With govt's draft ecommerce policy, the deep discount days of online marketplaces are numbered

The draft, which was made after discussions with stakeholders, also recommends a single regulatory body be made to look into everything related to FDI.

A draft ecommerce policy released by the Union Minister for Commerce and Industry Suresh Prabhu on Monday states that the online marketplaces are not to, directly or indirectly, influence sale prices. However, the policy also gives a window for sales seasons, clearly defining the duration for which deep discounts will be allowed.

The draft, which was made after discussions with stakeholders (including sellers’ organisations, payment companies, and government officials), recommends a single regulatory body be made to look into everything related to FDI (foreign direct investment).

Ecommerce in India has faced many challenges due to a lack of clarity on government regulations regarding the industry. With foreign funding to the tune of billions of dollars flowing into ecommerce companies like Flipkart, discounts have become synonymous with online shopping.

Often, the marketplaces have been accused of encouraging unfair prices, and the ambiguity in regulations was a roadblock to clearing these issues. However, the Central government seems to have taken a clear stand this time.

Efforts on for a fair game

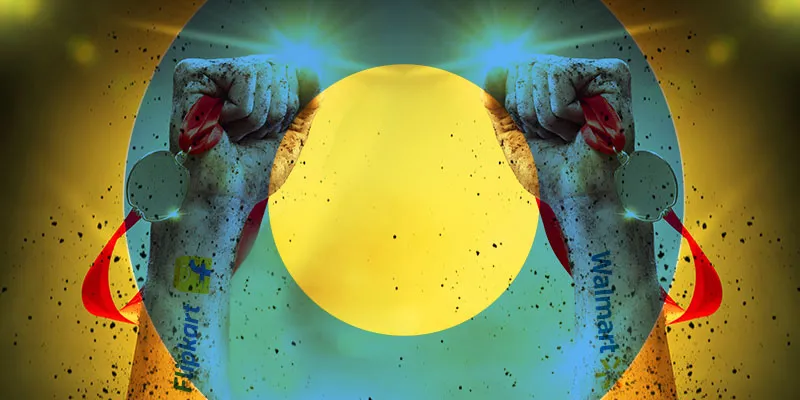

According to this draft policy, related party sellers are not allowed to buy fashion, mobile phones and electronic appliances in bulk. This could be a strong blow to ecommerce titans Amazon and Walmart-owned Flipkart, which have built their vanity metrics through these categories.

The Competition Commission of India has been asked to look into mergers or/and acquisitions that will induce unfair/anti-competitive pricing. This decision comes in the wake of online sellers protesting Walmart's acquisition of Flipkart.

(Walmart’s success all over the world has been built on offering low prices to the customers with their ‘Every Day Low Pricing’ (EDLP) strategy. Retailers who sell on online marketplaces have been complaining that this merger will hurt their business, as the alliance will offer cheaper prices.)

FDI regulations

The clearly-worded draft policy also says that Indian-owned and Indian-controlled online marketplaces (which are not foreign funded) shall hold inventory, provided the products are 100-percent domestically manufactured.

India’s FDI laws restrict foreign funded companies from holding inventory while allowing 100 percent FDI in marketplace model.

The policy defines Indian ecommerce firms as those with less than 49 percent FDI. Incidentally, on Monday, the Delhi High Court issued notices to Amazon and Flipkart for allegedly flouting FDI laws by giving cheaper prices through proxy sellers, thereby playing an unfair game against the rest of the sellers.

FDI policies have restricted revenue contribution to marketplaces from a single vendor at 25 percent – which has made them tie up with multiple sellers for pushing their private label too. Amazon’s Cloudtail and Flipkart’s WS Retail have earlier faced online sellers’ wrath due to this.

Focus on existing sellers

It looks like the honeymoon period with sellers are over for online marketplaces. In fact, a new study by RedSeer advisory has found that online marketplaces have slowed down the thrust on increasing their seller base. (While Flipkart and Amazon claim to have nearly two lakh sellers, ShopClues claims hosting five lakh sellers.)

According to the report, leading industry players are now focussing on growing business from the existing seller base. “This helps them have a good control on the sellers to ensure the right products are getting delivered to the consumers,” it says.