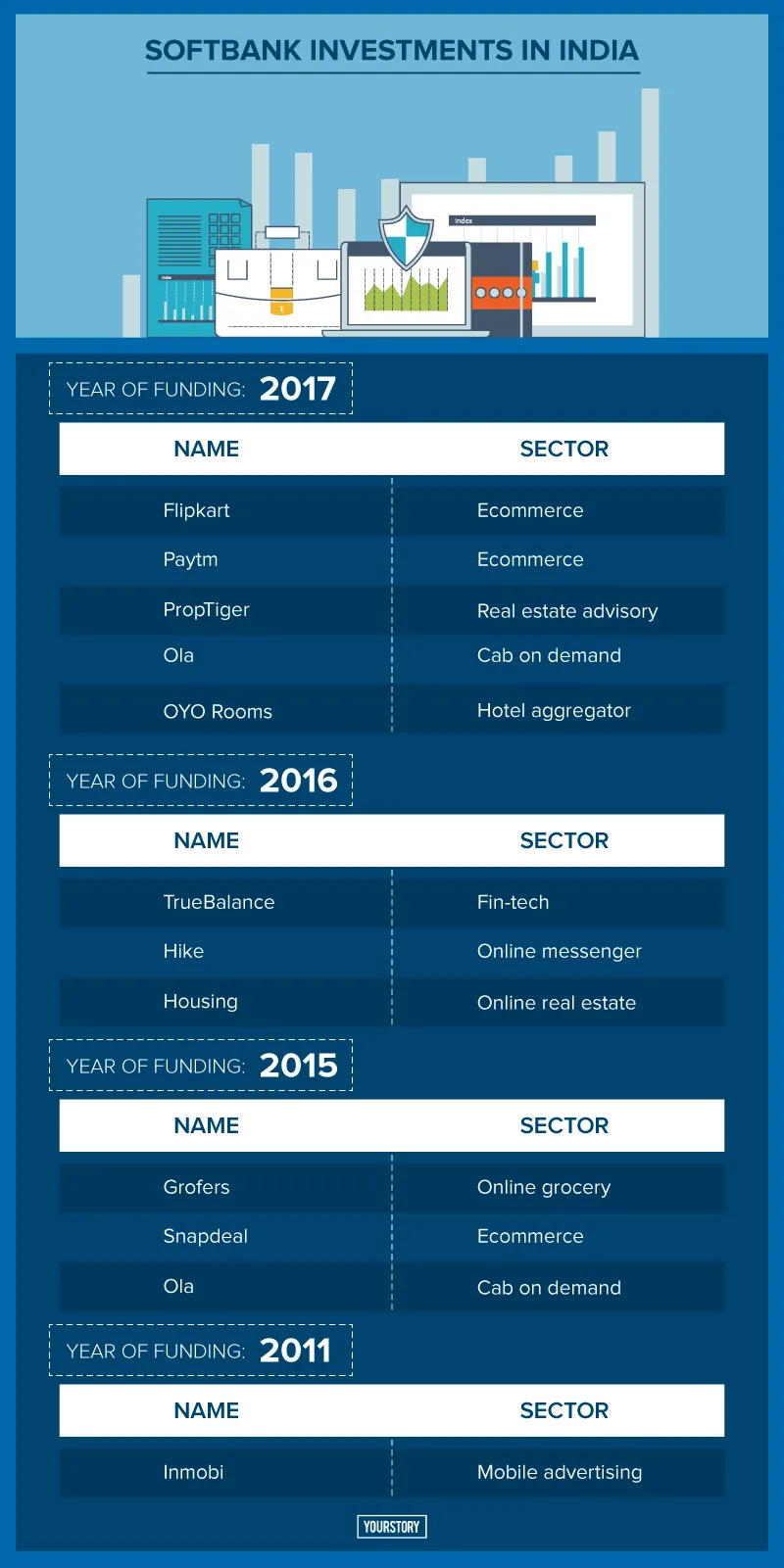

SoftBank has had its falls in India – initially with the Housing fiasco , and then having to write off Snapdeal. Its other investments—Ola, OYO Rooms, Delhivery, Grofers, Swiggy, and among them—have more or less become the leaders of their respective sectors. But e-commerce has not been kind to SoftBank in India, with its Snapdeal investment going south, which is why it has backed industry leader Flipkart.

Having become the largest stakeholder in Flipkart, now the Masayoshi Son-led investment firm is probably the single-biggest startup investor in India. The fact that Softbank is also the force behind Alibaba, the most successful e-commerce firm, adds to the charm. Because Alibaba, keen on India in its own rights, can bring in not just money but very advanced technology as well to Indian players. Alibaba might be looking to build another Cainiao (its logistics and parcel tracking platform in China) in India, with its impending investment of $100 million (with SAIF Partners, according to sources) in logistics firm Xpressbees.

Alibaba’s technology for QR scan code has been already implemented in Paytm Mall. However, Satish of Forrester Research says that it might be too early for Alibaba to launch its famed ‘New Retail’ model, which brings together offline and online channels of retail in an advanced way in India. Alibaba’s focus on O2O model is clear – from CEO Daniel Zhang’s statement that Paytm Mall’s omni-channel model is a precondition for New Retail.

Satish opines that Paytm Mall’s focus will be on O2O for now. “They would want to see how customers respond first. They might experiment from Alibaba’s playbook in the coming quarters, though,” he adds.

However, a fashion e-commerce expert tells YourStory that if Paytm Mall wants to establish itself in online fashion, Alibaba’s AI may not help them compete with the market leader Myntra. “Fashion websites in China have entirely different dynamics. So, customer experience and front end may not change, but there will be assistance in the backend,” he says, requesting anonymity.

The battle of the new holy trinity in e-commerce

The Flipkart-Amazon-Snapdeal battle till 2016 became Flipkart-Amazon-Paytm Mall battle in 2017, and this will continue this year too. Amazon is now fighting Flipkart backed by SoftBank and Paytm Mall backed by Alibaba. The obsession over growth and profit has now given way to focus on sustainable growth and domination in market share.

“If the last two years were focused on profitability, the focus will be on building market share this year, as Flipkart is getting good unit economics. There is no push for profitability at the moment,” says an industry source on condition of anonymity.

In fact, according to Satish of Forrester Research, now that Flipkart and Amazon have similar wallets, they should focus on expanding the market.

“More investors might join Flipkart and Paytm Mall, but they won’t actively look for funding in 2018. This year, they will focus on using the money they raised last year to scale. Paytm Mall should increase the market both in payments and e-commerce, and Flipkart has to retain the market share,” he says.

Now that e-commerce has moved beyond fashion, mobile phones, and electronics, to online grocery becoming the centre of attention, Flipkart will need to take a leaf out of Amazon’s book in logistics and invest in warehouse and last-mile delivery too. Satish adds, “Amazon already has three different models in grocery; they will keep pushing it as this category is about making shoppers buy everything online. Flipkart will also push the category.”

Customer experience, profit, sustainability

While most entrepreneurs are optimistic that the SoftBank-Alibaba impact will bring in more credibility and validation to Indian startups, the funding game need not be all about venture capitalists.

Sujayath Ali, Co-founder and CEO of fashion e-commerce platform Voonik, says that in 2018, vertical players will be keen on private equity. “Once their unit economics is good and they start getting profitable, they would prefer different types of credit rather than just VCs,” he says.

And that would be fair. Because the push for profitability will also determine the way e-commerce is done. As Sajid of Blume Ventures puts it, it is hard to make money by just being a platform. “Companies want to play the value chain from discovery until fulfilment giving them more scope to make money,” he says.

This shift is sure to bring light into the fundamentals of retail business. According to Rajiv of Urban Ladder, pricing of the products will be better thought out. He is also expecting more optimisation across the supply chain — everything from sourcing to buying to running the supply chain and direct costs.

“Every aspect up the cost will be re-evaluated in this push for profitability,” he adds.

In fact, unprofitable startups shutting down can be a good sign. Vatsala of LoveThisStuff believes that laying the focus on healthy growth is better than wasteful expenditure and raising round after round of funding.

“Startups have no choice but to focus on sustainability and strong unit metrics. My hope is for e-commerce companies to move towards a more traditional 'Marwari' business sentiment of ROI with a clear plan towards profitability,” she says.

E-commerce will continue to grow, slowly but steadily in 2018, as there is still a significant wallet share online, and customers will increasingly shop online for electronics, fashion and grocery.

If e-commerce ever had huge yet realistic scope for growth, it is now. The winners will be decided on how they utilise the money. Throwing discounts is not the answer for long-term sustainability.

Urban Ladder’s Rajiv has a few wise words to add. “If these companies use these funds SoftBank and Alibaba have put into the ecosystem to build better systems, be a lot more thoughtful on what initiatives they are taking up, making sure that lesser people are solving the same problems and are growing within the organisation, consumers are coming in for the right reasons and not just for discounts — if companies are able to attack some of these key issues, then we would see a mammoth maturity of the ecosystem in the next two-three years. It's not about the last person standing, but about using these investments to build a more profitable and sustainable business.”