FINO Payments Bank rolls out Android-based PoS device to ramp up doorstep banking service

FINO intends to reach 50 million customers in the next five years, and strengthening its last-mile delivery network with an Android-based mPOS is a step in that direction.

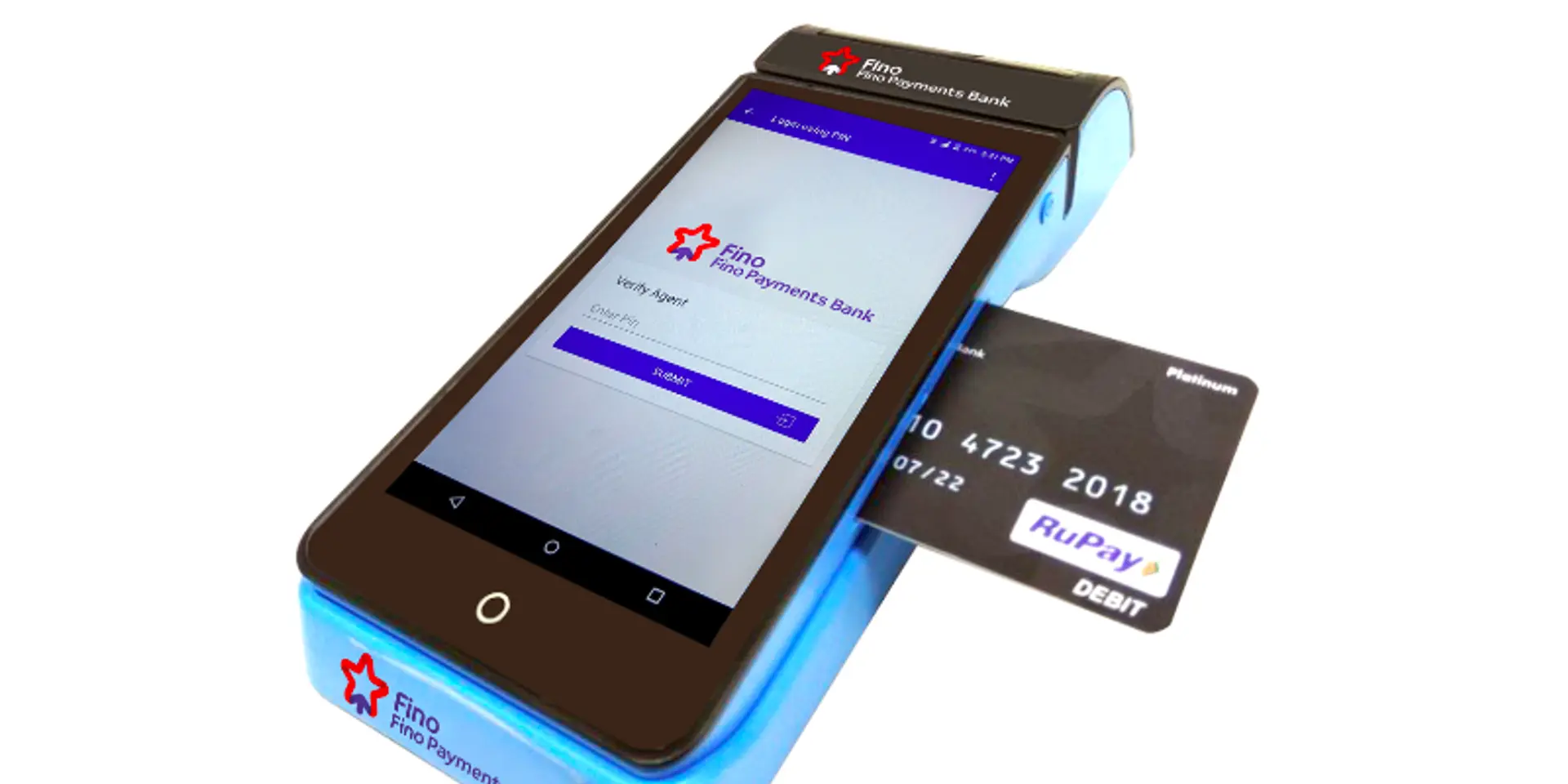

FINO Payments Bank has rolled out an Android-based point-of-sale (PoS) device to ramp up its door-to-door banking services. More than 10,000 locations across India will be equipped with this multi-utility device that bundles a tablet, a fingerprint scanner, a card reader, a camera, and a printer.

The Android-powered mPOS device can carry out the entire gamut of transactions viz. account opening, deposits, cash withdrawals, money transfers, purchase of financial products and services (gold, loans, insurance), and Aadhaar-Enabled Payment Systems (AEPS). It is interoperable and will allow even customers with debit cards issued by other banks to do payments and withdrawals at FINO’s banking points.

FINO Payments Bank, run by FINO Paytech, became operational in July 2017 after getting a licence from the RBI in March. It has more than 400 branches and 25,000 access points, including outlets of its strategic investor Bharat Petroleum (BPCL). FINO also rolled out its app, BPay, last September to ride the tide of mobile banking in India.

The payments bank intends to reach 50 million customers in the next five years, and strengthening its last-mile delivery network with an Android-based mPOS is a step in that direction. FINO believes that the all-in-one device will ensure seamless transactions and bring about greater efficiencies in the banking process.

Ashish Ahuja, Executive Vice President and Head - Products, Fino Payments Bank, said:

“In the next 12 months, we would deploy these devices at 10,000 of our retail as well as corporate banking points, including branches, BPCL outlets, franchisee points, and partner bank’s BC channel. We have already deployed around 2,000 devices to enhance doorstep and neighborhood banking services in urban as well as rural areas for the convenience of our customers.”

FINO Paytech has been conducting doorstep banking on behalf of other banks for over a decade now. The Blackstone-backed firm enables financial inclusion for micro customers in rural India. In 2015, FINO had also partnered with Snapdeal to drive seamless payments in ecommerce transactions from rural areas.

Meanwhile, reports indicate that Blackstone might now be looking to exit its nearly 26 percent stake in FINO. A suite of investors, including Japan’s SoftBank, Singapore’s Temasek, and others, could be potential buyers. There’s no official word on it yet, but if the deal goes through, it could value Mumbai-based FINO at over $300 million.