Here's why CoD will remain the norm and how this will affect growth of e-tail in smaller towns

Despite the focus of the e-tailing industry shifting to Tier II+ cities and improvement in delivery time, winning consumer trust is not so easy when it comes to digital payments. CoD will remain stagnant at 50%, says research firm RedSeer.

According to the latest study by research firm RedSeer Consultancy, delivery speed for ecommerce parcels has continuously improved in the last two years.

“With the increasing focus on Tier II+ cities, e-tailers are increasing their stronghold on the overall consumer experience. They are hence investing in the supply chain infrastructure to expand the number of delivery centres and fulfillment centres, which is resulting in the improvement of the delivery time in Tier II+ cities. This is a great move by the industry as it would result in the improvement of the consumer experience in Tier II+ cities, making them shop more,” the study says.

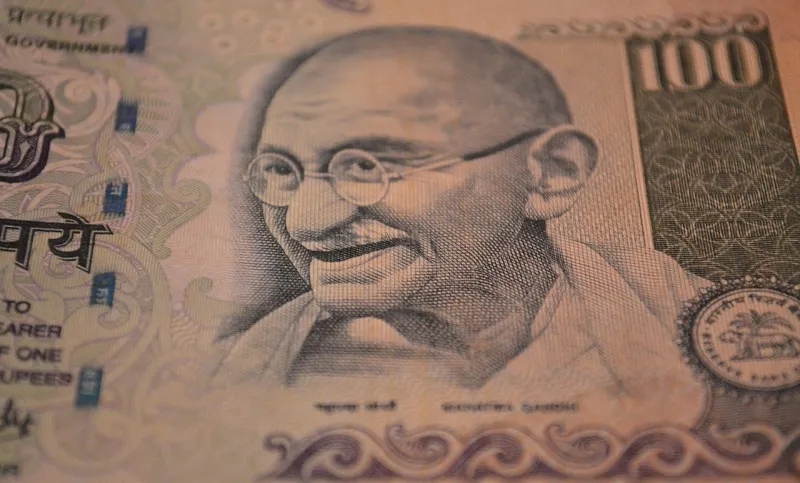

Curiously, the same factor – expansion of ecommerce in Tier II cities – is the reason for another pain point for ecommerce companies: Cash on Delivery. The same report by RedSeer states that CoD will remain stagnant at 50 percent as the focus of the e-tailing industry shifts to Tier II+ cities.

“The share of COD which was impacted due to demonetisation and stabilised after it is expected to remain stagnant. Though there has been an increase in the adoption of digital payments, there has also been a shift of focus of e-tailers towards Tier II+ cities. These two situations are set to cancel out the effect of each other, resulting in the share of COD being stagnant,” the study states.

While ecommerce cannot possibly survive by focusing only on the metro cities, the last few years have seen only Tier I city customers adapting to online payments. For the rest of India, cash on delivery is still the norm. Since the sales figures are not matching yet – with 80 percent of sales coming from outside Tier I cities- the ones shifting to other mode of payments in metros are not able to compensate for the difference.

Why CoD is a pain

While it brings in the trust factor for customers, extra charges on CoD transactions for logistics are troubling marketplaces and sellers alike. Ecommerce companies pay logistics surcharges for CoD – around Rs 40 per delivery. Additionally, there are insurance and cash-handling costs.

The customer not being present at home to receive the order entails multiple attempts for the logistics player to make one delivery. Hence the logistics pricing itself is a function of the client’s business in prepaid and CoD capacity.

Online payment means faster delivery with lesser number of attempts, as the industry average for every successful CoD delivery is 1.24, which means 24 percent extra manpower is required for last-mile delivery for CoD orders. Compared to prepaid returns, CoD returns are 30-percent more, especially in Tier II cities.

Free shipping, too, is not sustainable in long term. Since Indian consumers are more likely to make an online purchase when there is promise of free delivery, a balance can be sought to reduce costs by lengthening the period for delivery. But, as mentioned above, that is not the case either.

What are the options?

Although some websites offer card-on-delivery option, in which the customers can swipe their credit or debit cards after delivery, it is not very popular yet. Another interesting option now offered is e-CoD, which makes digital payments possible any time before the order is delivered.

Pune-based startup PhiCommerce has enabled this method to eliminate cash in transactions. Once the delivery boy is on the way to deliver a shipment to the customer, Phicommerce intimates the customer to pay digitally instead of using cash through card, via net banking, or mobile wallets, UPI/BHIM, Bharat QR, and Aadhaar Pay.

But PhiCommerce has found that buyers choose to pay only when the package reaches their doorstep although the payment window is open for customers throughout the delivery process, starting from dispatch from the retailer. Obviously, trust in e-commerce companies and strong infrastructure are also essential to change consumer behaviour.

Digital payments for offline shopping only can lead to the customers getting comfortable with online payments for ecommerce. Recently, NITI Aayog reported that digital payment volumes recorded a CAGR of 55 percent in 2016-17 as compared to 28 percent in 2015-16 because of demonetisation.

A report by the Centre for Digital Financial Inclusion (CDFI) also found that around 63 percent of retailers are now open to digital payments. Still, luck for ecommerce in this regard seems far away.

As per industry data, 1 out of every 5 card transactions fails, which reduces customer trust in digital payments. Due to this, customers default to cash, especially for low-priced higher frequency items. But if they are comfortable paying for their groceries at their local store through Paytm, hopefully, they will move on to the same methods when shopping online.