Y-Combinator-backed SimpleMoney automates tracking of mutual funds and equities using emails

Chennai-based SimpleMoney is a fintech startup that helps mutual fund investors and financial advisors track their investments without having to input any data.

At a glance

Startup: SimpleMoney

Founders: Pranshu Maheshwari

Year it was founded: 2016

Where it is based: Chennai

The problem it solves: Automated mutual fund investment tracking

Sector: Fintech

Funding raised: Seed round (undisclosed)

Many of us use multiple investment platforms to transact in mutual funds, and consolidation of data across all these portals normally takes hours, and makes decision-making very slow. SimpleMoney automates the consolidation process, saving users a significant amount of time. SimpleMoney’s founder Pranshu Maheshwari created the product because of the frustration of trying to manage personal finances across multiple portals.

Pranshu is an alum of the Wharton School of Business and the College of Arts and Sciences at the University of Pennsylvania. Pranshu’s previous companies include Prayas Analytics and Metricboy, and he launched SimpleMoney in 2016. The startup has received seed funding from Y Combinator and 500 Startups seed fund.

The mutual fund industry in India is only just moving towards automated processes, and gaining a holistic understanding of an individual’s portfolio is challenging, because data is stored in many places. SimpleMoney’s aim is to overcome that hurdle by presenting powerful data to power wise investment decisions.

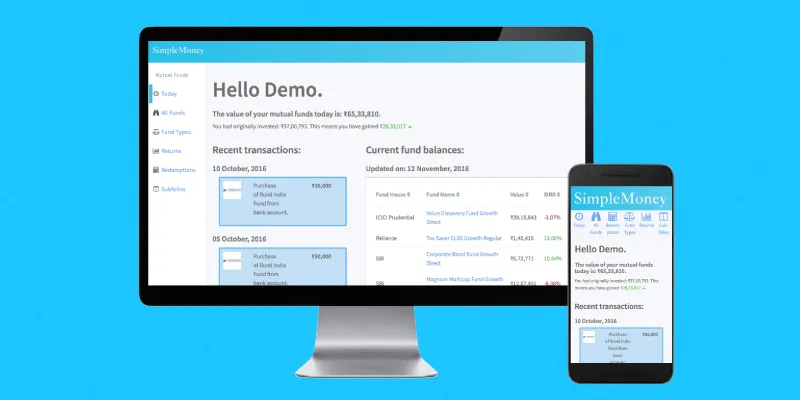

SimpleMoney is a fully automatic portfolio tracker for mutual funds and stocks. SimpleMoney uses machine learning to read investment statements and provides users with information about their investments. To set up SimpleMoney, users just need to log in, wait a few minutes, and their entire portfolio gets tracked. Even new investments get added automatically as soon as the email notification is received in their inbox.

By providing automatic portfolio tracking, SimpleMony allows users to check their portfolios more frequently, and without any effort. This makes decision-making significantly easier.

SimpleMoney’s detailed reports include the XIRR (Extended Internal Rate of Return) of individual funds, asset classes and the entire portfolio. Users can see how their funds are performing in relation to market performance by using CorrectCompare, Simplemoney’s proprietary comparison algorithm. Users can view the asset allocation of their portfolios amongst types and sub-types of funds to see whether their portfolio needs any rebalancing. SimpleMoney also tracks whether your funds are out of exit loads and capital gains. When you need money, this will help you figure out which funds of yours are available without a penalty.

SimpleMoney users can see the fund allocation in their portfolios (between Equity, Debt and Hybrid) funds, and can use this data to rebalance their portfolio to stay in line with their financial goals. SimpleMoney also provides instant exit load and capital gains calculations so that users can make informed decisions about which funds to sell and keep.

The startup claims to be growing at a rate of 40 percent per month. Currently, their user base consists largely of direct mutual fund investors who fall into the ‘DIY category’ of investing: people who were among the first to move from regular to direct mutual funds when direct funds were introduced in 2013. Many of them store the bulk of their savings in the form of mutual funds, with few equities investments. SimpleMoney is particularly useful for them because they don’t have to use exhausting Excel spreadsheets to understand their finances anymore. The other set of users are financial advisors who use SimpleMoney to keep a track of their clients’ portfolios.

SimpleMoney currently does not charge their users and are not making any revenue, but plan to introduce a paid subscription service in April. With the introduction of a paid subscription-based model in April, SimpleMoney’s business model will be SaaS-based, and they also plan to charge for any additional services.

By the end of 2018, SimpleMoney aims to build technology that will track all of a user’s financial accounts, including savings accounts, fixed deposits, and insurance schemes. With all of this data in one place, they aim to provide administrative services that will take away the headache of money management that many people experience. This includes services such as finding a financial advisor (human or robo-advisor) through SimpleMoney, based on clients’ requirements and existing portfolio; support with filling in and submitting of forms related to the accounts where their assets are held, and figuring out the best financial instruments for them given their demographic data, income levels and financial goals.

Website: https://simplemoney.in

![[Funding alert] Spacetech startup Pixxel raises pre-seed round from growX Ventures and angels](https://images.yourstory.com/cs/2/fd6b2ee0-c6f4-11e8-af1c-974e95f3b2db/PIXXEL_FOUNDERS_21558884868943.jpeg?mode=crop&crop=faces&ar=1%3A1&format=auto&w=1920&q=75)